‘Strong international standards are an essential common yardstick that will support a safe and sound cross-border banking on a global scale' Andrea Enria, Chairperson of the EBA, said in welcoming the Basel agreement. ‘The EBA is committed to engaging with Competent Authorities and European co-legislators to ensure a successful implementation of the standards in the EU' Enria added. The EBA published today a summary of the results showing the impact of the agreed reforms on the EU banking sector.

Key findings of the EBA impact assessment

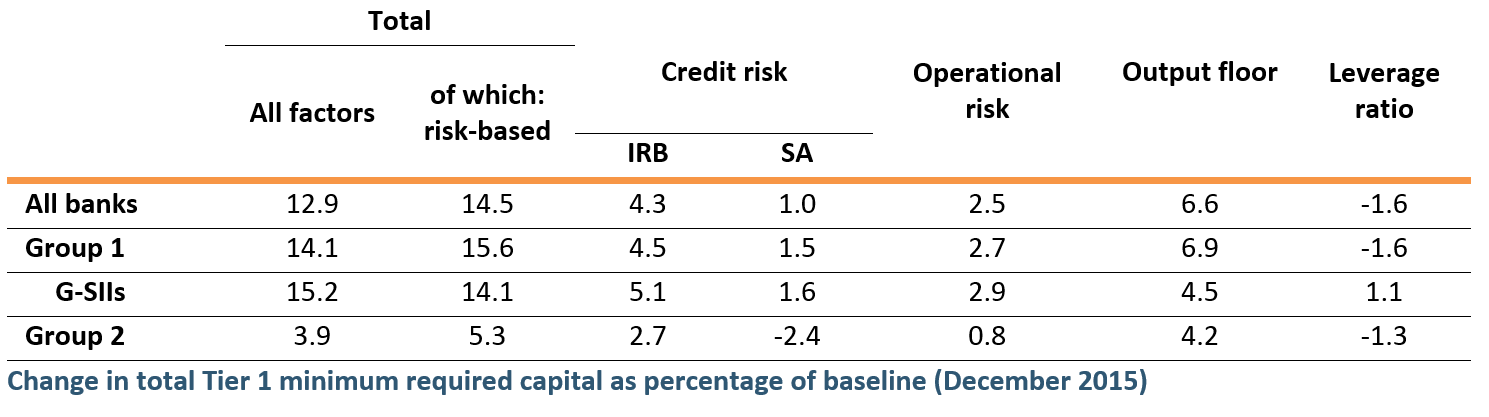

The EBA analysis showed that, under the revised international standards, minimum required capital (MRC) for the EU sample would increase by 12.9% in weighted average terms. The increase is mainly driven by the impact of the reforms on global systemically important institutions (G-SIIs) and larger institutions (Group 1 banks). The assessment also finds that the weighted average CET1 ratio, calculated in accordance with the revised framework, is 0.6 percentage points lower than the status quo. The aggregate output is the main driver of the capital impact for the EU sample under the new standards.

© EBA

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article