EBA published its annual risk assessment of the European banking system....and publication of the 2023 EU-wide transparency exercise... detailed information, in a comparable and accessible format, for 123 banks from 26 countries across the European Union (EU) and the European Economic Area (EEA).

Highlights of the EBA risk assessment:

- The EU banking sector has proven to be resilient in the aftermath of the banking turmoil in March.

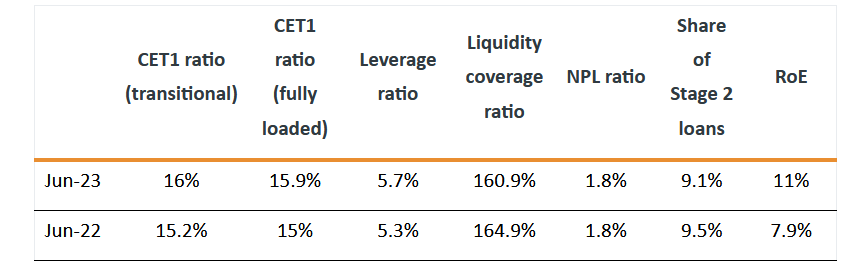

- Capitalisation remains high with an average common equity tier 1 (CET1) ratio at its highest reported point (16%). Underlying profitability has supported banks’ payouts.

- Elevated interest rate levels have so far supported widening interest margins, but this might have reached its turning point.

- Asset quality remains robust, yet subdued economic growth and elevated interest rate levels create pockets of risks.

- Liquidity remains high but it started normalising from its pandemic highest levels.

- Market funding costs have increased in line with interest rates, yet deposits rates have remained comparatively low but might rise going forward.

EBA

© EBA

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article