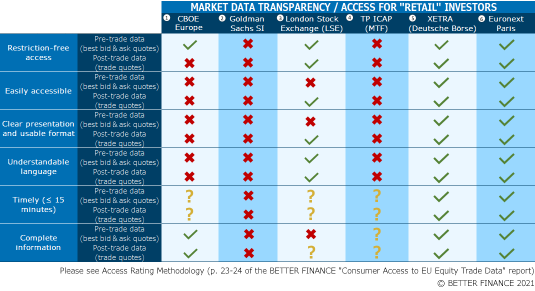

Access to equity market data is essential for “retail” investors

to make informed investment decisions. However, new research by BETTER FINANCE found that the equity market data published by the four largest

EU equity markets (in 2019, according to ESMA) on their websites are either

totally or partially

de facto not accessible for non-professional users.

Equity

trading venues (Regulated Markets and Multilateral Trading Facilities)

operating in the European Union are required to publish pre- and post-trade

data that is accessible and understandable for end-users. This data must be

provided free of charge and has to be directly available in an easily

accessible and non-discriminatory manner, in a format that can easily be

read, used, copied and understood by the average reader, and respecting a

maximum delay of 15 minutes. Any practices diverging from - or circumventing

these basic rules would be in breach of EU law.

The

European Securities and Markets Authority (ESMA) also found that many equity

markets fail to fully comply with the law, especially with regards to the

timeliness (a maximum delay of 15 minutes) and format of the information

provided.

A quick look at European equity markets in recent years reveals

a dramatic shift away from EU-based “lit” regulated equity trading venues

(down to less than a fifth of trades in 2019) to less transparent and less

retail investor-friendly non-EU based players. The research carried out by

BETTER FINANCE clearly shows how poorly the new market leaders disclose pre-

and post-trade data to non-paying non-professional users on their own public

websites, from requiring registration and little known securities codes

instead of issuers’ names, to using unintelligible jargon, or burying it deep

within their platforms, only accessible through a maze of clicks and

redirections or downloads of “csv” tables, making it de facto impossible for

the average non-professional investor to access it (see table below).

Guillaume Prache, Managing Director of BETTER FINANCE, couldn’t

be clearer: “As stated by the European Commission, EU households are the

main source of long-term financing for the real economy. For the Capital

Markets Union (CMU) to succeed, individual investors and savers should be at

the heart of the project and have trust in capital markets. Therefore, the EU

must end the discrimination of consumers as “retail equity investors” in

terms of:

-

access to market data,

-

access to Pan-European

collective redress,

-

best execution of

“retail” trade orders and prevention of conflicts of interests such as those

generated by the practice of “payments for order flows”.

These findings revealing the very poor retail access to market

data, the recent collapse of Wirecard, - wiping out close to 20 billion of pension savings with no

right to Pan-European collective redress for the victims – and the issues

with payments for order flows that recently finally emerged with the GameStop case in Germany, all further

demonstrate that it is urgent for the EU Authorities to better protect EU

financial consumers.”

|