Mario Draghi analyses how ECB's monetary policy measures have become more complex over the past year, culminating in the decision of expanding asset purchases towards public sector securities.

Camdessus lecture by Mario Draghi, President of the ECB, IMF, Washington, DC, 14 May 2015

Ladies and gentlemen,

Over the past year the ECB has taken a series of major monetary policy measures, culminating in our decision in January this year to expand our asset purchases towards public sector securities. While the aim of these measures is the same as it has always been – maintaining price stability over the medium-term – their form is unprecedented for our central bank. And as such our policy decisions have become more complex in two key ways.

First, as interest rates have reached their effective lower bound in the euro area, we have become more constrained in our ability to deploy conventional monetary policy tools. This has required us to develop new instruments to achieve the same results.

Second, because the use of these new instruments can have different consequences than conventional monetary policy, in particular with respect to the distribution of wealth and the allocation of resources, it has become more important that those consequences are identified, weighed and where necessary mitigated.

In my remarks today I would like to discuss how our monetary policy has evolved within this new environment – both in terms of how we have deployed our instruments and how we are managing their consequences.

1. Monetary policy in an uncertain environment

At the start of 2014, the macroeconomic landscape in the euro area was characterised by a high degree of uncertainty.

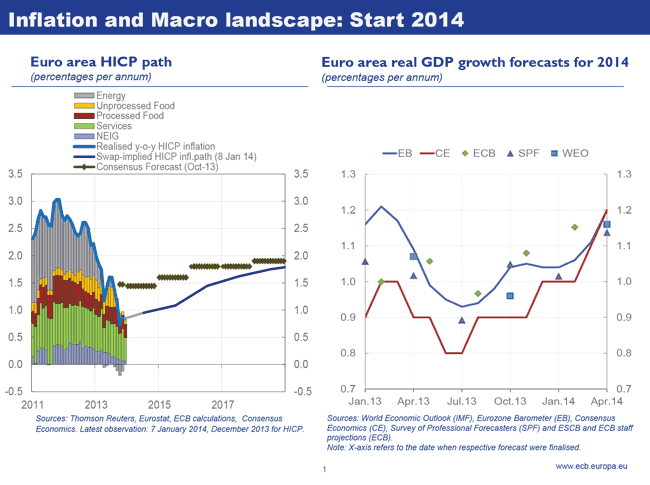

On the one hand, we were confronted with a consistent and broad-based downward trend in past inflation, falling from 3% at the end of 2011 to less than 1% at the beginning of 2014. But on the other, sentiment on the economic outlook was relatively upbeat for 2014, with nearly all forecasters expecting the recovery to firm over the course of the year. In this context, while we felt relatively comfortable that the medium-term inflation outlook was secure, the risks surrounding that outlook were clearly elevated. It hinged crucially on the benign macroeconomic scenario materialising and no further shocks emerging (Chart 1).

Chart 1: Macro and inflation landscape in early 2014

Given that uncertainty and its impact on expectations of future monetary policy, it became much more important for us to communicate clearly how we would respond should different risks to the outlook emerge. In this context, in a speech in Amsterdam in April I laid out our reaction function to what we saw as the three most likely contingencies.

These were, first, an unwarranted tightening of the policy stance emanating from external developments, which would warrant a more conventional response. Second, a persistent impairment of the bank lending channel to which we would react with targeted credit easing measures – that is, measures to provide longer-term refinancing for banks and free up capacity for new lending on their balance sheets. And third, a worsening of the medium-term outlook for inflation and/or a loosening in the anchoring of inflation expectations, which would justify overcoming the lower bound constraint on interest rates by engaging in a broad-based asset purchase programme.

Through 2014 each of these contingencies materialised.

As the discussion of exit from accommodative monetary policy in the US gathered pace it became increasingly important for us to distinguish the diverging paths of monetary policy on either side of the Atlantic. From June onwards we therefore entered the first contingency and brought our main refinancing rate to its effective lower bound, while also introducing measures to strengthen the propagation of short-term rates to the medium-term curve. This included strengthening our forward guidance and introducing a negative interest rate on our deposit facility, which combined to measurably increase the traction of our policy rates over the shape of the yield curve.

But crucially, by the middle of the year we were still not seeing movements in the yield curve being reflected in the actual borrowing conditions faced by firms and households across the euro area, which meant this considerable easing was not having the impact we would normally expect (Chart 2). It was in this context that we moved into the second contingency and launched our credit easing measures. This took the form of targeted long-term refinancing operations (TLTROs), which provide cheap long-term funding to banks on the condition that they expand loans to the real economy, and thereby help restore a more normal supply and pricing of credit.

Full lecture

© ECB - European Central Bank

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article