Post-Brexit UK bank regulation is not likely to compromise on international standards, but will place greater emphasis on competition, making close UK-EU dialogue essential.

Brexit has already done considerable

damage to the United Kingdom’s financial sector. The EU-UK Trade and

Cooperation Agreement did not secure continued market access for

UK-based banks to the European Union’s financial sector, as access will

depend on future regulatory equivalence decisions. In the wake of the

loss of passporting rights for most banking services, about £900 billion

in bank assets (or 11% of total UK assets at end-2020) has already

moved to the EU. Further shifts of assets, staff and legal entities are

likely as European supervisors demand that fully functional units be

established within the EU. Nevertheless, despite this diminished

post-Brexit stature, the UK banking sector in late 2020 remained the

largest globally in terms of cross-border claims, and the second-most

important in terms of foreign claims consolidated within the home base

of internationally active banks. The liquidity, human capital and

financial services ecosystem in the UK is as yet unrivalled by any financial centre within the EU.

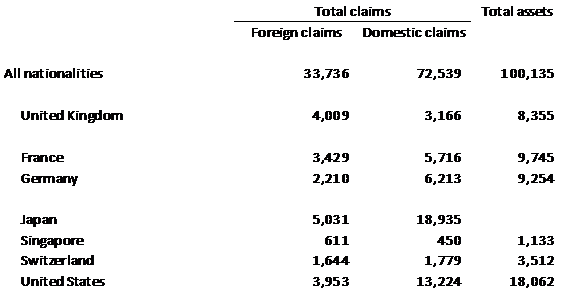

Table 1: Consolidated banking statistics, by nationality of reporting bank, end-2020, (US$ billions)

Source: Bruegel, based on BIS consolidated banking statistics.

The complexity and size of the UK banking

sector (which is equivalent to roughly five times UK GDP) brings with it

significant financial-stability risks. Post-Brexit, UK policymakers

therefore envisage a distinct style of regulation and supervision,

though do not call for a complete revamp of how it was done while the UK

was still in the EU. There are nevertheless concerns in the EU that the

UK could embark on wide-ranging deregulation, in an effort to build a

more international financial centre (dubbed ‘Singapore-on-Thames’). As

detailed in a Bruegel paper

for the European Parliament, divergence between the two systems is

indeed inevitable. However, the UK’s adherence to international norms,

crucially the Basel framework,

is not in doubt. In fact, this adherence to international norms is now

enshrined in UK law, including the UK-EU Trade and Cooperation

Agreement. The extensive engagement of UK banks in international markets

and what will in future become a more agile style of UK regulation,

nevertheless call for continued close coordination between EU and UK

regulators and supervisors.

Strict rules

While still within the EU, the UK built a

reputation for strict regulation and supervision, often ‘gold-plating’

EU standards. The UK’s ring-fencing of bank retail units, for instance,

is unique in Europe. Ring-fencing has reduced systemic risks and

improved the options for resolving failing banks. In some areas the UK

insisted on distinct rules for the local financial market (for instance

relating to the compensation of senior banking executives), though rules

on the safety and soundness of banks and investment firms were as

strict as in the EU, if not more so. Well before the end of the Brexit

transition period, all key elements of EU financial regulation,

including the latest elements of the Basel III framework, were

‘on-shored’ into UK law. The UK hence ended the transition period in

December 2020 with its banking regulation closely aligned with that of

the EU.

The UK’s new financial services law of

April 2021, one of the first pieces of legislation outside the EU,

confirmed this commitment to international norms, though it also

signalled some significant new directions. Alongside other

considerations, the Bank of England will need to take into account in

its rulemaking the competitiveness of the UK financial markets (this is

common also in other financial centres, including Australia, Hong Kong

and Japan). This could be significant, because in future considerable

regulatory powers are likely to be delegated to the Bank of England. The

UK government has said that a future regulatory framework

will be defined in a way that greater flexibility and ability to

respond to changes in international markets and standards can be squared

with predictability of regulation and the Bank’s accountability to the

UK Parliament. Greater flexibility and responsiveness on the part of the

regulator could be important once financial institutions revamp their

data management and begin to deploy artificial intelligence to a greater

extent. Fintech firms in the UK may well benefit from a special regulatory regime.

A further likely change in UK post-Brexit

financial regulation will be a simplification of the regime for smaller

banks. Originally, the Basel regime was designed only for

internationally active banks. Only for these were the objectives of a

level playing field and prevention of competitive distortions between

banks relevant, as laxer prudential standards could result in

cross-border spillovers. As the more complex Basel III framework was

introduced, many jurisdictions began to make use of so-called

proportionality provisions already envisaged in the Basel Accord,

exempting smaller institutions from all but the most essential

provisions. The EU remains exceptional in largely rejecting such

carve-outs for smaller banks. The EU Capital Requirements Directive

requires more-or-less uniform treatment across the single market and

for all types of institutions, though of course there is some

differentiation in supervision. Outside the EU, the UK is set to reduce the regulatory compliance burden

for banks that are small or not active in international markets. As

smaller banks grow, additional requirements would be introduced

gradually. This will likely intensify competition within the UK banking

market and restrain the market dominance of the larger banks.

Supervision by the Bank of England

The pursuit of several parallel objectives

has also shaped the work of the Bank of England as the UK’s principal

financial sector supervisor. Competition within the UK market is a

secondary objective in law, and several other objectives have been

announced, such as financial inclusion and mitigating risks from climate

change. Again, this is not unusual by the standards of other large

jurisdictions. The European Central Bank’s work in banking supervision

in the euro area is exceptional in being exclusively focused on

financial-sector stability and the safety and soundness of institutions.

As yet, these multiple mandates do not

seem to have distracted the Bank of England from its core work on the

safety and soundness of institutions. Since 2016, the Bank has

continually reviewed banks’ internal risk models, which are crucial in

determining risk-weighted assets, and hence capital adequacy. A similar ECB review

has recently concluded, resulting in over 250 decisions that required

substantial revisions. Limitations on the use of banks’ internal models,

known as ‘guardrails’, are set to be included in regulation as the very

final elements of the Basel framework at the end of a lengthy

transition period. This could be an important test of the credibility of

UK and EU banking standards.

A period of financial liberalisation

provided the original motivation for rules establishing a level playing

field and common standards in regulatory capital. Brexit is obviously a

reversal in this process of integration, though large UK and euro-area

banks still compete in the same international market. In their home

bases, banks should be regulated based on comparable norms. A

high-quality supervisory regime in the UK may in fact attract

institutions which expect to benefit in terms of reputation and funding

costs. The UK and euro-area supervisors have a shared interest in

alignment with the Basel framework at a common and comparable high

standard, and in strengthening bilateral dialogue.

Bruegel

© Bruegel

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article