Articles from 24-30 September 2021

General Financial Policy

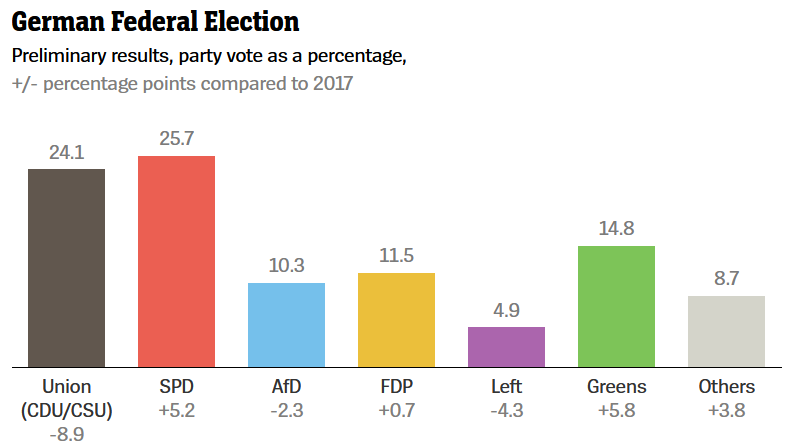

Der Spiegel: Difficult Talks Ahead for Greens and Free Democrats : The Green Party and the business-friendly Free Democrats plan to hold exploratory talks with each other before meeting with the main chancellor candidates in the coming days. They appear to be worlds apart but are already finding some common ground.

EPC: Differentiated EUrope 2035: Elaboration and Evaluation of Five Potential Scenarios : Differentiated integration has been and will remain a necessity if Europe wants to overcome stalemate and improve the functioning of the European integration process.

Banking Union

The EBA publishes its regular monitoring Report on Basel III full implementation in the EU : The full Basel III implementation would result in an average increase of 13.7% on the current Tier 1 minimum required capital of EU banks. To comply with the new framework, EU banks would need EUR 3.1 billion of additional Tier 1 capital.

GBIC comments on the current EBA consultation on draft SREP guidelines and supervisory stress testing : GBIC welcomes the decision to update the SREP Guidelines. We also agree with the overarching objectives, namely (a) to increase convergence of practices followed by competent authorities across the EU, and (b) to align the SREP Guidelines with other relevant EBA guidelines and technical standards.

Capital Markets Union

ESMA: MiFID II/MiFIR review report on Algorithmic Trading : Many provisions and requirements of MiFID II relate either directly or indirectly (e.g. direct electronic access or tick sizes) to algorithmic trading.

ESMA consults on proposals for a review of the MiFID II best execution reporting regime : ESMA launches a consultation on proposals for improvements to the MiFID II framework on best execution reports. These proposals aim at ensuring effective and consistent regulation and supervision and enhancing investor protection.

ESMA consults on the review of the Short Selling Regulation : ESMA will consider the responses it receives to this consultation paper by 19 November 2021 and expects to publish a final report by the end of Q1 2022.

ESMA: Final Report Guidelines on Settlement Fails Reporting under Article 7 of CSDR : ESMA is also very much looking forward to the publication of the European Commission legislative proposal - expected by the end of the year. However, this timing will collide with the expected entry into force of the current CSDR settlement discipline regime on 1st February 2022.

ALFI responds to the EC consultation on the functioning of the EU securitisation framework : ...some of the rules contemplated by the SECR have generated some adverse effects, such as disadvantaging EU institutional investors in certain segments of the market.

Environmental, Social, Governance (ESG)

Insurance Europe: Insurers welcome EC proposal for EU Green Bond Standard and suggest refinements to ensure its uptake : As Europe’s largest institutional investor, the industry supports measures to stimulate the development of the green bond market.

EURACTIV: The EU taxonomy can strengthen SMEs in the green transition : Small and medium-sized companies will remain exempt from new disclosure rules on the EU’s sustainable finance taxonomy starting in 2022. However corporate leaders would be well-advised to follow its implications, including SMEs, writes Finn Wendland.

Release of SASB Standards XBRL Taxonomy Accelerates Structured Reporting of ESG Data : Key objectives of the Taxonomy are to simplify the disclosure process for businesses and improve the quality,usefulness and comparability of environmental, social, and governance (ESG) disclosures to investors.

Protecting Customers

BEUC: PUBLIC CONSULTATION ON THE DIRECTIVE ON DISTANCE MARKETING OF CONSUMER FINANCIAL SERVICES : It is crucial for EU legislation to adequately protect consumers when theypurchase financial services at a distance, regardless of the means of communicationused. V

Fin Tech Regulation

Proposal for a regulaton laying down harmonised rules on AI act: EBF response : The Act aims to develop an ecosystem of trust for AI in the EU, which encourages investment, aims to strengthens competitiveness and to ensure that AI systems respect fundamental rights and EU values.

CEPS: Clarifying the costs for the EU’s AI Act : The figures in the CDI paper are based on a study, which we at CEPS conducted ... the CDI paper contains incorrect and spurious information concerning the prospective cost of the proposed AI Act.

Economic Policies Impacting EU Finance

Public country-by-country reporting: Council paves the way for greater corporate transparency for big multinationals : The Council today adopted its position at first reading on the proposed directive on the disclosure of income tax information by certain undertakings and branches, commonly referred to as the public country-by-country reporting (CBCR) directive, paving the way for its final adoption.

Brexit and the City

TheCityUK: Financial services access to global high-skilled talent needs streamlining and lower costs : Over nine months on from the introduction of the UK’s 2021 immigration system, financial and related professional services firms are seeing significant cost increases to securing the high-skilled talent that they need to compete on the global stage.

Veron: Brexit and European Finance: Prolonged Limbo : the full impact of Brexit on the financial sector has been delayed by risk aversion.... in part related to the Covid-19 pandemic. It will take longer than many had anticipated for the dust to settle on the post-Brexit financial landscape and its respective implications for the EU and the UK.

POLITICO: City of London seeking more action, not words, on deregulation : The future of the UK’s finance industry is to be decided by key policy changes in the coming months.The pandemic and Brexit drove British bankers and politicians back into each other’s arms after a period of acrimony. But will the rekindled relationship last?

EURACTIV: New York, London keep top spots in global financial centres index : New York easily kept the top spot in the latest Global Financial Centres Index (GFCI), while London held on to second place as Chinese cities slipped, according to the ranking published on Friday.

City Corporation calls on Labour to help the financial sector support the economic recovery :The City of London Corporation is today calling on the Labour Party to support and promote the growth of financial and professional services across the UK in order to boost the national economic recovery post-pandemic.