Crypto assets offer a new world of opportunities: Quick and easy payments. Innovative financial services. Inclusive access to previously “unbanked” parts of the world. All are made possible by the crypto ecosystem.

As crypto assets take hold, regulators need to step up.

Consumer protection risks remain substantial given limited or inadequate disclosure and oversight.

But along with the opportunities come challenges and risks. The latest Global Financial Stability Report describes the risks posed by the crypto ecosystem and offers some policy options to help navigate this uncharted territory.

The Crypto Ecosystem—What Is It, What’s at Risk?

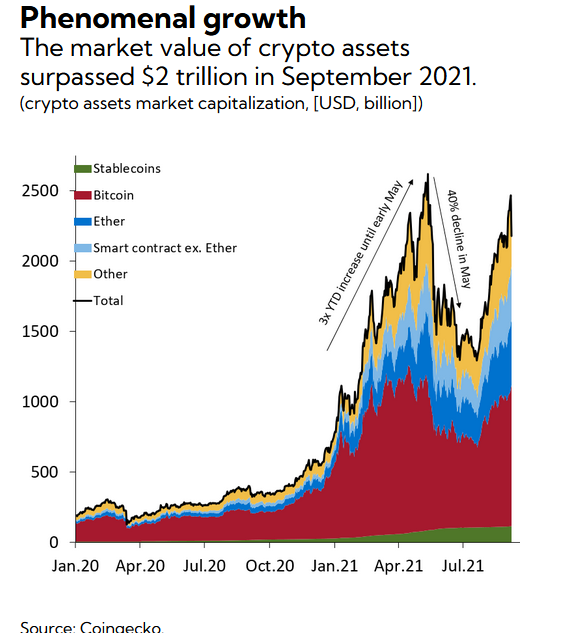

The total market value of all the crypto assets surpassed $2 trillion

as of September 2021—a 10-fold increase since early 2020. An entire

ecosystem is also flourishing, replete with exchanges, wallets, miners,

and stablecoin issuers.

Many of these entities lack strong operational, governance, and risk

practices. Crypto exchanges, for instance, have faced significant

disruptions during periods of market turbulence. There are also several

high-profile cases of hacking-related thefts of customer funds. So far,

these incidents have not had a significant impact on financial

stability. However, as crypto assets become more mainstream, their

im

Consumer protection risks remain substantial given limited or

inadequate disclosure and oversight. For example, more than 16,000

tokens have been listed in various exchanges and around 9,000

exist today, while the rest have disappeared in some form. For example,

many of them have no volumes or the developers have walked away from

the project. Some were likely created solely for speculation purposes or

even outright fraud.

The (pseudo) anonymity of crypto assets also creates data gaps for

regulators and can open unwanted doors for money laundering, as well as

terrorist financing. Although authorities may be able to trace illicit

transactions, they may not be able to identify the parties to such

transactions. Additionally, the crypto ecosystem falls under different

regulatory frameworks in different countries, making coordination more

challenging. For example, most transactions on crypto exchanges happen

through entities that operate primarily in offshore financial centers.

This makes supervision and enforcement not only challenging, but nearly

impossible without international collaboration.

Stablecoins—which aim to peg their value usually against the US

dollar—are also growing at lightning speed, with their supply climbing

4-fold throughout 2021 to reach $120 billion. The term “stablecoin,”

however, captures a very diverse group of crypto assets and can be

misleading. Given the composition of their reserves, some stablecoins

could be subject to runs, with knock-on effects to the financial system.

The runs could be driven by investor concerns about the quality of

their reserves or the speed at which reserves can be liquidated to meet

potential redemptions.

Significant challenges ahead

Although the extent of the adoption of

crypto assets is difficult to measure, surveys and other measures

suggest that emerging market and developing economies may be leading the

way. Most notably, residents in these countries increased their trading

volumes in crypto exchanges sharply in 2021.

Looking ahead, widespread and rapid

adoption can pose significant challenges by reinforcing dollarization

forces in the economy—or in this case cryptoization—where residents

start using crypto assets instead of the local currency. Cryptoization

can reduce the ability of central banks to effectively implement

monetary policy. It could also create financial stability risks, for

example through funding and solvency risks arising from currency

mismatches, as well as amplify the importance of some of the previously

mentioned risks to consumer protection and financial integrity.

Threats to fiscal policy could also

intensify, given the potential for crypto assets to facilitate tax

evasion. And seigniorage (the profits accruing from the right to issue

currency) may also decline. Increased demand for crypto assets could

also facilitate capital outflows that impact the foreign exchange

market.

Finally, a migration of crypto “mining”

activity out of China to other emerging market and developing economies

can have an important impact on domestic energy use—especially in

countries that rely on more C02-intensive forms of energy, as well as those that subsidize energy costs—given the large amount of energy needed for mining activities.

Policy action

As a first step, regulators and supervisors

need to be able to monitor rapid developments in the crypto ecosystem

and the risks they create by swiftly tackling data gaps. The global

nature of crypto assets means that policymakers should enhance

cross-border coordination to minimize the risks of regulatory arbitrage

and ensure effective supervision and enforcement.

National regulators should also prioritize

the implementation of existing global standards. Standards focused on

crypto assets are currently mostly limited to money laundering and

proposals on bank exposures. However, other international standards—in

areas such as securities regulation, as well as payments, clearing and

settlements may also be applicable and need attention.

As the role of stablecoins grows,

regulations should be proportionate to the risks they pose and the

economic functions they serve. For example, rules should be aligned with

entities that provide similar products (e.g., bank deposits or money

market funds).

In some emerging markets and developing

economies, cryptoization can be driven by weak central bank credibility,

vulnerable banking systems, inefficiencies in payment systems and

limited access to financial services. Authorities should prioritize

strengthening macroeconomic policies and consider the benefits of

issuing central bank digital currencies and improving payment systems.

Central bank digital currencies may help reduce cryptoization pressures

if they help satisfy a need for better payment technologies.

Globally, policymakers should prioritize

making cross-border payments faster, cheaper, more transparent and

inclusive through the G20 Cross Border Payments Roadmap.

Time is of the essence, and action needs to

be decisive, swift and well-coordinated globally to allow the benefits

to flow but, at the same time, also address the vulnerabilities.

IMF

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article