Major central banks are increasingly considering a digital currency available to general public. But what are the advantages of doing so in the light of generally well working private sector payment solutions?

This column discusses the range of proposed central bank digital

currency architectures, how they could complement existing payment

options, and what they imply for the financial system and central bank

of the future.

A retail central

bank digital currency (CBDC) is electronic central bank money that –

just like cash – is directly available to consumers and non-financial

corporations. The question of whether central banks should issue a

retail CBDC is attracting increasing attention. Surveys indicate that

80% of central banks are engaging in work on the topic (Barotini and

Holden 2019, Boar et al. 2020) and over 30 central banks have already

launched research or design reports (see a companion Vox column, as well

as Kiff et al. 2020 and Group of Central Banks 2020).

But what are the

specific problems that such a retail CBDC would address? What are the

designs that offer actual solutions? And what are the potential side

effects for the monetary and financial system in general, and central

banks in particular? In this column, after briefly revisiting the

motives for CBDC issuance, we examine which CBDC architectures can

complement existing payment options without adverse side effects for the

monetary and financial system. Our argument is based on the CBDC design

framework of Auer and Böhme (2020a) and an evaluation of current

approaches in the field of computer science (Auer and Böhme 2020b).

The key

consideration for issuing a retail CBDC is that current electronic

retail money represents a claim on an intermediary, rather than

functioning as the digital equivalent of cash (Figure 1). This raises

several issues, as the intermediary might run into insolvency, be

fraudulent, or suffer technical outages.

Figure 1 Cash vs electronic money in today’s two-tier monetary system

Notes:

Cash is a direct claim on the central bank, while deposit accounts are

claims on the commercial bank. Commercial banks back some of these

claims by holding reserves at the central bank, but such value backing

is never full. A CBDC that is unaffected by financial crisis must be a

cash-like direct claim on the central bank.

Source: adapted from Auer and Böhme (2020b).

CBDC design efforts

have to be viewed against the backdrop of central banks’ core mandate to

provide a resilient and universally accepted means of payment. For

centuries, this has been cash; but should cash no longer be generally

accepted, not everyone might have access to an easy payment means,1 and a severe financial crisis might disrupt day-to-day business.2 The

collapse of Wirecard and the ensuing impairment of some electronic

payment options foreshadows the importance of this concern.

Looking ahead, a

main concern is that in a cashless economy, a financial crisis could

create havoc by leading to situations in which some financial

institutions have to freeze their retail clients’ deposits, thus

impairing the ability of these clients to pay their bills. The Covid-19

pandemic raised concerns that cash can transmit pathogens, leading some

merchants not to accept it (Auer et al. 2020b).

At the same time, a

CBDC should by no means displace the private sector. One aspect –

discussed at length elsewhere (e.g. Brunnermeier and Niepelt 2019,

Fernández-Villaverde et al. 2020)3 – concerns balance sheet

concerns. The economic design of a CBDC should not lead to a massive

reallocation of funds away from commercial banks and to the central

bank.

A second – less

discussed, but maybe even more important – aspect is the operational

dimension and effectiveness of the payment system. The customer-facing

side of real-time payments – including clearing, onboarding, enforcement

of know-your-customer legislation, ongoing due diligence, dispute

resolution and related services – are a massive operational task. This

task is likely better handled by the private sector than the central

bank.

These considerations

bring to the fore the issue of how a CBDC can live up to central banks’

mandate to provide a universal means of payment for the digital era,

while at the same time giving the private sector the primary role in the

retail payment system. Only some of the numerous proposed CBDC

architectures can achieve this feat.

CBDC architectures and the payment system

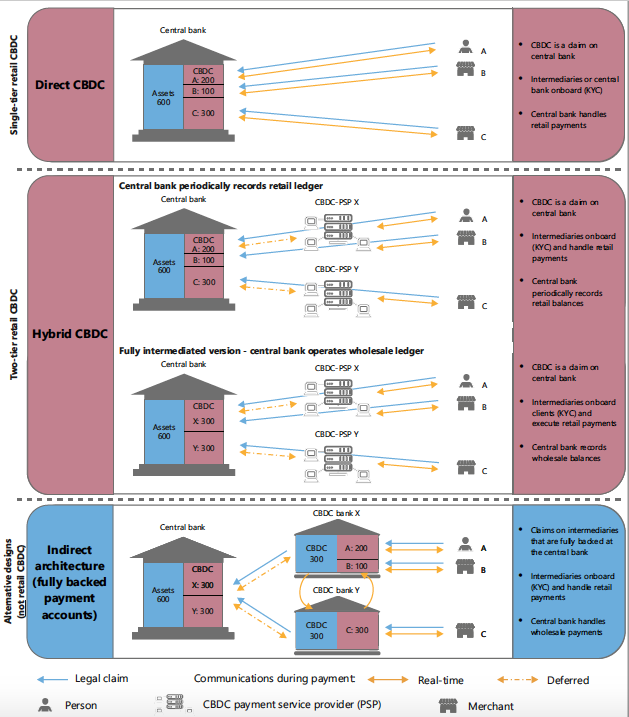

Figure 2 gives an

overview of possible architectures for CBDCs and the alternative of a

narrow payments bank. These examples differ in terms of the structure of

legal claims and the record kept by the central bank.4

Consider first the

most radical departure from the existing system: a single-tier design

operated by the central bank, which we term the “direct CBDC” (top panel

of Figure 2). Here, the central bank operates the retail ledger. As a

result, the central bank server is involved in all payments. This

requires substantial technical infrastructure to offer headroom capacity

even during peak demand. On the upside, the system is very resilient as

the central bank’s complete knowledge of retail account balances allows

it to honour claims with ease – the information needed for verification

is readily available.

The most substantial

argument against this architecture is that it marginalises private

sector involvement. Intermediaries help to smooth the flow of payments

by taking on risk, for example during connectivity breaks or offline

payments.5 Also, an emerging fintech sector innovates with

value-added services, such as automated financial advice, integration

with consumer platforms and connection to other financial products like

consumer credit. It is unlikely that the central bank would wish to

substitute for the private sector in all these activities.

In contrast,

consider an alternative to issuing retail CBDC: the simple requirement

to fully back payment accounts with reserves at the central bank (bottom

panel of Figure 2). This proposal has been floated under many names;

here we follow Auer and Böhme (2020a) and term it the “indirect”

architecture.6 This model’s regulatory and supervisory

issues, as well as those pertaining to deposit insurance, are different

from those of a CBDC with direct claims. If the intermediary is under

financial stress and goes bankrupt, determining the legitimate owner

might involve lengthy and costly legal processes with uncertain

outcomes. Whereas full backing would likely mean that such episodes

occur infrequently, the recent example of Wirecard underlines that these

concerns have to be taken seriously.

Figure 2 Retail CBDC architectures and fully backed alternatives

Notes:

A retail CBDC allows consumers to hold a direct claim on the central

bank. In the “Direct CBDC” model (top panel), the central bank handles

all payments in real time and thus keeps a record of all retail

holdings. Hybrid CBDC architectures (middle panel) incorporate a

two-tier structure with direct claims on the central bank while

real-time payments are handled by intermediaries. Several variants of

the hybrid architecture can be envisioned. The central bank could either

retain a copy of all retail CBDC holdings (upper variant in the middle

panel), or only run a wholesale ledger (lower variant in the middle

panel). An alternative to retail CBDC architectures are fully backed

payment accounts that feature intermediaries who need to fully back

payment account holdings at the central bank (bottom panel).

Source: adapted from Auer and Böhme (2020a).

On balance, we thus

argue that the most interesting design space combines the credibility of

a direct claim on the central bank with the convenience of

private-sector payment services. This architecture is called “hybrid

CBDC” in Auer and Böhme (2020a). A key element is the legal framework

that underpins claims and keeps them segregated from the balance sheets

of the payment service providers (PSPs). This way, in the event of PSP

insolvency, consumers’ CBDC holdings would not be exposed to claims by

the PSP’s creditors.

This segregation is

the most important pillar for the credibility of the system. However, if

a PSP fails – financially or technically – there must be a way for the

central bank to unambiguously honour claims and, ideally, resume

payments for the failing PSP’s customers without much delay. This

capability depends on the information about retail accounts available to

the central bank in such an event.

We note that there

are several possible implementations of a hybrid architecture. These

offer a number of variants that trade off information needs of the

central bank against convenience and resilience considerations. This is

illustrated by two variants in Figure 2. In the first (upper variant in

the middle panel of Figure 2), the central bank does not operate retail

payments, but maintains a backup copy of balances which allows it to

restart payment should intermediaries run into insolvency or technical

outages.

Some central banks

might shy away from running a record of all retail data, for example due

to issues with privacy and data security (e.g. Powell 2019). Therefore,

the second variant of the hybrid CBDC (lower variant in the middle

panel of Figure 2) could be considered as “fully intermediated” in the

information structure as the central bank records wholesale balances

only.7 However, the downside of an intermediated CBDC

architecture is that the central bank needs to honour claims of which it

has no record. Consequently, to safeguard cash-like credibility, PSPs

would need close supervision to ensure at all times that the wholesale

holdings they communicate to the central bank indeed add up to the sum

of all retail accounts.

Stepping up: Payments and the central bank of the future

As central banks

play a key role in payment systems, both the declining use of cash and

related private sector developments may require them to step up and take

a more active role (Carstens 2020). If a central bank were to issue a

CBDC, it might opt to – but would not have to – operate any of the

communication and record-keeping infrastructure. However,

record-keeping, integrity protection and establishment of the necessary

level of consistency can also be delegated to the private sector, which

might either be allowed to use proprietary technology or be required to

run open protocols specified by a standardisation body.

The need for

technical supervision emerges as soon as the central bank is shielded

from some retail transactions, which a fraudulent or technically

compromised PSP could use to appropriate customer funds. Maximum

supervision is required when the central bank has the conceivable

minimum information set. Payment supervision must happen at a high

frequency – perhaps even in real time. It must put aspects like data

consistency, cyber security and privacy at centre stage.8

All this pinpoints a

novel trade-off for central banks in the digital era: they can operate

either complex technical infrastructures or complex supervisory regimes.

There are many ways to do so, but all will require the central bank to

develop substantial technological expertise.

Authors’ note:

The views expressed in this column are those of the authors and do not

necessarily reflect those of the Bank for International Settlements. We

thank Stijn Claessens, Giulio Cornelli, Jon Frost, Antonio Fatas, and

Leonardo Gambacorta for comments and suggestions.

References

Armelius, H, G Guibourg, S Johansson and J Schmalholz (2020), “E-krona design models: pros, cons and trade-offs”, Sveriges Riksbank Economic Review, June: 80–

96.

Auer, R and R Boehme (2020a), “The technology of retail central bank digital currency”, BIS Quarterly Review, March: 85-100.

Auer, R and R Boehme

(2020b), “Central bank digital currency: the quest for minimally

invasive technology”, BIS working papers, forthcoming.

Auer, R, G Cornelli and J Frost (2020a), “Rise of the central bank digital currencies: drivers, approaches and technologies”, CEPR Discussion Paper 15363.

Auer, R, G Cornelli and J Frost (2020b), “Covid-19, cash and the future of payments”, BIS Bulletin No. 3, April.

Vox

© VoxEU.org