Stronger financial regulation and supervision, and developing global standards, can help address many concerns about crypto assets

The already volatile world of crypto has been upended anew by the collapse of one its largest platforms, which highlighted risks from crypto assets that lack basic protections.

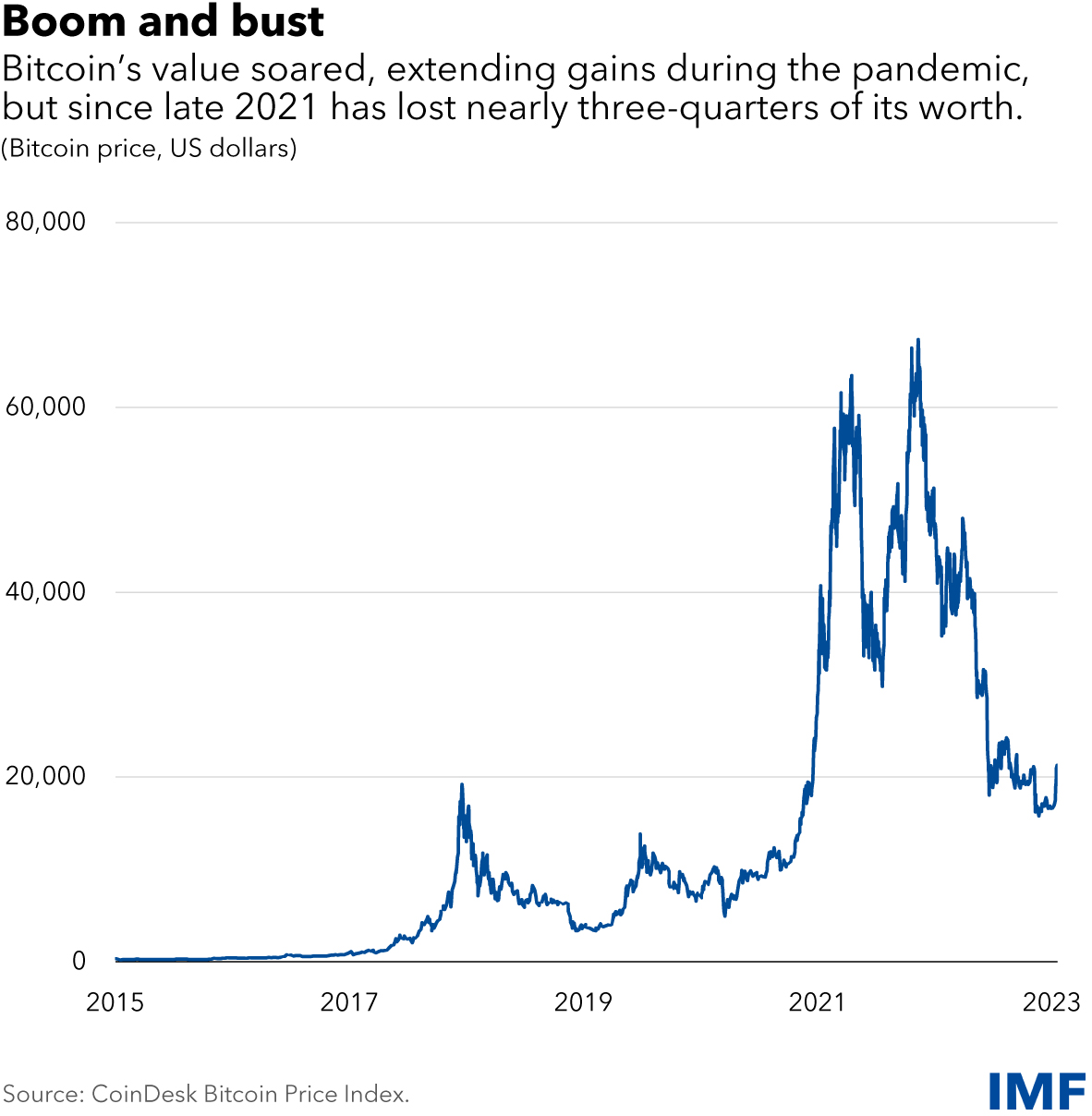

The losses punctuated an already perilous period for crypto, which has lost trillions of dollars in market value. Bitcoin, the largest, is down by almost two-thirds from its peak in late 2021, and about three-quarters of investors have lost money on it, a new analysis by the Bank for International Settlements showed in November.

During times of stress, we’ve seen market failures of stablecoins, crypto-focused hedge funds, and crypto exchanges, which in turn raised serious concerns about market integrity and user protection. And with growing and deeper links with the core financial system, there could also be concerns about systemic risk and financial stability in the near future.

Many of these concerns can be addressed by strengthening financial regulation and supervision, and by developing global standards that can be implemented consistently by national regulatory authorities.

Two recent IMF reports on regulating the crypto ecosystem are especially timely amid the severe turmoil and disruption in many parts of the crypto market and the repeated cycles of boom and bust for the ecosystem around such digital assets.

Our reports address the issues noted above at two levels. First, we take a broad approach, looking across key entities that carry out the core functions within the sector, and hence, our conclusions and recommendations apply to the entire crypto asset ecosystem.

Second, we focus more narrowly on stablecoins and their arrangements. These are crypto assets that aim to maintain a stable value relative to a specified asset or a pool of assets.

New challenges

Crypto assets, including stablecoins, are not yet risks to the global financial system, but some emerging market and developing economies are already materially affected. Some of these countries are seeing large retail holdings of, and currency substitution through, crypto assets, primarily dollar-denominated stablecoins. Some are experiencing cryptoization—when these assets are substituted for domestic currency and assets, and circumvent exchange and capital control restrictions.

Such substitution has the potential to cause capital outflows, a loss of monetary sovereignty, and threats to financial stability, creating new challenges for policy makers. Authorities need to address the root causes of cryptoization, by improving trust in their domestic economic policies, currencies, and banking systems.

Advanced economies are also susceptible to financial stability risks from crypto, given that institutional investors have increased stablecoin holdings, attracted by higher rates of return in the previously low interest rate environment. Therefore, we think it’s important for regulatory authorities to quickly manage risks from crypto, while not stifling innovation.

Specifically, we make five key recommendations in two Fintech Notes, Regulating the Crypto Ecosystem: The Case of Unbacked Crypto Assets and Regulating the Crypto Ecosystem: The Case of Stablecoins and Arrangements, both published in September.

IMF

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article