While some Fed interventions had little or no impact on market fear, the most powerful were the US dollar swap lines, which strongly reduced the perceived likelihood of global market losses decades into the future. The results suggest that the Fed's relative global role has been strengthened, possibly at the cost of increased moral hazard.

While the direct economic consequences of

Covid-19 have been significant, the impact on the financial markets has

been more nuanced. This column uses a unique data set on the financial

markets’ fears and perceptions of long-run financial risk to identify

how Covid-19, and particularly Fed policy responses to Covid-19,

affected global market fears.

The direct economic consequences of Covid-19 have been significant

(Baldwin and Weder di Mauro 2020) but the impact on the financial

markets has been more nuanced, with considerable disruption but no

crisis – unlike in 2008 – perhaps thanks to prompt central bank

responses.

While central bank interventions did alleviate immediate market

fears, it remains an open question whether that success came at the

expense of higher longer-term moral hazard and the increased global

importance of the US Federal Reserve.

Shedding more light on those issues motivates our companion work

(Bevilacqua et al. 2021), where we document how the various categories

of Fed policy responses at the height of the Covid-19 crisis affected

market fears across a wide range of countries, maturities, levels of

losses and assets.

Data and methodology

Our empirical investigation is based on a uniquely rich global

options data set provided by the data vendor IHS Markit, containing

maturities ranging from one week to 30 years, strike prices from drops

up to 80% all the way to 200% price increases, across 242 indices and

3,334 individual stocks. We use the options data to obtain a time

series of the risk-neutral distribution of market outcomes – the term

structure of fear – the main ingredient in our empirical analysis. We

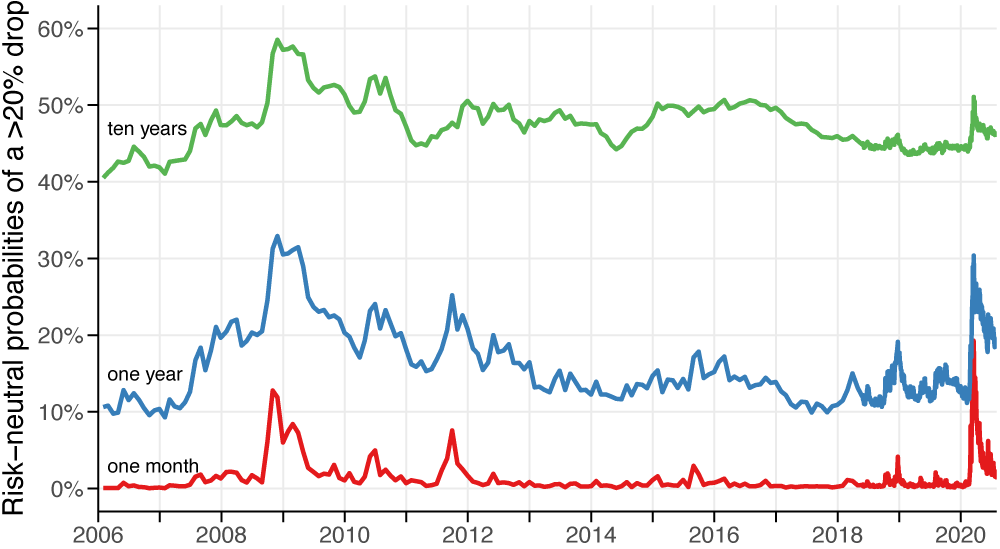

show a snapshot of the data in Figure 1.

Figure 1 Probabilities (risk-neutral) of a 20% or higher drop in the S&P 500 over the next month, year and decade.

The difference between how the markets saw the 2008 and the Covid

crises is remarkable. The increase in fear was much more fleeting in

2020, and then mostly manifesting in short-term risk.

In order to better understand the reactions to the Fed interventions in the Covid crisis, we classify them into five categories.

1. Wider economy support: Credit to households, businesses and the public sector

2. Interest rate changes and forward guidance

3. Liquidity support for domestic financial markets

4. Macroprudential regulations

5. US dollar swap lines and FIMA repo facility

We run a series of regressions, with either the one day change in the

perceived quantile of expected losses or volatility (VIX) as dependent

variables and policy announcements and controls as exogenous variables,

and do this across a wider range of maturities and levels of losses,

identifying the policy shocks by their immediate impact. Below we only

report the quantiles changes, termed fear, but the companion paper does

both...

full paper Vox

© VoxEU.org

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article