On 10 November 2021, the European Fiscal Board (EFB)

published its new annual report (EFB 2021). The report provides an

assessment of the immediate fiscal policy response to the Covid-19

crisis and further updates the EFB’s reform proposal for the EU fiscal

framework to account for post-pandemic realities. The deep contraction

of over 6% – unprecedented in its severity since WWII – invalidated

earlier policy plans, which in many cases contained unambitious fiscal

targets, in particular for high-debt countries.

The Covid-19 impact on public finances in the EU

An explicit provision was introduced in the Stability and Growth Pact

(SGP) in 2011 to cater for Covid-like symmetric calamities, the ‘severe

economic downturn clause’ (in the public debate commonly known as the

‘general escape clause’). Its swift, and very first, activation, in

conjunction with the equally swift reaction of the ECB via the pandemic

emercency purchase programme (PEPP), provided the necessary room for

policy manoeuvre. Starting from March 2020, Member States have virtually

all enacted massive crisis-relief packages, so the budgetary impact was

more pronounced than after past major economic shocks, with the

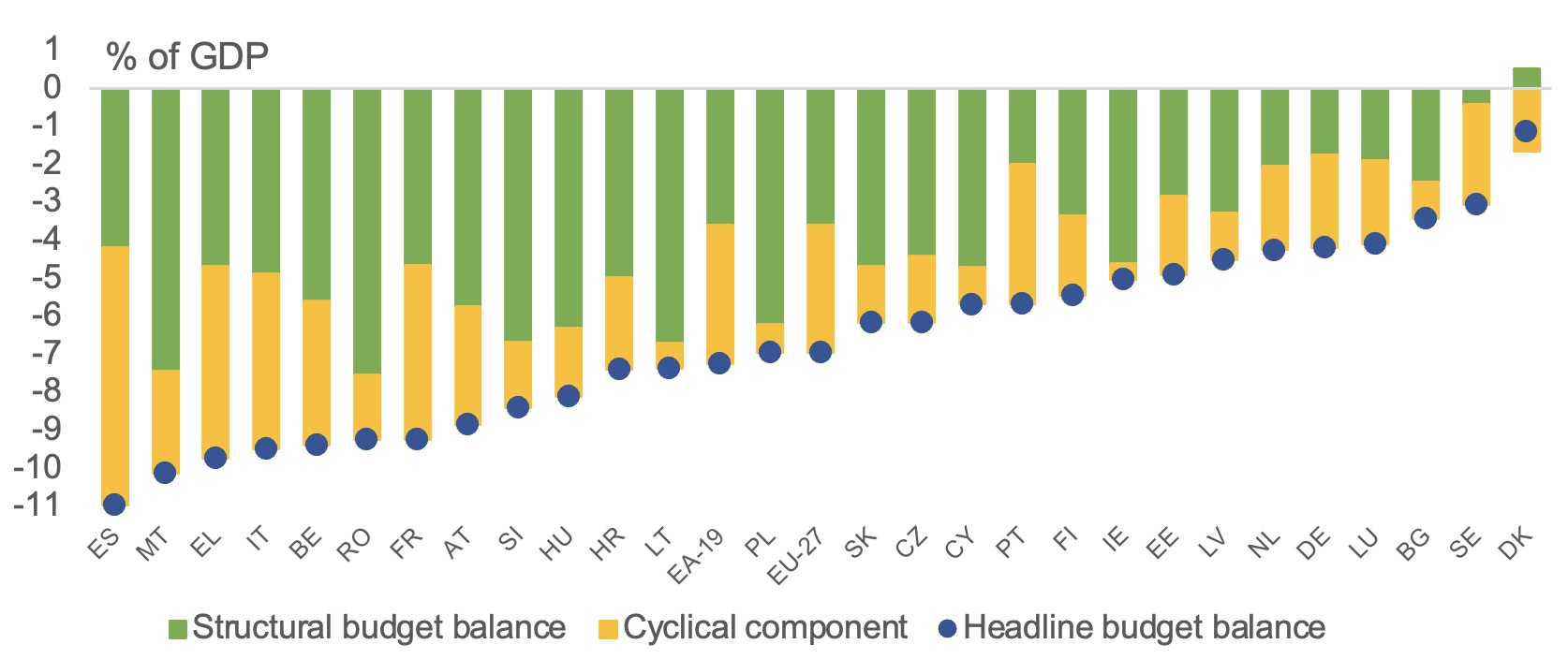

deficits exceeding 9% of GDP in several Member States (see Figure 1).

This robust fiscal response coupled with the sharp drop in economic

activity led to an equally unprecedented increase in government

debt-to-GDP ratios by over 13 percentage points on average. Member

States with the highest debt before the crisis recorded the biggest

jumps in debt ratios, also linked to the fact that they happened to be

particularly hard hit by the pandemic.

Figure 1 Government balances in 2020 by country

Note: Estimates of the structural budget balance are

surrounded by uncertainty as they involve forecasts of real GDP. They

are likely to be revised when new data become available.

Source: European Commission’s spring 2021 economic forecast.

Overall, the swift and forceful reaction of both fiscal and monetary

authorities was warranted. It stands in sharp contrast to what happened

in the wake of the global financial and economic crisis and was, without

doubt, instrumental in softening the economic and social fallout of the

pandemic, at least for the short term. At the same time, the policy

response underscored at least two important and interlinked issues in

the EU fiscal surveillance framework: the notorious failure or

difficulty on the part of some Member States to build fiscal buffers in

good economic times, followed by the tendency to find new often forms of

flexibility in the implementation of the EU fiscal rules or through new

elements of risk sharing when times turn bad.

As was explained in previous EFB reports (e.g. Thygesen et al. 2020),

not all Member States had taken advantage of the protracted recovery

from the global economic and financial crisis to improve public

finances. A significant number of euro area Member States entered the

pandemic with a debt-to-GDP ratio well above pre-2007 levels and had

more limited or no budgetary leeway for responding to another major

economic shock. In light of the truly exogenous nature of the pandemic,

common EU initiatives created room for manoeuvre for this latter group

of countries as well. In particular, following difficult negotiations in

the Council the EU started the Next Generation EU (NGEU) initiative,

which involves substantial cross-country transfers. In addition, the

ECB’s PEPP programme very much helped mitigate early signs of stress on

certain euro area sovereigns and stabilise yields at low levels.

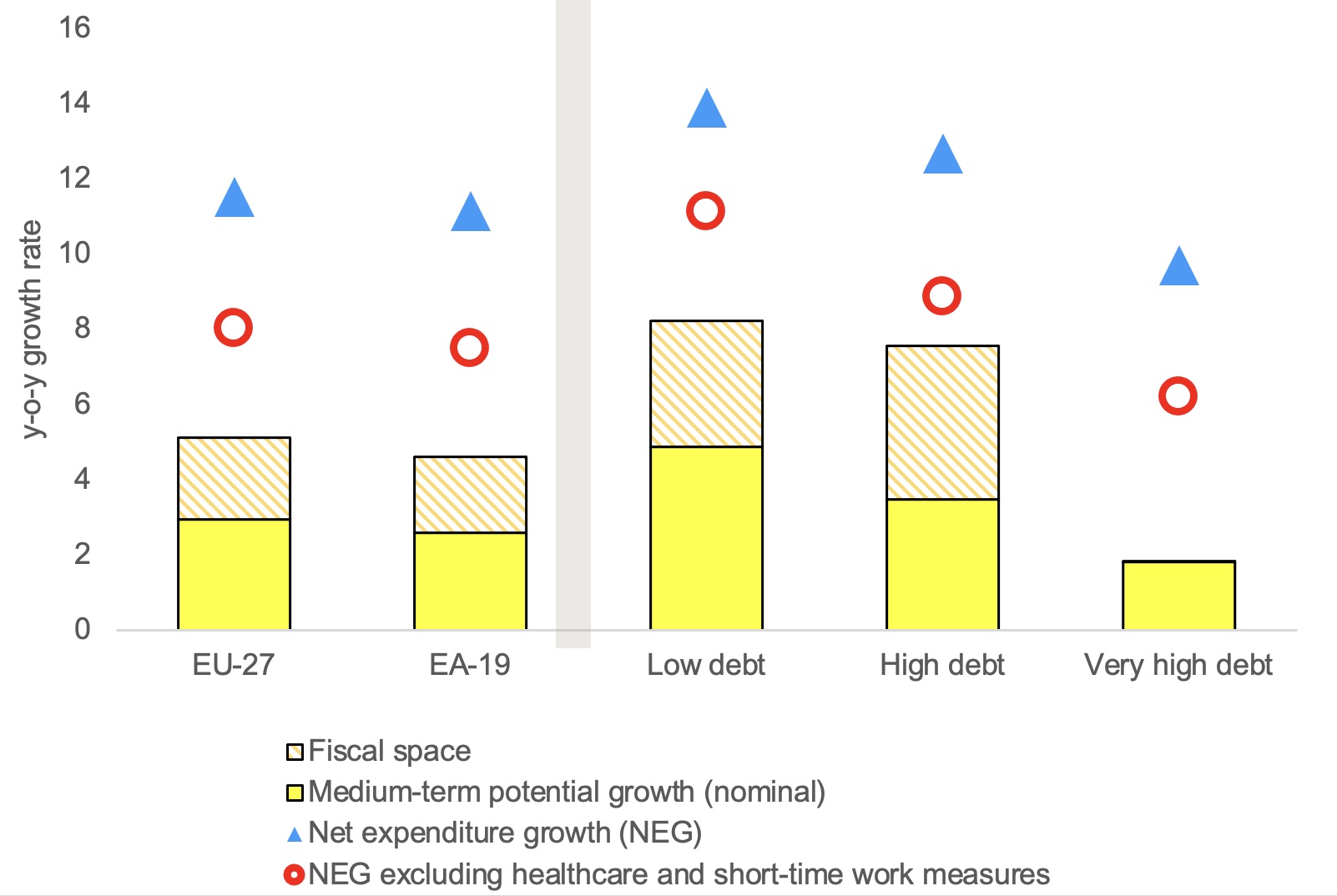

Nevertheless, as Figure 2 demonstrates, countries with less fiscal

headroom mobilised a comparatively smaller increase in government

expenditure in 2020; it remains true when one takes into account the

impact of the various liquidity support schemes, such as the

government-guaranteed lending programmes.

Figure 2 Net expenditure growth in 2020 (country groups by fiscal positions)

Notes: (1) The medium-term rate of potential GDP

growth is in nominal terms. It is calculated as the 10-year average of

real potential output growth rates plus the GDP deflator, taken as an

average over the same 10-year period. (2) Fiscal space reflects the

difference between the estimated structural budget balance and the

medium-term objective (MTO). The fiscal space for Greece is set to zero

due to fiscal commitments taken at the end of the economic programme.

(3) Net expenditure growth refers to the growth rate of government

expenditure in 2020 excluding some items (interest expenditure,

expenditure on EU programmes fully matched by EU funds revenue, and the

cyclical part of unemployment benefit expenditure) and is net of

discretionary revenue measures and one-offs. Investment expenditures are

averaged over four years. (4) Low debt countries = EE, LU, BG, CZ, SE,

DK, RO, LT, LV, MT, PL; High debt countries = NL, IE, SK, FI, DE, HU,

SI, AT, HR; Very high debt countries = CY, FR, BE, ES, PT, IT, EL.

Source: European Commission’s spring 2021 economic forecasts, EFB calculations.

To accommodate the fiscal response within the EU fiscal rules, the

Commission and the Council started early on to discuss various

flexibility options. They quickly agreed to resort to the severe

economic downturn clause. Although extra flexiblity was needed, the way

decisions were taken highlights issues in the implemenation of a

rules-based system. In particular, although designed to grant some

flexibility on a country-by-country basis around the requiremens of the

SGP, the severe economic downturn clause was communicated and applied

like a general waiver without real differentiation across countries.

Second, the timing or conditions for its deactivation were not addressed

until spring 2021, which in turn had been singled out by a number of

independent fiscal institutions as complicating factors to provide

guidance to national bugdetary authorities. Furthermore, official

Commission documents rightly insisted that the activation of the clause

did not mean the suspension of the SGP. However, the Commission and the

Council decided, citing the high degree of uncertainty surrounding the

economic outlook, not to launch any procedural follow-up when they

assessed clear cases of non-compliance, notably excessive deficits. This

approach was based on political considerations rather than established

practice or precedents. Excessive deficit procedures (EDPs) were

customarily opened for straightforward breaches of the deficit

criterion. At the current juncture, EDPs are clearly not to be used as

an instrument of frontloaded and abrupt fiscal adjustment, but could

still offer policy guidance and credibility for the medium term. The

extensive interpretation of the severe economic downturn clause, which

as described above gave rise to diverging interpretations as to the

procedural follow-up and the modalities of deactivation, is a

particularly visible symptom of the underlying challenge in the current

arrangements of EU fiscal surveillance: within the limits imposed by the

Treaty, discretion (when backed by the necessary majority in the

Council) trumps rules. A more organic review of the current set of

flexibilty clauses, taking into account the lessons learnt, is needed.

The case for a swift and comprehensive reform

The pandemic understandably froze the economic governance review

process initiated in early 2020; its recent relaunch by the Commission

was timely and more than welcome. Regardless of divergent perceptions

among Member States as to how to return to a rules-based fiscal

framework, the EFB believes in the significance of wide-ranging changes.

Our reform proposal organised around three central elements: i) a

medium-term debt anchor; ii) an expenditure rule as the main policy

instrument; and iii) a single escape clause applied on the basis of

independent analysis. It was basically laid out in detail before the

outburst of the pandemic (Beetsma et al. 2018, EFB 2019), and it gained

more relevance post-Covid. In fact, there is an emerging generation of

reform blueprints that are similar to the EFB’s.

The EFB is a strong advocate of maintaining reference values, as

clear and recognisable numerical goalposts play an important role in any

solid fiscal framework. They provide tangible focal points for public

debates and a basis for decision-makers’ accountability in the fiscal

domain. Concretely, the 3% of GDP deficit threshold remains a useful

backstop against unsustainable debt dynamics. The headline deficit is

observable, easy to interpret, and uniformly applicable to all EU

countries. It should remain the main triggering point for assessing the

opportunity to initiate corrective actions in a revised framework.

A revised EU fiscal framework should preferably be complemented by

additional policy levers enhancing its resilience and robustness. Beyond

the update of EU fiscal rules, there are other long-overdue governance

reforms in the EU, most notably the creation of a central fiscal

capacity and schemes to promote public investments, such as augmenting

the EU budget by dedicated national envelopes for providing EU common

goods. The availability of a joint fiscal capacity is all the more

important when monetary policy is constrained by the effective lower

bound and some Member States struggle with keeping public finances on a

sustainable path. Conditioning the access to the common instrument to

compliance with the fiscal framework may further encourage fiscal

responsibility across the EU. The recently established NGEU facility

consists partly of budgetary transfers, with strings attached as to how

they can be spent and to what reforms should be pursued, also with a

view to reverse the trend of declining government investment and to

improve the quality of public finances. The jury is still out whether

this initiative remains a one-off or it will lead to permanent

institutional changes.

In a scenario of no major changes to the SGP, EU institutions should

spell out transparently how the necessary flexibility and constrained

discretion vis-à-vis the ‘Maastricht numbers’ will be applied in the

coming period. Most importantly, the boundaries of flexibility should be

clarified. In this vein, routine channelling of the outcome of

bilateral negotiations between the Commission and national governments

through the Council should be abandoned.

Ideally, independent fiscal institutions should play a greater role

in the EU surveillance process, in particular outside the corrective

arm. While greater reliance on country-specific guidance by national

IFIs can have its clear benefits, the EFB sees limits to the reform

avenue of significant decentralisation. In a broad sense, national

fiscal institutions remain too heterogeneous in the EU to consistently

shape the conduct of fiscal policy. This insight is corroborated by our

annual report’s analysis of the early experiences with the national

correction mechanisms. Absent a conscious effort to harmonise the role

and functions of these entities, the Commission’s and the Council’s role

in monitoring performance and formulating recommendations will remain

essential.

Reforming the framework in time would serve the interests of both

groups of Member States: those keen to avoid a further erosion of the

rules-based system, and those willing to exploit flexibility in a

productive manner. By contrast, less predictable fiscal policy only

makes sudden risk repricing by financial markets more likely. Given the

two decades history of discretionary and hard-to-predict tweaks in the

implementation of the existing SGP rule book, reforming genuinely the

fiscal framework seems to be a far better approach.

References

Beetsma, R, N Thygesen, A Cugnasca, E Orseau, P Eliofotou and S Santacroce (2018), “Reforming the EU fiscal framework: A proposal by the European Fiscal Board”, VoxEU.org, 26 October.

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher,

C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N

Veron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No 91.

Darvas, Zs, P Martin, and X Ragot (2018), “European fiscal rules require a major overhaul”, Bruegel Policy Contribution No. 18.

EFB – European Fiscal Board (2019), “Assessment of EU fiscal rules with a focus on the six and two-pack legislation”.

EFB (2021), Annual Report 2021.

Martin, P, J Pisani-Ferry and X Ragot (2021), “Reforming the European Fiscal Framework”, Les notes du conseil d’analyse économique No 63., Conseil d'Analyse Économique

Thygesen, N, R Beetsma, M Bordignon, X Debrun, M Szczurek, M Larch, M Busse, M Gabrijelcic, E Orseau and S Santacroce (2020), “Reforming the EU fiscal framework: Now is the time” , VoxEU.org, 26 October.