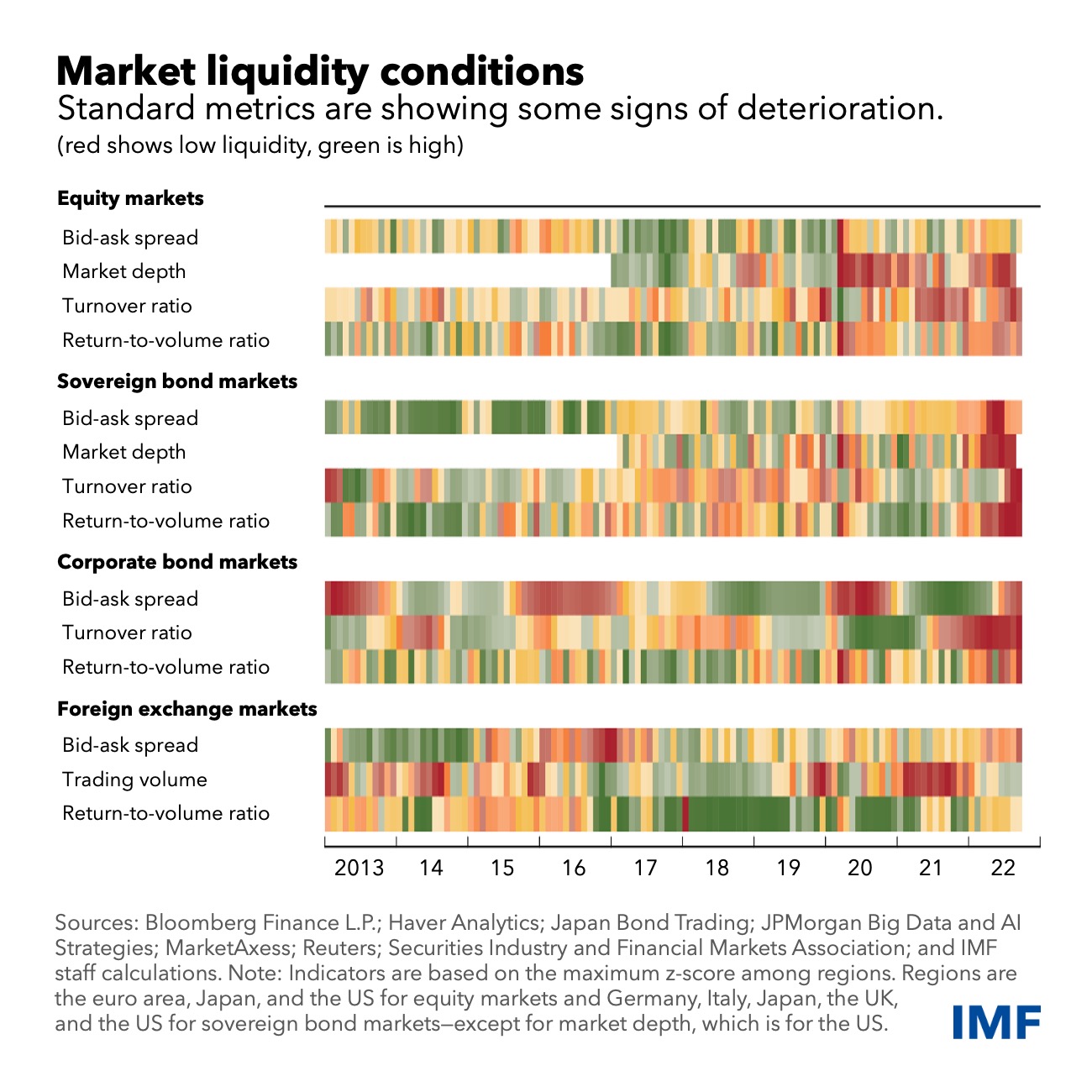

Liquidity is a key measure of how well financial markets are working.

It refers to how easily assets can be bought or sold—and when it dries

up, it can be disruptive.

After more than a decade of abundant liquidity and relative calm in

markets, central bank interest-rate increases to contain inflation have

been accompanied by elevated market volatility.

As the Chart of the Week

shows, measures of market liquidity have worsened across asset classes,

especially in recent weeks, as heightened uncertainty about the

economic outlook and monetary policy left investors with much less risk

appetite.

This may pose risks to financial stability, as our Global Financial Stability Report

outlined earlier this month. This was recently underscored by the

stress in the United Kingdom’s government bond market, which required

the Bank of England to intervene. This episode showed how sudden price

moves combined with forced selling and deleveraging can lead to

disorderly conditions in asset markets that could threaten broader

market functioning and stability. Spillovers from disorderly asset

markets could also increase borrowing costs for governments and

corporations, worsening financial conditions.

IMF

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article