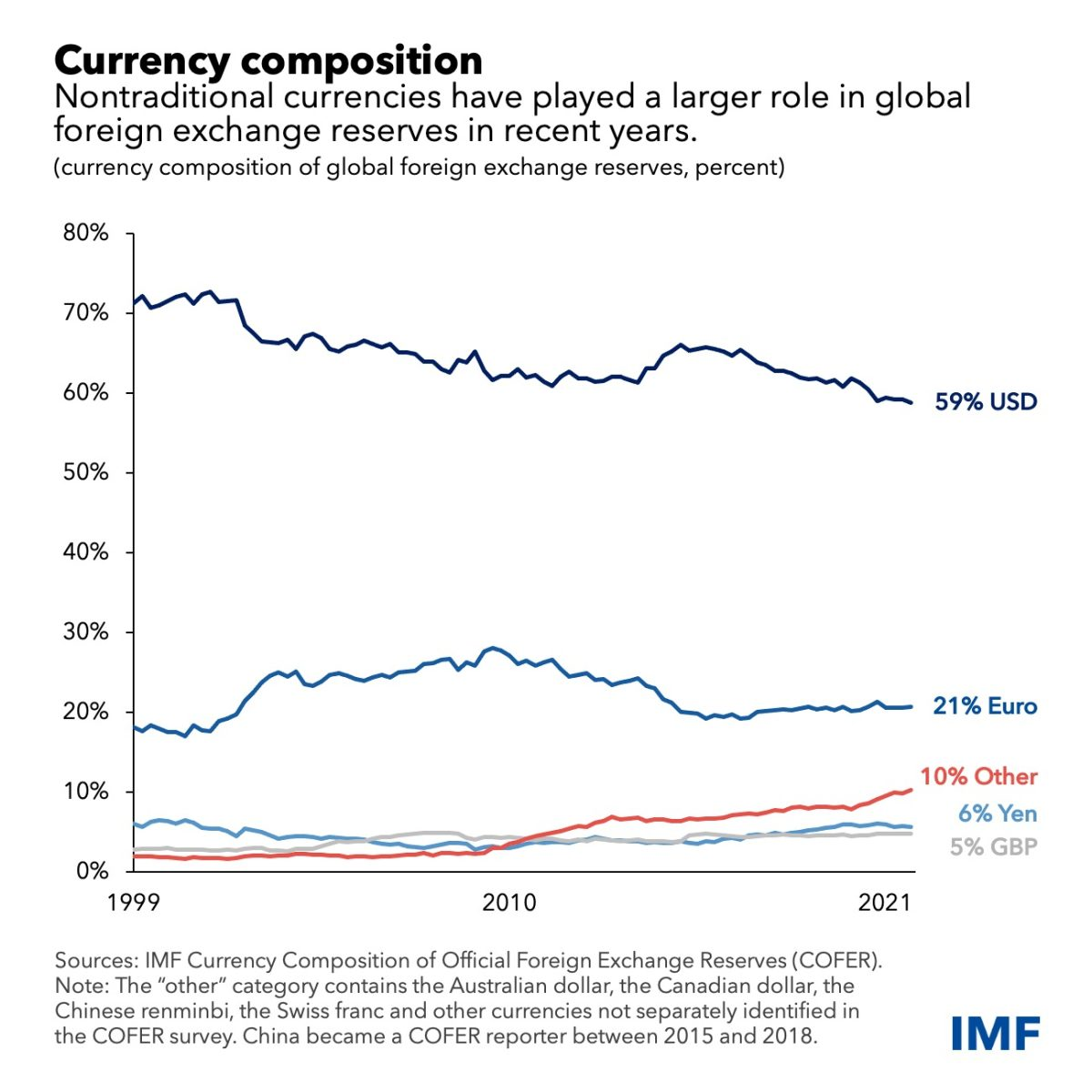

The US dollar has long played an outsized role in global markets. It continues to do so even as the American economy has been producing a shrinking share of global output over the last two decades.

But although the currency’s presence in global trade, international

debt, and non-bank borrowing still far outstrips the US share of trade,

bond issuance, and international borrowing and lending, central banks

aren’t holding the greenback in their reserves to the extent that they

once did.

As the Chart of the Week

shows, the dollar’s share of global foreign-exchange reserves fell

below 59 percent in the final quarter of last year, extending a

two-decade decline, according to the IMF’s Currency Composition of

Official Foreign Exchange Reserves data.

In an example of the broader shift in the composition of foreign exchange reserves, the Bank of Israel recently unveiled a new strategy for its more than $200 billion

of reserves. Beginning this year, it will reduce the share of US

dollars and increase the portfolio’s allocations to the Australian

dollar, Canadian dollar, Chinese renminbi and Japanese yen.

As we document in a recent IMF working paper,

the reduced role of the US dollar hasn’t been matched by increases in

the shares of the other traditional reserve currencies: the euro, yen,

and pound. Moreover, while there has been some increase in the share of

reserves held in renminbi, this accounts for just one quarter of the

shift away from dollars in recent years, partly due to China’s

relatively closed capital account. Moreover, an update of data

referenced in the working paper shows that, as of the end of last year, a

single country—Russia—held nearly a third of the world’s renminbi

reserves.

more at IMF

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article