Mutual fOpen-end investment funds, as they are known, have grown significantly in the past two decades, with $41 trillion in assets globally this year. That represents about one-fifth of the nonbank financial sector’s holdings. unds holding hard-to-sell assets but offering daily redemptions can spark volatility and magnify the impact of shocks, especially in periods of market stress

Mutual funds that allow investors to buy or sell their shares daily are an

important component of the financial system, offering investment

opportunities to investors and providing financing to companies and

governments.

These funds may invest in relatively liquid assets such as stocks and

government bonds, or in less-frequently-traded securities like corporate

bonds. Those with less-liquid holdings, however, have a major potential

vulnerability. Investors can sell shares daily at a price set at the end of

each trading session, but it may take fund managers several days to sell

assets to meet these redemptions, especially when financial markets are

volatile.

Such liquidity mismatch can be a big problem for fund managers during

periods of outflows because the price paid to investors may not fully

reflect all trading costs associated with the assets they sold. Instead,

the remaining investors bear those costs, creating an incentive for

redeeming shares before others do, which may lead to outflow pressures if

market sentiment dims.

Pressures from these investor runs could force funds to sell assets

quickly, which would further depress valuations. That in turn would amplify

the impact of the initial shock and potentially undermine the stability of

the financial system.

Illiquidity and volatility

That’s likely the dynamic we saw at play during the market turmoil at the

start of the pandemic, as we write in an analytical chapter of the Global Financial Stability Report. Open-end funds were forced to sell

assets amid outflows of about 5 percent of their total net asset value,

which topped global financial crisis redemptions a decade and a half

earlier.

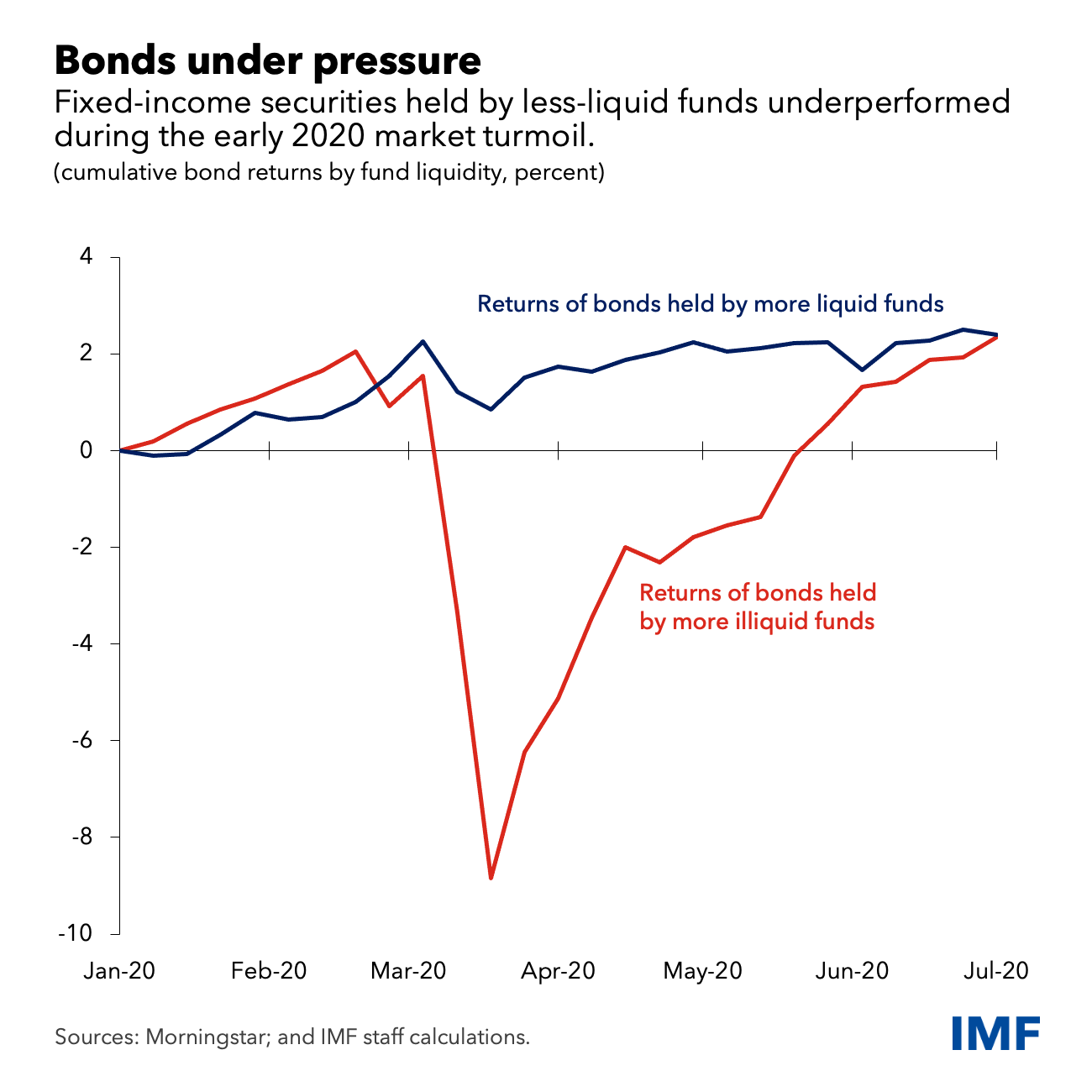

Consequently, assets such as corporate bonds that were held by open-end

funds with less-liquid assets in their portfolios fell more sharply in

value than those held by liquid funds. Such dislocations posed a serious

risk to financial stability, which were addressed only after central banks

intervened by purchasing corporate bonds and taking other actions. Looking beyond the pandemic-induced market turmoil, our analysis shows that

the returns of assets held by relatively illiquid funds are generally more

volatile than comparable holdings that are less exposed to these

funds—especially in periods of market stress. For example, if liquidity

dries up the way it did in March 2020, the volatility of bonds held by

these funds could increase by 20 percent.

Looking beyond the pandemic-induced market turmoil, our analysis shows that

the returns of assets held by relatively illiquid funds are generally more

volatile than comparable holdings that are less exposed to these

funds—especially in periods of market stress. For example, if liquidity

dries up the way it did in March 2020, the volatility of bonds held by

these funds could increase by 20 percent.

IMF

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article