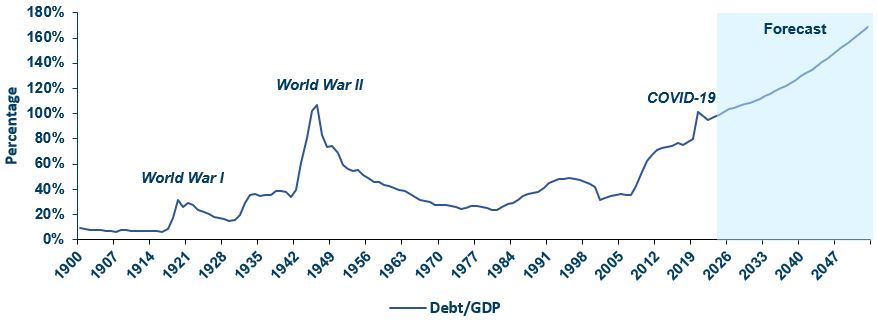

The trajectory of US federal government debt is escalating, with debt held by the public potentially rising from just under 100% today to more than 170% of GDP in 30 years. This raises concerns about the feasibility of financing and the associated costs.

The United States is approaching an unprecedented level of debt, exceeding historical highs after World War II. Fiscal adjustment will be unavoidable as the country cannot outgrow its debt dilemma. Despite high domestic and external demand for US debt, relying on this demand amid such significant debt increases is imprudent. The lack of strong growth prospects to reduce the debt-to-GDP ratio and the absence of political willingness for fiscal adjustment present significant risks.

The trajectory of US federal government debt is escalating, with debt held by the public potentially rising from just under 100% today to more than 170% of GDP in 30 years. This raises concerns about the feasibility of financing and the associated costs. The end of low interest rates could lead to a higher portion of tax revenue dedicated to debt service, higher inflation, and possibly stifling economic growth.

Historical data suggests a weak relationship between the supply of federal debt and the interest rates charged. However, this relationship may not hold with much higher debt levels.

Two scenarios of fiscal adjustment are explored: gradual fiscal consolidation and forced abrupt adjustment. The optimistic gradual adjustment would entail a slow increase in yields, leading to political consensus for spending cuts and tax increases. The latter, driven by a more sudden loss of investor confidence and market disruptions, could result in significant global repercussions. In either case, the Federal Reserve may be required to support US bond markets, although its actions could be less effective in a high-inflation environment with diminished confidence in US debt.

“The path to a more stable fiscal outlook for the US is expected to be significantly more volatile

than what markets have witnessed over the last ten to fifteen years.”

A Rising Trajectory

US federal government debt is on a rising trajectory. It is estimated that debt held by the public could increase from just under 100 percent of GDP today to more than 170 percent in 30 years.1 Can this be financed, and at what cost?

The USD’s privileged reserve currency status and the United States’ dominant share of global capital markets will ensure the US Treasury retains market access, but the end of the low interest rate period will entail costs. Higher real interest rates will raise the share of tax revenue taken up by debt service, high fiscal deficits may keep inflation high, and, more importantly, high debt and deficits could also reduce growth.

Figure 1: US Debt Held by the Public / GDP Ratio

Source: CBO, BEA, measuringworth.com, Amundi Investment Institute.

more at SUERF

© SUERF

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article