by Arnold, Claveres, Frie : Reforms could increase investment in high-tech startups that power innovation

The European Union has a productivity problem. Its people produce nearly 30 percent less per hour worked than they would have, had real output per hour worked increased in line with that in the United States since 2000.

A failure to sufficiently develop innovative startups into “superstar” firms is one of the reasons for the bloc’s poor productivity growth.

Europe’s fragmented economy and financial system partly underly this problem. Without a more frictionless single market for goods, services, labor, and capital, it’s more expensive and difficult for successful startups to scale up.

On top of that, Europe’s bank-based financial system is not well-suited to finance risky startups. High-tech startups often develop new technologies and business models, which are risky and may be hard for banks to assess. And the value of startups often lies in their people, ideas, and other intangible capital, which is difficult to pledge as collateral for a bank loan. Banks are also constrained by rules that (rightly) limit lending to risky firms without collateral—even fast-growing ones that are likely to make large profits later.

European pools of private capital are also smaller and more fragmented than in the US. Europeans park more of their savings in bank accounts rather than capital markets. Americans invested $4.60 in equity, investment funds, and pension or insurance funds for every dollar invested in such assets by Europeans in 2022. In part, this is because Europeans rely more on pay-as-you-go pensions than Americans. But regardless of the reason, the end result is less availability of equity financing for companies.

The fragmentation of markets stems in part from national laws, regulations, and taxes that hamper cross-border consolidation, capital raising, and risk-sharing. Many institutional investors prefer to allocate capital to companies based in their own countries. This often applies to investments in venture capital as well, especially in smaller funds.

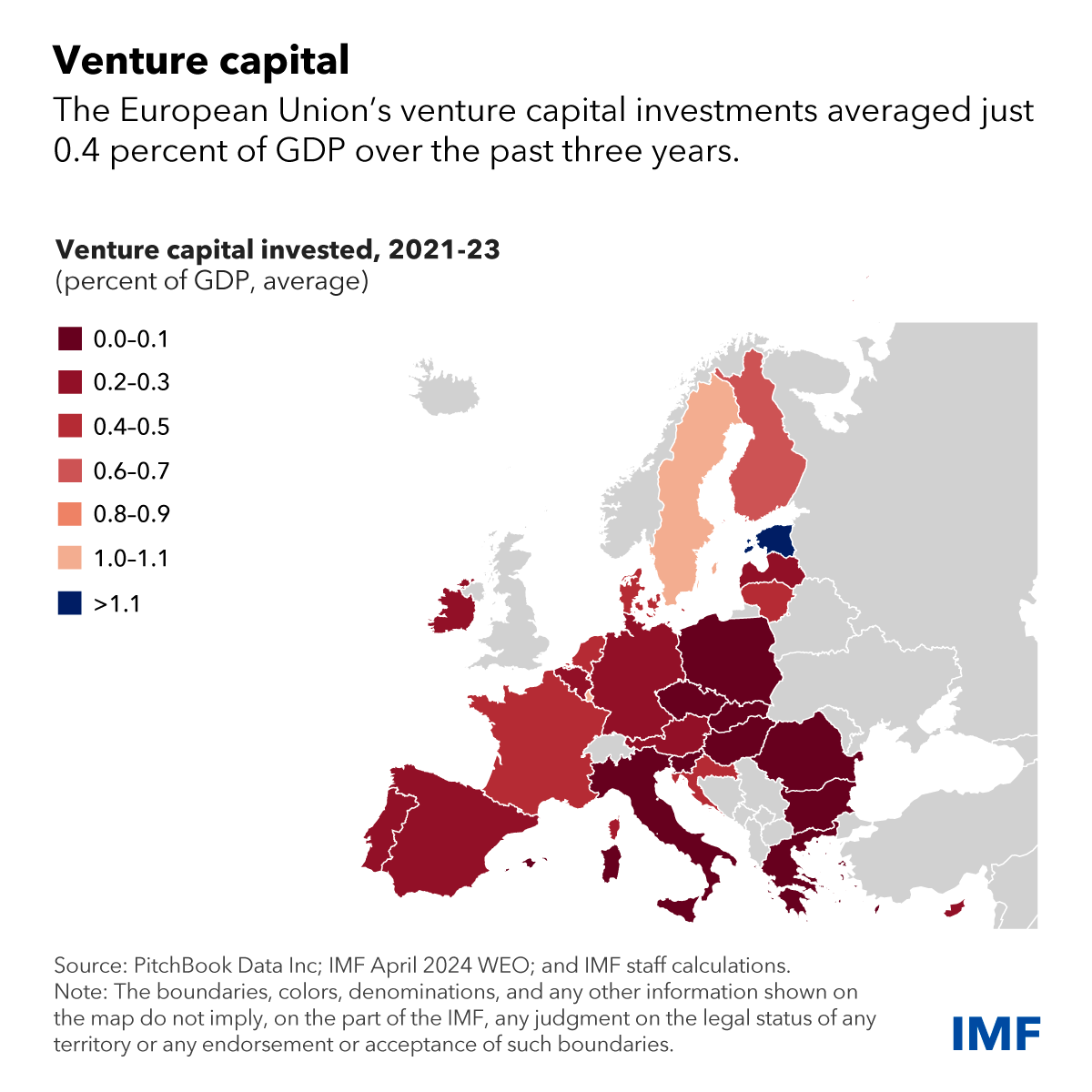

Greater venture capital investments could spur productivity and strengthen the EU’s innovation ecosystem. But Europe’s shallow pools of venture capital are starving innovative startups of investment and making it harder to boost economic growth and living standards.

As our new paper argues, measures to strengthen the EU’s venture capital markets and remove cross-border financial frictions to pension funds and insurers investing in venture capital could increase the flow of funding to promising startups and fuel productivity gains.

The EU lost its largest venture capital center, London, following the United Kingdom’s vote to leave the Union in 2016 and its remaining centers lack the scale of those in the United States.

IMF blog

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article