Both the European Council and the

European Parliament have called on the Commission to consider the

development of European sustainability reporting standards for

corporates. The Commission has taken a number of preparatory steps to

speed up the development of European sustainability reporting standards.

One of these steps was to ask the European Financial Reporting Advisory

Group (EFRAG) to explore what these standards might look like and to

propose a roadmap for their development. A dedicated multi-stakeholder task force chaired by Patrick de Cambourg, President of the French Accounting Standard Setter (Autorité des normes comptables)

was set up for this purpose. The Commission also asked Jean-Paul

Gauzès, the President of EFRAG and ex-MEP, to make recommendations for

possible changes to the governance of EFRAG in the event that it were to

be entrusted with the task of developing these standards. EFRAG

published both reports on 8 March 2021. The Commission, which is

preparing the revision of the Non-Financial Reporting Directive, is

considering the recommendations when finalising its proposal, which it

plans to publish in April 2021.

Sustainability reporting

Standardised,

comparable, reliable and relevant sustainability information provided

by companies constitutes the foundation of the sustainable finance

ecosystem. Banks, insurance companies and asset managers need this

information to manage their own exposure to sustainability-related risks

and to manage the impacts of their investment and lending portfolios on

society and the environment. NGOs and other civil society organisations

need this information to monitor and hold companies accountable for the

impact their business has on the outside world. Common sustainability

reporting standards would be a major improvement on the current

corporate reporting framework. They would mark a key step towards

putting sustainability reporting and financial reporting on an equal

footing.

The report from Jean-Paul Gauzès proposes how to deal

with the challenge of creating a rigorous and inclusive process for the

development of sustainability reporting standards. It sets out how

national and European authorities could be involved, while ensuring that

the process also draws upon the expertise of the private sector and

civil society organisations. The report proposes the creation of an

additional element – or ‘second pillar’ – within EFRAG, dedicated to

work on the sustainability reporting standards. This would leave the

existing financial reporting pillar of EFRAG largely unchanged. The

proposed governance structure would also ensure the coordination and

interconnectivity between the two pillars, given the growing interaction

between financial and sustainability reporting.

Standard setting

The

report from the multi-stakeholder task force chaired by Patrick de

Cambourg, proposes a roadmap for the development of a comprehensive and

dynamic set of EU sustainability reporting standards. It highlights a

number of important building blocks, including:

- Standard-setting

for sustainability reporting should reflect the needs of EU policies

and legislation, including key components of the sustainable finance

agenda such as the Taxonomy Regulation and the Sustainable Finance

Disclosure Regulation

- The standard-setter should adopt a

proportionate approach to SMEs by balancing (i) the specific governance,

organisation and resources of SMEs and (ii) the need for sustainability

information produced by SMEs to be relevant for their stakeholders

(value chain and financial institutions in particular)

- The

standard-setter should consider intangibles as a key dimension of

sustainable business development and therefore of sustainability

reporting

The report stresses the need to adequately

connect financial and sustainability reporting, and for standards to

cover not just backward-looking information about past performance, but

also forward-looking information. It explores in detail the practical

implications for the standard-setter and for companies of the so-called

double materiality perspective: the idea that companies should report on

the sustainability-related risk to which they are exposed, as well as

on their own impacts on people and the environment.

Future standards

The

report from the multi-stakeholder task force chaired by Patrick de

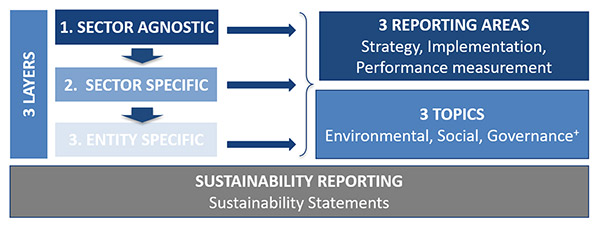

Cambourg recommends three layers of reporting: “sector-agnostic”

(disclosures that all companies have to make regardless of their

sector), “sector-specific” (disclosures that reflect the particular

risks and impacts of a given sector), and “entity-specific” (disclosures

that a company may make about issues relevant to its own particular

circumstances). The standards would cover the complete range of

sustainable issues under the well-established structure of

environmental, social and governance (ESG). And they would cover three

broad reporting areas: the company’s strategy, its implementation, and

performance measurement.

Standards Target architecture

Standards Target architecture

Financial

standard-setting has taken decades to reach maturity, but we do not

have that luxury in the case of sustainability reporting standards. The

report proposes therefore to begin the process by establishing a first

set of standards covering core information for the three sustainability

topics (ESG) and the three reporting areas. The content of those

standards would then be enhanced in a second phase and on an on-going

basis.

The international dimension

Both

reports stress that standard setting should build upon and contribute

to international initiatives that have similar goals, and this

cooperation should be carried out in a spirit of partnership and

‘co-construction’. The report from Jean-Paul Gauzès proposes a

structured dialogue between EU and global standard-setting initiatives,

and raises the idea of joint projects to develop new standards where

that might be appropriate. It also proposes the establishment of a

Consultative Forum through which EFRAG would coordinate with

international and national standard-setting bodies.

These reports

represent an important voice in the discussions about how best to

develop European corporate sustainability reporting. Their

recommendations are being considered by the Commission when finalising

the proposal for the revision of the Non-Financial Reporting Directive

(NFRD). The revision of the NFRD is a crucial element for strengthening

the foundations for sustainable investment, the importance of which was

stressed in the sustainable finance action plan.

Read more on the reports:

https://ec.europa.eu/commission/presscorner/detail/en/mex_21_1062

https://ec.europa.eu/info/publications/210308-efrag-reports_en