CMU is one of the cornerstones of the euro area’s financial architecture. But progress in developing it has been slow. Since the agreement on establishing CMU in 2015, many subprojects have been launched, and some completed, but European capital markets are still far from being fully integrated.

The capital markets union (CMU) is one of the cornerstones of the

euro area’s financial architecture. But progress in developing it has

been slow. Since the agreement on establishing CMU in 2015, many

subprojects have been launched, and some completed, but European capital

markets are still far from being fully integrated. Despite the fact

that the coronavirus (COVID-19) crisis has made CMU more important than

ever, progress has unfortunately slowed, notwithstanding the substantial

headway made on the fiscal side with the agreement on the European

recovery package (Next Generation EU).

Financing the post-crisis

recovery is one of the most pressing challenges Europe is facing today.

Capital markets will be crucial. The new bond issuance by the European

Commission, in the context of Next Generation EU, relies on

well-functioning capital markets.

But public funding cannot do the heavy lifting alone; it will have to

be complemented by substantial private financing. With the banking

sector under pressure due to the pandemic, private bond and equity

markets can play an important role in complementing bank financing.

In

order to recover from the pandemic and strengthen the euro area’s

growth potential, a new push is needed towards the long-term ambition of

creating a genuine single European capital market that is deeply

integrated and highly developed. This will not only mobilise the

resources needed to reboot the euro area economy after the global

contraction. It will also help meet the additional challenges posed by

external developments, such as Brexit and global trade tensions.

In addition, it will provide opportunities for accelerating the

transition to a low-carbon economy – thereby supporting the European

Union’s ambition to be a leader in green finance – and for funding the

transition towards the digital economy. A single capital market will

also strengthen our common currency’s role on the global stage. And last

but not least, a deeper and more integrated financial system is also

needed from a monetary policy perspective, as integrated capital markets

improve the transmission of our single monetary policy to all parts of

the euro area. In turn, this will help limit the risk of growing

asymmetries among member countries as our economies recover from the

COVID-19 shock at different speeds.

Our aim with this blog post is

to re-emphasise the importance of strengthening efforts to advance the

CMU project, in the light of the European Commission’s forthcoming new

Action Plan.

First, we explain why CMU is important, especially due to the COVID-19

crisis. Second, we describe the current state of play regarding capital

market development and integration in the EU, and identify the areas

where progress is needed most. And third, we set out a roadmap of policy

measures that would remove core barriers to further integration.

Following this roadmap would benefit the euro area, the EU and its

citizens. It would stabilise funding sources for households, companies

and governments, foster cross-country risk-sharing and consumption

smoothing, and stimulate growth and the post-COVID-19 recovery.

The

measures we propose are broad in nature and require strong commitments,

in line with the ECB’s long-standing view that the CMU project has to

be ambitious.

Accomplishing these reforms could trigger a virtuous cycle of better

economic outcomes and further reforms, strengthening the European

project. We recognise that developing and integrating European capital

markets will primarily be a market-led process, so the measures we

propose are designed to enable market forces.

Why is CMU even more important due to the COVID-19 crisis?

Even

before the pandemic, the ECB was a strong supporter of the CMU project.

CMU aims to deepen and further integrate capital markets in order to

establish a genuine single capital market within the EU, which would

allow investors, savers, firms and market infrastructures to access a

full range of services and products, regardless of where they are

located. Let us explain why CMU matters, and why it is particularly important due to the COVID-19 crisis.

First,

European firms would benefit from more diverse funding sources, which

would allow them to adapt more effectively to changing funding

conditions. Easier access to market-based financing instruments would

lessen firms’ reliance on bank financing when the banking sector has

been weakened by a shock, such as the COVID-19 crisis. This would also

support the smooth transmission of monetary policy.

Second,

progress towards CMU would increase private risk-sharing across

countries and actors, generating positive effects from a macroeconomic

stabilisation perspective and making economies more resilient to local

shocks. This is particularly important now, with the risk of diverging

economic development within the euro area due to the shock from the

pandemic. Within Europe, increasing cross-border ownership of stocks and

debt securities and cross-border business financing would be an

important way of sharing risks and thereby stabilising households’

consumption and firms’ investment over time.

Equity markets tend to have particularly strong risk-sharing

properties. Several studies also emphasise that equity funding is more

resilient to shocks than debt funding, and can be considered more stable

from a risk-sharing perspective.

Third,

boosting capital markets through policies aimed at increasing equity

financing would support growth and innovation. Research suggests that

firms with higher growth potential generally resort more to (public or

private) equity financing than debt financing and that capital markets

are better at financing innovation and new sources of growth.

This makes capital market funding particularly attractive with a view

to boosting Europe’s potential growth after the pandemic. A fully

fledged CMU would improve funding conditions for innovative firms, which

would mean brighter prospects for jobs and growth in a more sustainable

economy, thereby helping to successfully implement the structural

changes that will be unavoidable after the crisis.

Fourth,

advancing CMU would speed up the transition to a low-carbon economy.

Recent analysis suggests that an economy’s carbon footprint shrinks

faster when it receives a higher proportion of its funding from equity

investors than from banks or through corporate bonds.

Given equity investors’ propensity to fund intangible projects, equity

markets might be more successful in funding green innovation and

supporting the reallocation to green sectors.

Fifth, integrated

euro area capital markets would strengthen the international role of the

euro, as deep and liquid financial markets are fundamental to a

currency’s ability to attain international status.

By reducing transaction costs, deeper markets would make using the euro

more attractive for international financing and settlement. More liquid

markets also mitigate rollover risk and are thus perceived as safer by

investors. A stronger international role for the euro would benefit our

monetary policy, including through greater policy autonomy and improved

monetary policy transmission, with positive spillbacks and lower

external financing costs.

It would complement other measures supporting the international role of

the euro, such as the expansion of euro liquidity facilities during the

COVID-19 crisis.

Finally,

progress on CMU would dovetail with another key EU objective:

completing the banking union. Banks and capital markets complement each

other in financing the real economy, so the two projects are mutually

reinforcing.

On the one hand, more integrated capital markets support cross-border

banking activities, as banks exploit economies of scale and offer

similar capital market products across the EU. More cross-border

holdings would also allow banks to have more diversified collateral

pools for their securitised products and covered bonds. This could

ultimately make banks more resilient, as they would benefit from a wider

investor base for capital market-based funding instruments and a

broader market to which they could sell non-performing assets. On the

other hand, a more resilient and integrated banking system supports the

smooth functioning and further integration of capital markets. Just as

with CMU, the benefits of banking union become even more visible due to

the pandemic.

Where do European capital markets stand today and what has happened during the pandemic?

The

first CMU Action Plan of 2015 has generated some positive developments

in European capital markets. Among other things, it led to some progress

on harmonising and improving insolvency frameworks

and on establishing a new EU framework for covered bonds and simple,

transparent and standardised securitisations. But a significant “CMU

effect” has yet to be seen in the data – partly because these measures

have only been implemented recently and their full impact will take some

time to emerge.

European capital markets – and especially equity markets – remain

underdeveloped and insufficiently integrated at the European level.

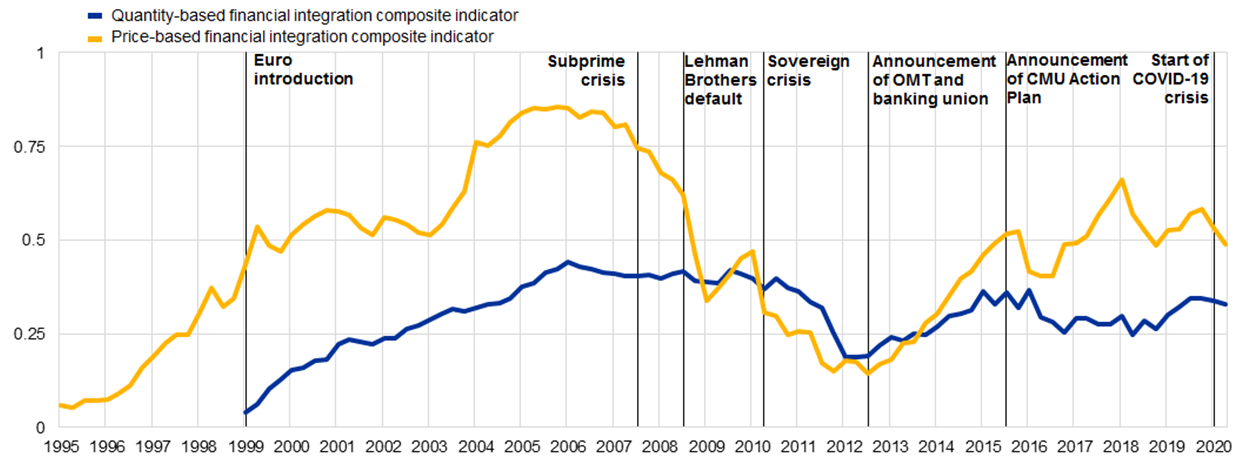

While there was a strong positive trend in capital market integration

following the great financial and euro area crisis, as shown by the

price- and quantity-based indicators in Chart 1, the integration of

equity markets has stagnated since 2015 and has even declined since the

fourth quarter of 2017. Cross-border holdings of debt have increased,

but this is mainly true for shorter maturities, which are less stable

than longer-term debt. Another notable trend is that investment funds are playing an increasingly important role in cross-border integration.

However, overall risk-sharing is still low compared with the levels

typically observed across regions or states within a single country or

federation.

While

it is too early to fully assess the impact of the COVID-19 outbreak on

EU capital markets, some initial indicators show that the pandemic has

triggered a refragmentation within euro area financial markets, mainly

through bond and equity markets. At the height of the pandemic, this

meant that our private purchase programmes could not reach the

non-financial corporations (NFCs) of all euro area countries in the same

way.

Chart 1

Price and quantity-based indicators of financial integration

(quarterly data; Q1 1995 – Q2 2020)

Source: ECB (2020), Financial Integration and Structure in the Euro Area, March 2020.

Notes:

The indicators are bound between zero (full fragmentation) and one

(full integration). The result of the quantity-based composite indicator

for Q2 2020 is based on money market and equity market benchmark data

from Q2 2020; for the bond market, Q1 2020 benchmark data are used. For a

detailed description of the indicators and their input data, see the Statistical annex to the ECB report “Financial Integration and Structure in the Euro Area” (see source above) and Hoffmann et al. (2019).

Capital market development is also lagging behind.

While the US economy is financed through capital markets to a

significant degree, the euro area economy continues to be mainly

financed by banks and through unlisted shares. Nevertheless, the role of

capital markets in providing a stable source of funding to the European

economy is expanding, thereby moving the euro area’s financial

structure towards a more balanced composition.

NFCs have gradually diversified their funding structures and are

increasingly financing themselves in the market by issuing debt

securities. At the same time, however, corporate bond markets are very

uneven across euro area countries.

Even though the share of all

equity instruments in total financing in the euro area is comparable to

other countries, financing through equity traded on public markets

(listed shares) remains relatively uncommon, and well below the levels

seen in other major economies.

Conversely, loans and unlisted shares account for particularly large

proportions of financing in the euro area economy. Similarly, the EU is

lacking in early-stage private equity investment (see Chart 2). Data on

venture capital investment relative to GDP show that even in Finland and

Estonia, which are the most advanced EU countries in this area, the

ratio is less than one-fifth of that in the United States. Early-stage

financing is not the only ingredient missing for innovative firms to

flourish: the EU is also lagging behind the United States as regards an

ecosystem that promotes the next stages of growth when firms mature and

need to scale up their businesses.

© ECB - European Central Bank

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article