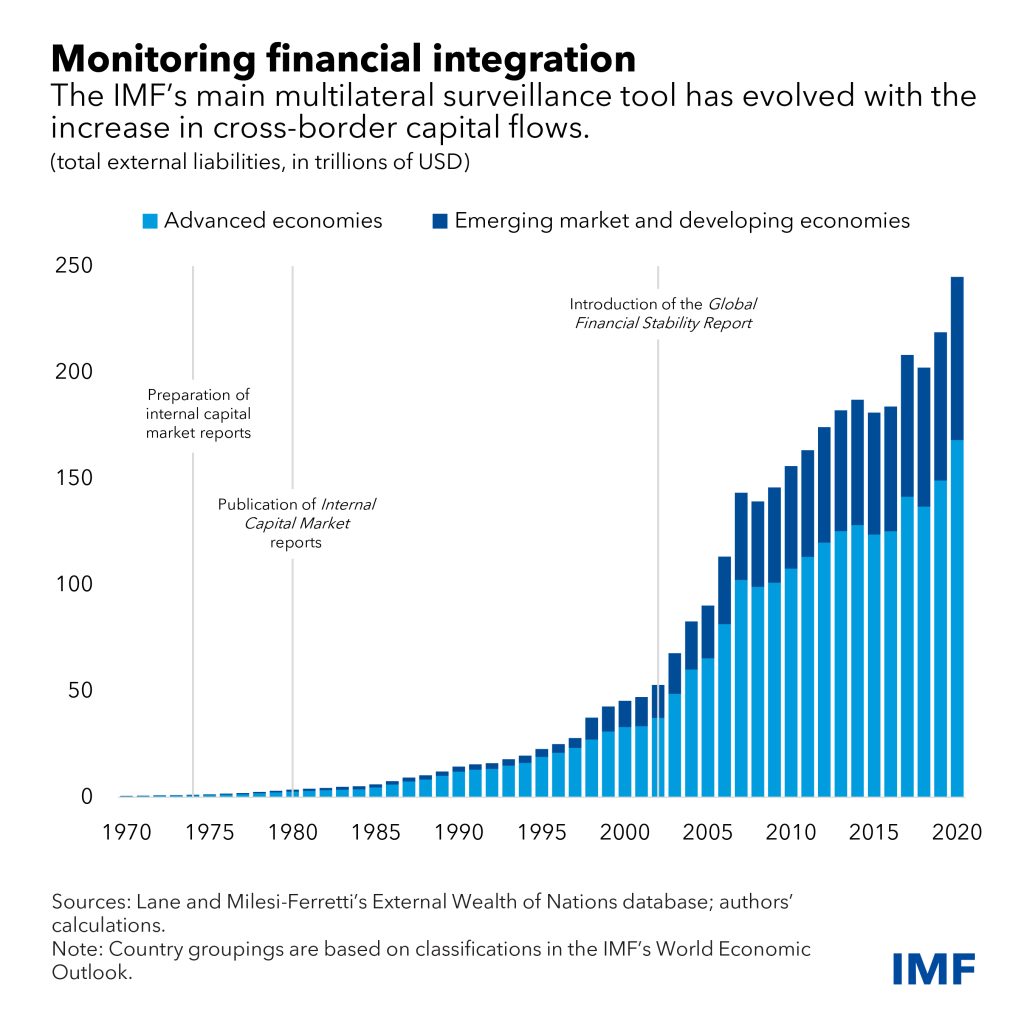

The IMF’s Global Financial Stability Report, introduced in 2002, was a step toward a more comprehensive assessment of risks in financial markets and cross-border capital flows.

Twenty years ago, the IMF released its inaugural Global Financial Stability Report to strengthen surveillance of financial markets after a series of crises in emerging market economies and the dot-com bust.

This semiannual publication by the Monetary and Capital Markets

Department has since evolved through years of seismic shifts in the

global economic and financial landscape into one of our key multilateral

surveillance tools. Along with the World Economic Outlook and the Fiscal Monitor, this flagship report aims to foster international monetary and financial stability.

The beginning

Monitoring the health and outlook of the global economy and member

countries is the bedrock of the Fund’s work. This surveillance role,

outlined in amendments to our Articles of Agreement first adopted at the 1944 Bretton Woods Conference, charges us with overseeing and safeguarding the international monetary system.

In the early years, surveillance focused on the macroeconomic and

exchange-rate policies of member nations, but growth in international

banking in the early 1970s highlighted a need to better track global

capital markets and assess financial-stability implications.

Consequently, the Fund started discussions with monetary authorities in

major financial centers and in 1974 initiated internal reports on market

developments and prospects.

Starting in 1980, the report known as International Capital Markets became our main vehicle to monitor conditions in financial markets, warn of risks, and analyze disruptions like Latin America’s debt crisis of the 1980s

or Europe’s exchange-rate mechanism crisis in the early 1990s. But that

era’s rapid expansion and integration of global capital markets, and

the ensuing financial crises in Asia and several other emerging markets,

highlighted the need to better assess systemic risks.

The introduction of the Global Financial Stability Report

marked an important step toward a more comprehensive and frequent

assessment of cross-border capital flows and financial market risks. In

his forward to the first GFSR, the then-Managing Director Horst Köhler noted how the report had its roots in crisis.

“The rapid expansion of financial markets has underlined the

importance of a constant evaluation of the private sector capital flows

that are the engine of world economic growth, but sometimes at the core

of crisis developments as well,” he wrote. “Opportunities offered by the

international capital markets for enhancing global prosperity must be

balanced by a commitment to prevent debilitating financial crises.”...

more at IMF

© International Monetary Fund

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article