|

|

The euro area is in a phase of policy normalisation. The ECB has increased policy rates by 2.5 percentage points and will raise them further to fight inflation. This will have a significant impact on bank balance sheets and profitability, and eventually on banks’ ability to provide households, small businesses and corporates with credit. So how resilient are banks when facing this changing environment? Our assessment of bank resilience under different macroeconomic scenarios shows that the banking sector is sound enough to handle the effects of rising rates on their balance sheets. However, banks must prepare for potential longer-term effects related to monetary policy normalisation. And they should pay special attention to interest rate risk in their asset and liability management.

We consider two types of instantaneous but temporary[1] shocks in the yield curve to assess the resilience of the banking sector over a three-year horizon:

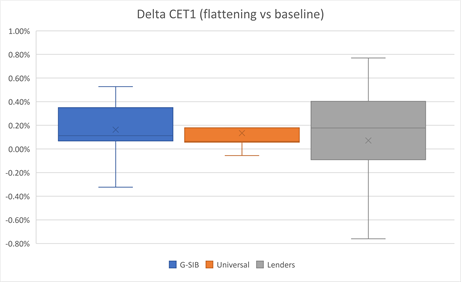

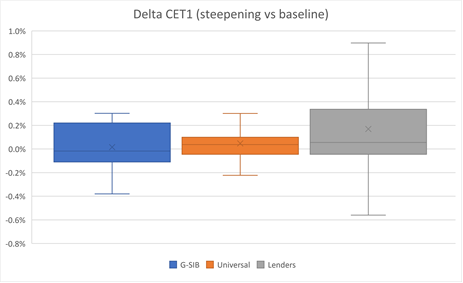

Overall, our analysis shows that the euro area banking sector would remain broadly resilient to a variety of interest rate shocks. That would hold also under a baseline scenario of an economic slowdown in 2023 with the risk of a shallow recession, such as the scenario included in the December 2022 Eurosystem staff macroeconomic projections. Profitability would increase overall, driven by net interest income. However, provisions would also increase, reflecting potential difficulties for borrowers. Results for the overall impact on solvency remain on average fairly muted with great heterogeneity across banks, within and across different business models (Chart 1; Budnik et al., 2020).[2]

Banking sector solvency under flattening and steepening scenarios.

Percentage points

Source: ECB staff calculation based on the Banking euro area stress test model (Budnik et al., 2020).

Notes: Distribution of changes of Common Equity Tier 1 (CET1). Capital as percentage of total risk weighted assets in deviation from the baseline scenario. Positive values represent an improvement of the solvency ratio with respect to the baseline scenario. The sample includes 89 significant banks under direct supervision of the ECB.

Each box and whisker chart shows the distribution of data into quartiles, highlighting (in descending order) the 90th, 75th, 50th, 25th and 10th percentile. The simple average is shown as an “x” and the median as a continuous line. “Lenders” includes diversified, corporate, retail and commercial lenders...

more at ECB