|

|

ECB Banking Supervision aims to keep banks sound and healthy. This requires ongoing supervision of their activities today, as well as making sure they are fit for tomorrow. Especially in uncertain times, effectively adapting business models to changes in the macroeconomic environment is crucial for managing risk. This is why banks’ business models and profitability have ranked high on supervisory agendas for several years in a row and supervisors regularly assess how banks fare in day-to-day supervision. This attention is clearly needed: one in four banks was not able to benefit from rising interest rates due to their business mix and internal steering. On a more positive note, the ECB found that banks with stronger strategic steering capabilities typically generate higher returns. This might incentivise all banks to proactively improve their processes and procedures, where relevant.

In this article, we explain how banks’ profitability responded to the challenging economic situation and why we would caution against overly optimistic forecasts. Finally, we share the key lessons from our 2022 on-site inspection campaign on banks’ business models and profitability.

The post-pandemic recovery shaped the macroeconomic environment in 2021, with rebounding GDP growth and elevated inflation as supply chain issues were exposed when demand picked up. At the beginning of 2022, most projections pointed towards more of the same and some moderate shifts of the yield curve indicated expectations of an exit from negative interest rates. However, with the Russian invasion of Ukraine, economic sanctions and the partial stoppage of Russian gas supplies to EU countries, the economic environment underwent rather drastic changes. Since the beginning of 2022, Eurosystem staff have significantly revised down their year-end projections for real euro area GDP growth: from 4.2% to 3.4% for 2022, and from 2.9% to 0.5% for 2023. Some euro area countries were even close to entering a recession in the second half of 2022. At the same time, inflation spiked to 9.2% in December 2022, mostly related to surging energy prices. Consequently, the ECB had to drastically speed up the exit from the low interest rate environment, raising the main refinancing rate (MRO) by large steps in consecutive meetings to the current MRO rate of 3%, which led to strong upward shifts of the yield curve.

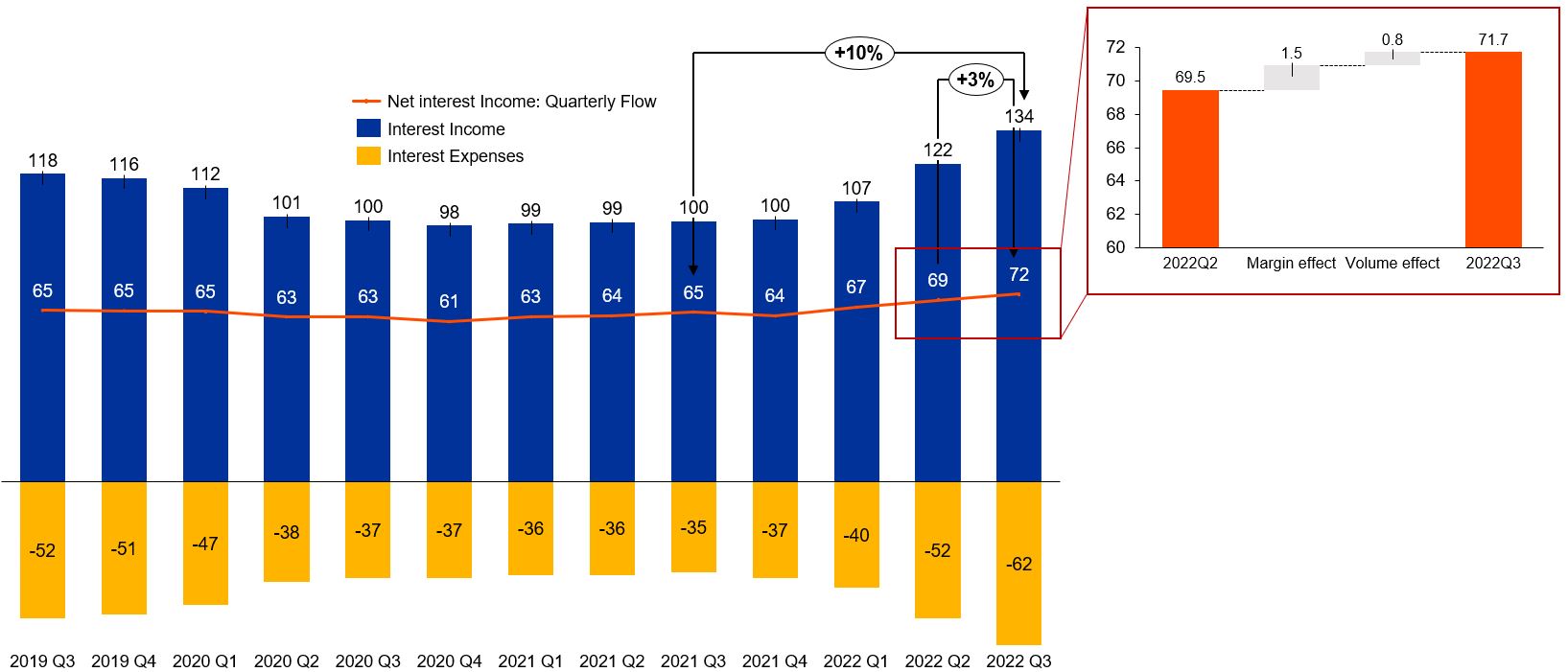

As a result, banks experienced a boost in profitability not seen for more than a decade: The upward shift of the yield curve has mainly had very positive effects on banks’ profitability because it has helped strengthen their lending margins. The pass-through of interest rates to deposit rates has been contained so far, while lending rates on new origination have spiked for all counterparties. This development contrasts with previous years when banks suffered from declining margins that they had to compensate for by raising lending volumes to keep net interest income (NII) roughly stable. Thanks to this new environment, banks were able to boost their NII by 10% on aggregate.

Net interest income has increased each quarter in 2022, supported by margin effect and volume effects

Net Interest Income, quarterly flows, EUR billions, for a constant sample of 105 Significant Institutions

Sources: Supervisory Reporting, ECB Banking Supervision calculations