|

|

November 2017 marked a major event in an increasingly instant world: the launch of the Single Euro Payments Area Instant Credit Transfer, which enables credit transfers in ten seconds – or less – across the . Since its launch, the scheme has kept on growing, and the latest Register of Scheme Participants, published in November 2020, reveals that the scheme now includes 2,287

(over fifty-seven percent of the total) from 23 countries in Europe.

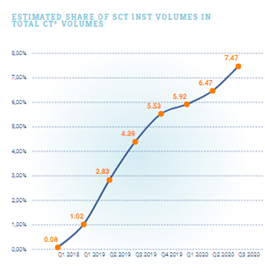

Furthermore, the estimated share of the volumes in total volumes of Credit Transfer ( plus ) is growing rapidly and reached 7.47 percent in the third quarter of 2020. Against that background, the invited professionals working in the payments industry to provide their views on the Q4-2022 level of the share of volumes, by participating in a poll.

Estimated share of INST volumes in total CT ( + INST) volumes Q3 2020

The question asked over the last two months to all interested stakeholders was the following: “In your opinion, what will be the volumes’ estimated share in total CT volumes ( +) in Q4-2022? (Latest data: 7.47% in Q3 2020)”

The results were as follows:

Less than 10% (20%)

11-20% (22%)

21-30% (20%)

31-40% (19%)

Above 40% (20%)

The results were spread virtually equally across the various ranges showing a wide diversity of opinions, but it is however worth highlighting that substantially more than half of the voters (59%) agreed on a predicted share of volumes in total CT volumes above 20% by end-2022. Remaining voters chose 11-20% (22%) or less than 10% (20%). See you in January 2023 for the reality check!