|

|

EU leaders reached an agreement in July to establish a coronavirus recovery fund offering €390 billion in grants and €360 billion in low-interest loans to pandemic-stricken EU countries. The EU has departed from its previous policy of not financing deficits and will borrow in the commercial markets to finance up-front transfers.

"By issuing debt in the market on this scale, the EU also provides the ECB, as well as investors, with a new liquid euro-denominated benchmark instrument benefiting the euro's status as a reserve currency," said S&P Global Ratings.

The EU's scheme to fund the coronavirus recovery package by issuing bonds on a major scale for the first time will create a long-term, triple A-rated debt security for institutional investors, said Nicola Mai, portfolio manager and sovereign credit analyst at Pimco, an investment management company.

"This is a very significant step because for the first time the EU has got common bonds to finance cross border transfers," he said.

"This bond has not come to the market yet, but we think it will trade close to where EU bonds trade at now."

Only Germany and the Netherlands currently have a Triple-A rating in the EU, but the EU bond is expected to be Triple-A rated, too, said Mai, who also expects the bonds to be refinanced over the long term.

"The EU is rated triple A by two of the big rating agencies. I would think the EC has been in contact with the rating agencies to establish a system to satisfy the agencies in order to keep a very high rating. There are not a huge amount of safe assets around in Europe and the true safe asset is the German bund, but it is hard to see the EU defaulting. There is a decent chance these bonds will be rolled over in the long-term, too," he said.

The European Commission is empowered by the EU Treaty to borrow from international capital markets on behalf of the EU. This is not the first time that the EU has issued bonds — indeed it currently has three loan programs to provide financial assistance to countries with financial difficulties and all three are funded through bonds — but it has never before done so on such a scale. These EU bond maturities will be repaid after 2027 and by 2058 "at the latest," said the EU, and the bulk of the sum will be borrowed between 2020 and 2024.

'Step towards fiscal union'

EU government debt at the end of last year stood at more than €10 trillion, of which debt securities accounted for 80.9% of eurozone and 80.6% of all EU member states' government debt.

"The issuance of common debt is a step towards fiscal union and opens a box that many more fiscally conservative countries had sought to keep closed. Despite protestations now, future EU budgets may see greater use of borrowing and methods of repaying the debt will need to be agreed," said Oliver Blackbourn, portfolio manager on the multi-asset team at Janus Henderson, via email.

The EU's bond issuance will also ease political pressure on the ECB, said Blackbourn, by providing a less politically fraught source of government bonds for it to purchase. The ECB's capital comes from national central banks and is calculated using a key that reflects each country's share of EU output and population. It can buy up to 50% of debt issued by supranational institutions. The ECB has announced plans to purchase almost an extra €1.5 trillion of bonds in response to the coronavirus pandemic in addition to the €2.6 trillion it already owns.

"Purchases of German bunds have always represented a major challenge for the ECB as Germany is the largest subscriber to the capital key but has been relatively conservative in its issuance of debt," said Blackbourn.

"With the ECB self-imposing limits on how much of each issue it can buy, German bunds have always been most likely to hit the limit first. Any deviation from the capital key is a source of tension with the fiscal hawks on the ECB's governing council."

Germany represents 18% of the ECB's capital key and has more than €1.3 trillion in bunds outstanding. France, Italy and Spain have larger outstanding debt piles and smaller contributions to the capital key so are less likely to run into the ceiling per issue, said Blackbourn.

"While all major European nations are issuing more debt to deal with the pandemic, a common debt instrument that avoids the political frictions of buying individual country debt should remove an ongoing headache at ECB discussions, at least for a time," he said.

Doom loop

The EU's bond issuance provides an alternative asset class for financial institutions to invest in that are not linked to a single country. This potentially reduces the influence of "the doom loop," whereby banks hold their sovereign nation's bonds and so drag each other down in the event of a crisis.

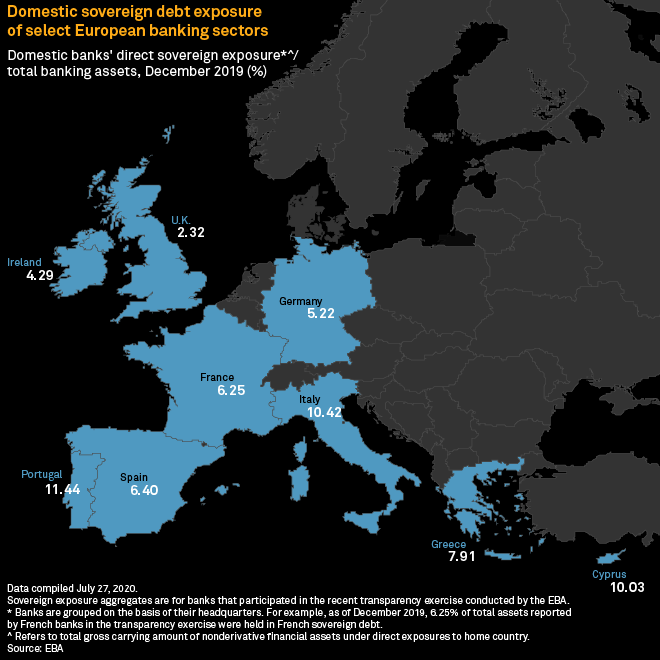

Banks can assign a zero risk weighting to sovereign bonds but this has long been controversial since it encourages banks to increase their stock of sovereign debt. This increases the risk of the doom loop being enacted as weak banks can destabilize their home nation's governments, while governments in trouble can push their banks over the edge. It is an issue which has dogged weaker European economies such as Italy, Greece and Portugal. For instance, Portugal has nearly five times the rate of domestic sovereign bond holding than the U.K., with Italy not far behind.

Jacqueline Mills, managing director at the Association for Financial Markets in Europe, has said creating a substantial market in EU bonds could relieve pressure on the doom loop, though she warned that this was likely to take some time.

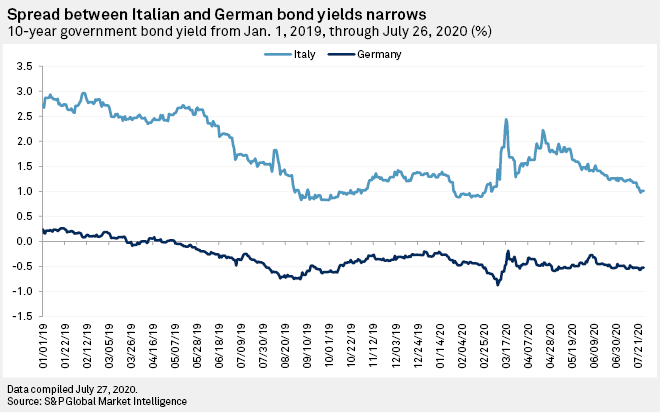

Mills also noted that the spread between German bunds and Italian bonds narrowed after the EU's rescue package announcement. German bunds have long been viewed as Europe's primary safe asset, so much so that yields on 10-year bunds are negative, though the spread between German and Italian bonds has narrowed over the past 18 months as the Italian government stabilized.

Christian Edelmann, co-head of EMEA financial services at financial services consultancy Oliver Wyman, also said the EU's bond issuance scheme would aid a lessening in pressure of the doom loop.

"It's a step in the right direction towards reducing the doom cycle, it provides a way for banks to diversify their portfolio, to provide them with a more balanced portfolio since they can invest in an asset class not linked to one country," he said.

Mai, too, viewed the EU's rescue package as likely to be positive in the long term for reducing the strength of the doom loop.

However, Fitch Ratings said measures taken by the ECB during the pandemic, with its targeted long-term financing operations now offering funding at negative rates, could see banks increase their sovereign exposure.