|

|

The association detailed that today UK pension funds invest almost £1trn in the UK through a mixture of UK shares, corporate bonds, government debt, and other asset classes.

This investment generates the capital businesses need to expand their operations, hire more employees and develop new products and services. It also supports spending on infrastructure, renewable energy and social programmes.

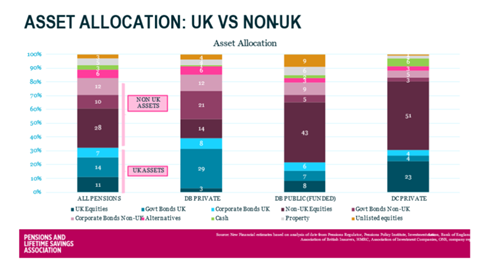

PLSA’s latest paper – Pensions & Growth – stated that pension funds are already large-scale owners of UK assets: about 32% of UK pension assets are invested in the UK, and around 50% overseas, with around 11% being invested in property and alternatives.

In the case of private sector defined benefit (DB) penison schemes, the allocation is 40% in the UK (equities and bonds), 47% in non-UK assets, and 10% in property and alternatives (some of which are in the UK).

In the case of open public sector DB funds, 21% invest in UK assets (equities and bonds), 57% in non-UK assets, and 9% in property and alternatives (some of which are UK).

Finally, for defined contribution (DC) pension schemes, 31% invest in UK assets (equities and bonds), 59% in non-UK assets, and 5% in property and alternatives (some of which are UK).

The association expects the scale and distribution of assets across the pensions sector to alter substantially over the next decade, during which time the volume of assets in DC pension schemes is expected to double to around £1trn and the value of assets in the Local Government Pension Scheme (LGPS) is forecast to increase up to around £500bn.