|

|

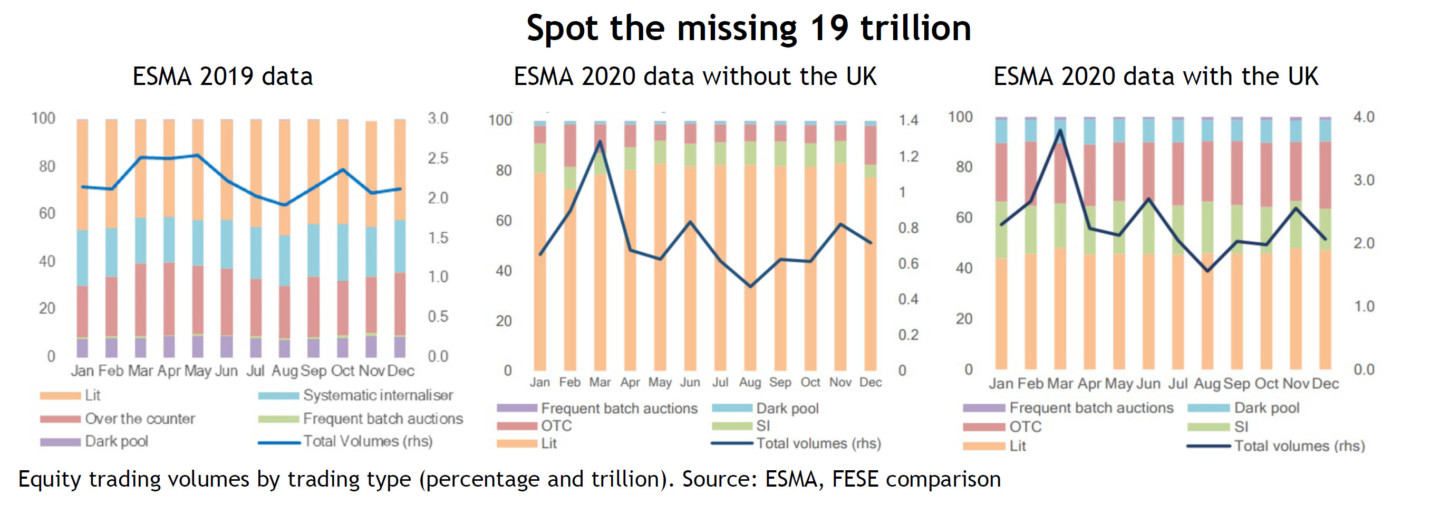

As per the withdrawal agreement, the UK remained part of the EU single market until the end of 2020, with its trading still subject to the MiFIR share trading obligation. As of 1st January 2021, UK trading was outside the EU single market and hence, through the share trading obligation, a significant part of this UK activity migrated to the EU. However, ESMA’s Annual Statistical Report for 2020 data presents indicators for EEA30, excluding UK data, and so reaching conclusions that misrepresent the reality. The truth is that, in the year 2020, the UK was a central part of the EEA securities markets.

With the approach taken, 19 EUR trillion in equity trading is left out of the scope of the main report and only mentioned in the executive summary. In 2020, the most trading in equities was conducted in the UK, represented not only trading on trading venues, but also SI trading and OTC. Off-venue volumes (including SI and OTC trading) are clearly underestimated since all transactions reported in 2020 via a UK APA in EEA instruments are excluded. Were they included, it would bring on-venue trading (including RMs and MTFs) down to 56%, instead of 82%.

ESMA’s chosen approach does not only differ from that adopted for 2019 but will also differ from the one for 2021 since, with the application of the share trading obligation, most of the UK flows on European securities have shifted to EU venues; data for 2021 will include the majority of SI and OTC activity which ESMA excludes for 2020.

Therefore, the conclusions of the report could lead to misinterpreting the full liquidity landscape of EU securities trading in 2020, ignoring the bulk of trading in EEA instruments. ESMA must oversee turnover in EEA instruments.

Commenting on ESMA’s decision to omit UK data from the report, Director General of FESE, Rainer Riess, remarked:

“It

is highly concerning that ESMA has ignored the reality of the UK’s

status in 2020. This isn’t a mere technical disagreement, either – this

decision will have a serious impact on the policy debate. It is critical

for ESMA to monitor the trading of EEA instruments outside of the Union

on a continuous basis and whether the share trading obligation is being

adhered to going forward.”

FESE President and CEO of the Prague Stock Exchange, Petr Koblic, observed:

“We

are in a moment where the EU is building the Capital Markets Union, and

we are in intense discussions about equity market structure rules. I do

believe the EU interests will not benefit from a too narrowly focused

statistical report that ignores two thirds of the trading landscape,

only looking at 30% of the trading EEA shares and ignoring the other

70%.”