|

|

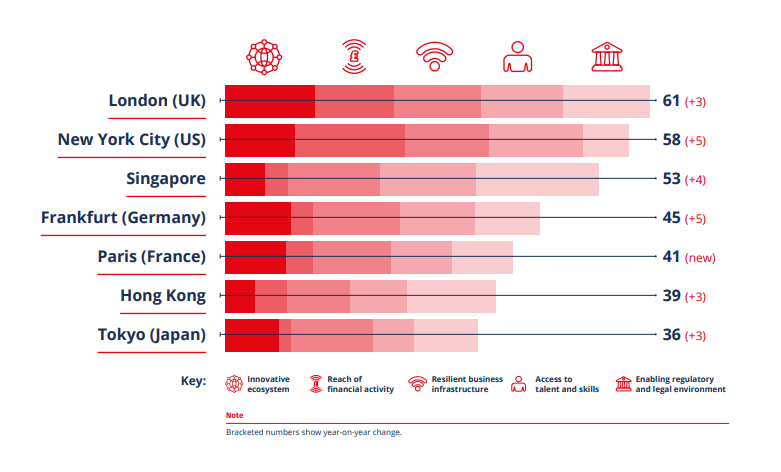

The study from the City of London Corporation selected seven centres that feature in other research on financial hubs, such as Z/Yen, which consistently puts New York in the top spot and London second.

The study, which added Paris this year, looked at five areas like digital skills, regulation and talent. While London remains top overall from last year, New York is only slightly behind and closing the gap, followed by Singapore, Frankfurt, Paris, Hong Kong and Tokyo.

New York remains by far the biggest financial centre, while London lags Singapore in resilient business infrastructure, access to talent and skills, and a friendly regulatory and legal environment.

"UK policymakers need to guarantee that its businesses continue to enjoy unrivalled access to the best of global talent," the study said.

"Withdrawal from the EU, the end of freedom of movement and the introduction of a new immigration system have damaged perceptions of the UK as an attractive business environment for international talent in recent years."

Total tax for UK-based financial services firms, in particular banks, is also relatively high, it said. The finance ministry is reviewing some of the taxes.

Britain's finance ministry has proposed that the Bank of England has a formal remit to "facilitate" London's competitiveness...

more at Reuters