|

|

Britain under Prime Minister Boris Johnson is running into the biggest headwinds it’s faced since the 1970s, heaping pain on an economy still reeling from Brexit and the pandemic.

After suffering from unprecedented shocks in recent years, the nation is succumbing to more intractable problems marked by plodding growth, surging inflation and a series of damaging strikes.

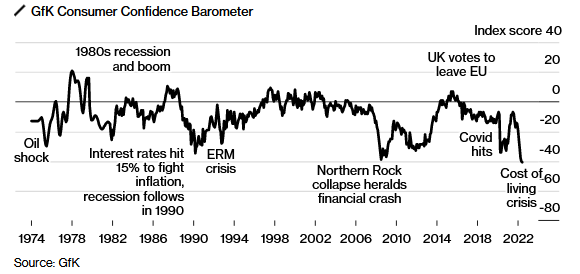

The result is a plunge in consumer confidence that analysts warn may lead to a recession. Railway workers last week walked off the job in anger that their living standards are slipping, and criminal barristers are striking Monday. Teachers and doctors may be next.

Britons are more pessimistic than at any time in at least half a century

The malaise is a far cry from the boom and “cool Britannia” reputation that Tony Blair’s government enjoyed through the early part of this century.

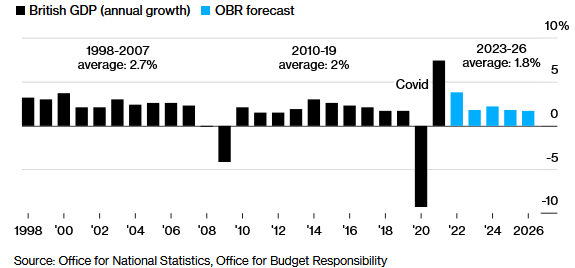

The headline figures make grim reading. The economy is on track to shrink in the second quarter, raising the possibility that the UK is already in a recession. Even when the outlook appeared brighter, officials estimated that growth would settle at a below-par 1.8% a year, with no end in sight to the feeble productivity that has blighted the country for over a decade.

The loss of momentum since the financial crisis is forecast to worsen

While growth is on track to lag most major economies next year, inflation is also on the rise. Consumer prices surged by 9.1% in the year through May, the most for 40 years.

The Bank of England expects inflation to accelerate again when energy bills are allowed to rise in the autumn, reaching more than 11%.

It’s a blow for the UK, which led the world in growth after the pandemic, and recalls the dark days of the 1960s and 1970s when commentators and politicians identified Britain as the “sick man of Europe” because of its performance....

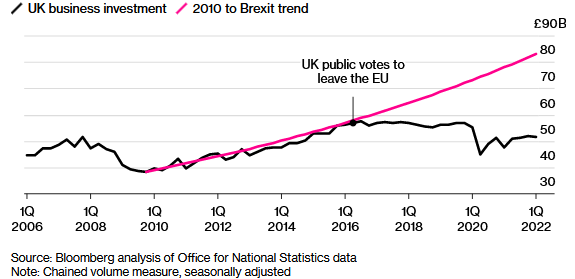

Brexit uncertainty also seems to have unsettled executives, with investment flat-lining since the 2016 public vote to leave the European Union. Had they continued to spend as they did before the referendum, investment would be around 60% higher today.

Firms would be investing £31 billion more had pre-Brexit trends continued

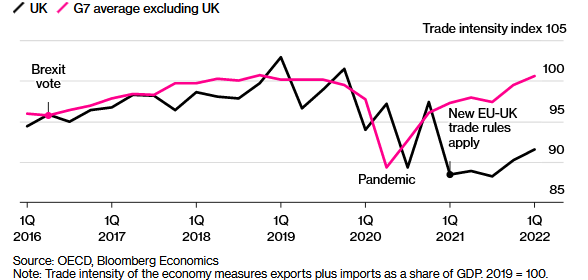

Life outside the EU has also had an impact on trade as importers and exporters contend with higher trade barriers. Despite a sharp fall in the pound since the vote, there is little evidence to suggest the external sector has benefited from increased competitiveness.

Analysis by Bloomberg Economics shows the UK lagged behind the trade performance of other big nations before the pandemic, and has failed to fully share in the global trade rebound since then.

The UK saw little benefit from a post-pandemic rebound in global trade

more at Bloomberg