|

|

In response, for OTC derivatives that are not cleared through central counterparties (CCPs), the Basel Committee on Banking Supervision (BCBS) and the International Organization of Securities Commissions (IOSCO) jointly issued global minimum standards on margin requirements in September 2013. These requirements are designed to reduce counterparty credit risk and limit contagion by ensuring that collateral is available to offset losses caused by the default of a derivatives counterparty. They are also intended to promote central clearing.

The BCBS-IOSCO margin requirements apply to all non-centrally cleared OTC derivatives1 (NCCDs) contracts entered into by financial firms and systemically important non-financial entities2 (collectively "covered entities"). The precise definition of covered entities is left to national regulation but explicitly excludes sovereigns, central banks, multilateral development banks and the Bank for International Settlements.

All covered entities that engage in NCCDs must exchange margin, ie both counterparties need to be covered entities for a transaction to be within scope. A separate treatment may apply to transactions between a covered entity and any other entities in the group to which it belongs (ie inter-affiliate transactions). For these transactions, the BCBS-IOSCO standard asks national supervisors to review their legal frameworks and market conditions and put in place margin requirements as appropriate.

There are two types of margin - variation margin (VM) and initial margin (IM). The methodologies for calculating the amounts of margin that covered entities need to exchange should ensure that all counterparty risk exposures are covered with a high degree of confidence.

VM is collateral that protects the parties to NCCDs from the current exposure - from changes in the mark-to-market value of the derivatives - that has been incurred by one of the parties after the transaction has been executed. The amount of VM that covered entities need to exchange regularly (eg daily) should reflect the size of this current exposure. The exchange is one-way, ie one party makes a transfer to the other.

For example, if counterparty B has entered into an interest rate swap (IRS) with counterparty A, and if A is out of the money (ie A owes money to B), then A needs to make a transfer to B (ie A posts VM and B collects VM). If A is in the money, then B needs to transfer the appropriate amount of VM to A.

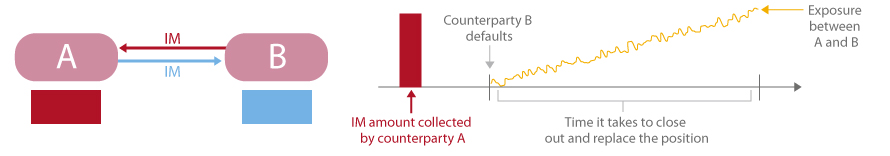

IM is collateral that protects the parties to NCCDs from the potential future exposure that could arise from future changes in the mark-to-market value of NCCDs during the time it takes to close out and replace the positions in the event of a counterparty default. The amount of IM that covered entities need to exchange should reflect the size of this potential future exposure.3

Unlike VM, the exchange of IM is two-way, ie each party has to make a transfer to the other without netting of the amounts collected by each party. To ensure that the IM collected is sufficiently protected in the event of bankruptcy, it needs to be subject to arrangements that protect the posting party to the extent possible in the event that the collecting party enters insolvency. This could be achieved, for example, by using third-party custodians.

By way of illustration, counterparties A and B have exchanged IM upon entering into an IRS. After some time, B defaults. On that day, because A and B have just exchanged VM, they have no exposure from that IRS to each other. In the days following B's default, A seeks to close out and replace the IRS, but this takes a bit of time. Meanwhile, the IRS gains in value for A (and loses in value for B). Luckily, A has collected IM, which it now can use to cover this exposure.

Assets collected as margin should be highly liquid and able to hold their value in a time of financial stress. They should also be reasonably diversified; not be subject to wrong-way risk4; and not be exposed to excessive credit, market and foreign exchange risk. Covered entities need to apply haircuts to the market value of eligible assets to ensure that pledged collateral is sufficient to cover margin needs. Haircuts may be determined either on the basis of risk-sensitive quantitative models (subject to approval) or a standardised haircut schedule.

The requirement to exchange margin is subject to a phase-in schedule. From 1 September 2016, the largest market participants have had to start exchanging margin. From 1 March 2017, all covered entities were required to exchange VM. For IM, the final implementation phase will take place on 1 September 2022.

1 Except for physically settled foreign exchange (FX) forwards and swaps. Margin requirements for these instruments are covered by the BCBS supervisory guidance for managing settlement risk in FX transactions.

2 For example, systemically important non-financial entities could include firms with sizeable positions in NCCDs.

3 To calculate the required IM amount to be exchanged, a covered entity may use a quantitative portfolio margin model (subject to supervisory approval) or a standardised margin schedule. Regarding the former approach, it has become market practice to use a common industry-wide model developed by the International Swaps and Derivatives Association (ISDA), the so-called Standard Initial Margin Model (ISDA SIMM). The full IM amount needs to be exchanged, unless it is below EUR 50 million on the basis of the consolidated group.

4 Securities are subject to wrong-way risk if their value exhibits a significant positive correlation with the creditworthiness of the counterparty or the value of the underlying NCCD portfolio.