|

|

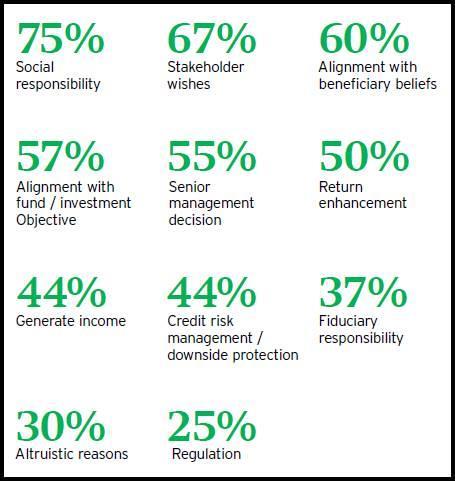

Investors interviewed for the asset manager’s third annual global fixed income study were given a range of motivating factors to choose from, with 75% picking social responsibility, 67% ‘stakeholder wishes’, and 60% saying they were motivated by a desire to align with beneficiary beliefs.

Half of investors that have incorporated ESG factors within their fixed income portfolios cited return enhancement as a key driver, with Invesco highlighting this figure as a reflection of a change in investor attitudes about ESG.

“Across all regions, very few investors report that integrating ESG has hindered returns, and in the case of EMEA, a majority (52%) have said that integrating ESG has improved them,” said Nick Tolchard, head of EMEA for fixed income at Invesco.

Overall, integration of ESG considerations in fixed income had “rocketed”, said Invesco, with 80% of surveyed EMEA investors reporting this practice and 69% of APAC, up from 51% and 38% the year before.

Invesco interviewed 159 fixed income professionals for its latest study, reflecting the views of 121 institutional – defined contribution and defined benefit pension funds, insurers and sovereign wealth funds – and 38 wholesale investors managing over $20trn (€18.2bn) in assets as at the end of December 2019.