|

|

Scenario analysis is a key tool to assess financial risks arising from climate change, as standard risk modelling cannot adequately capture the unprecedented nature of climate risks1 and the inherent uncertainty of future climate-related events.

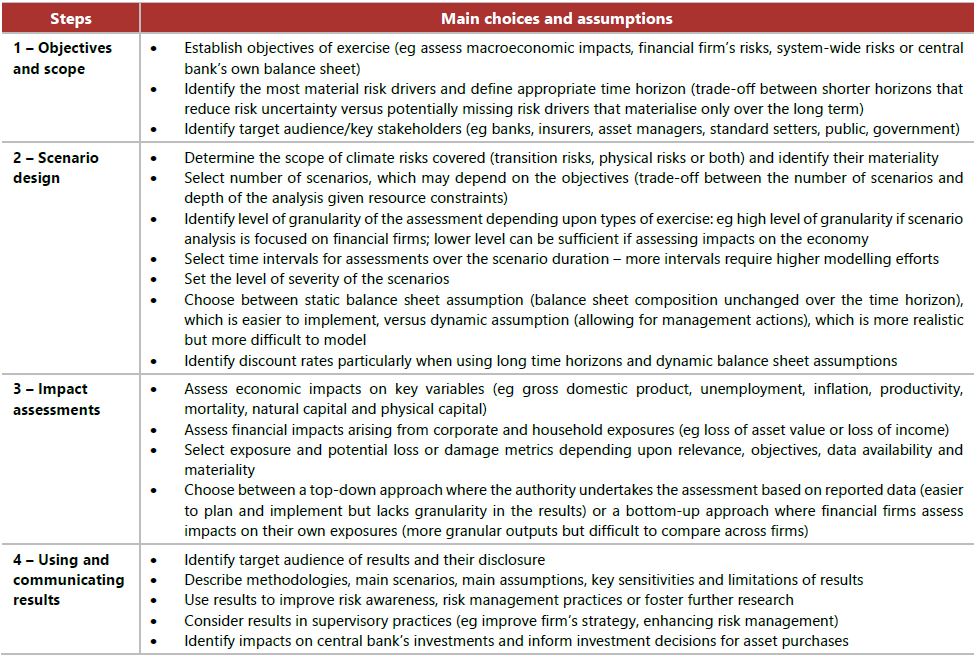

The first step is to decide on the objectives and scope of the exercise. The second is to select and design the scenarios. The third step involves assessing economic and financial impacts. The fourth step relates to using and communicating the results. The main design choices and assumptions are summarised below.

Table: Scenario analysis process – main choices and assumptions

The reference climate scenarios of the NGFS provide a starting point to explore economic impacts and financial risks arising from climate change.2 Each scenario explores a different set of assumptions about how climate policy, emissions and temperatures evolve. Scenarios are characterised by their overall levels of physical and transition risks. These levels are based on assumptions relating to policy ambition, timing, coordination and technological developments. The NGFS scenarios fall into three categories: orderly, disorderly and "hot house world". Each category consists of two scenarios reflecting different levels of physical and transition risks. The categories and scenarios are as follows:...

more at BIS