CEPR/ECB's Hiebert: A macroprudential approach to managing climate risk

17 January 2024

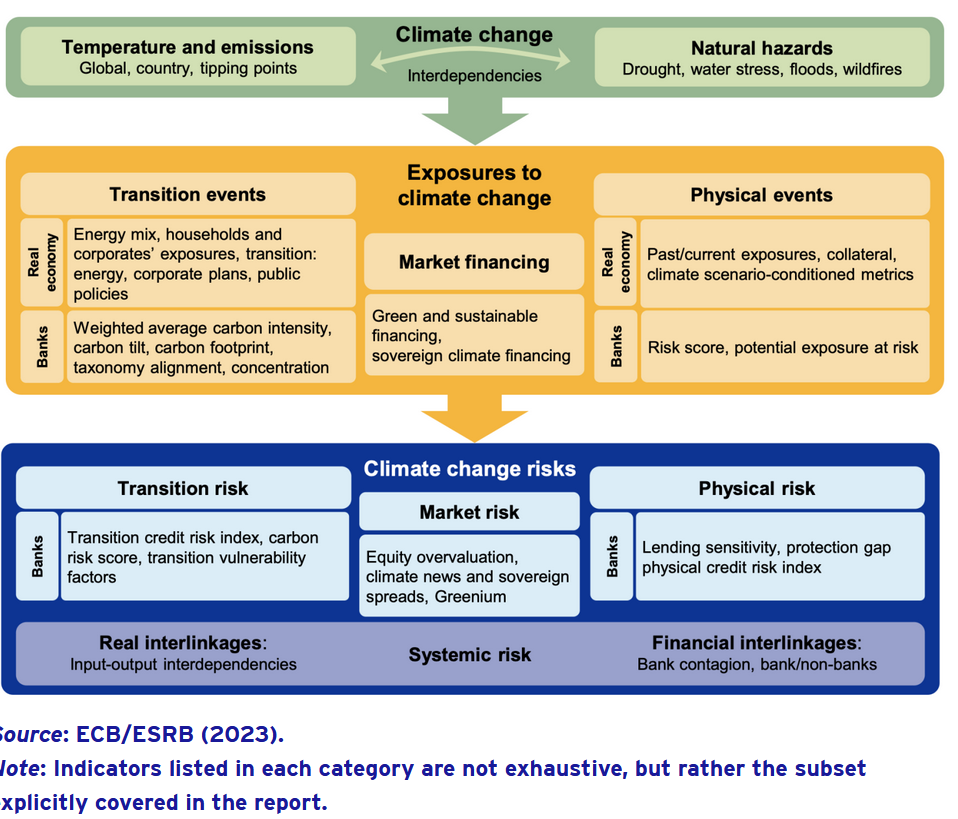

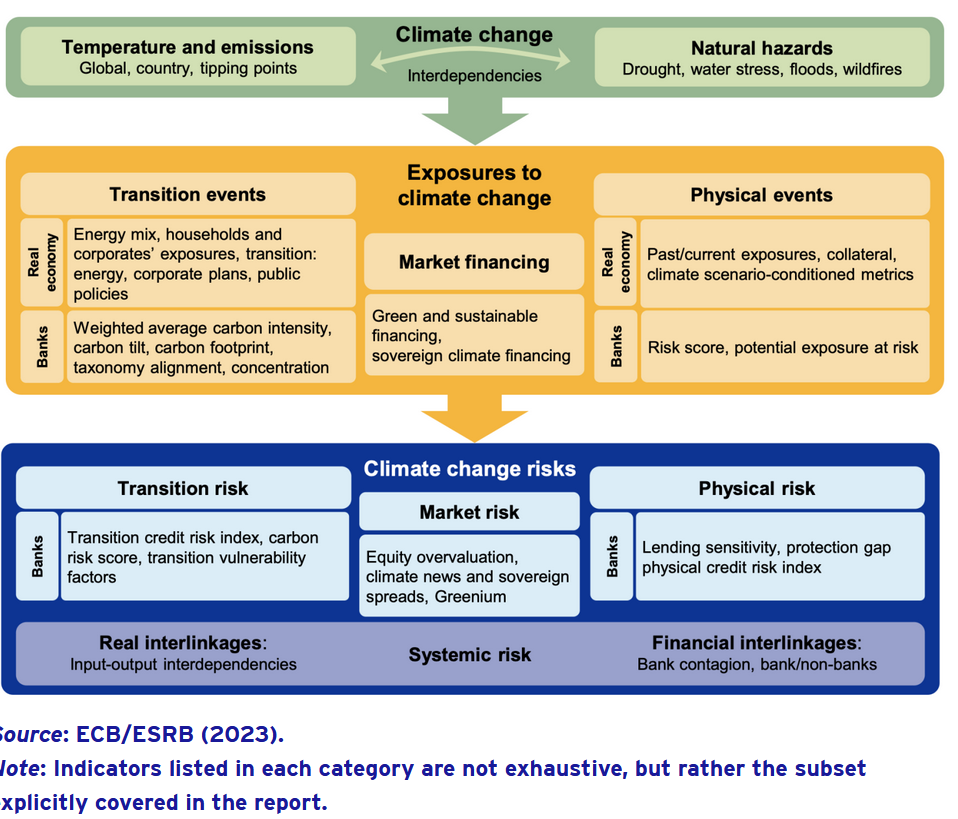

This column harnesses a growing body of evidence on indicators into three primary categories: climate shocks, exposures to these shocks, and financial risks resulting from the interaction of exposure and prevailing vulnerabilities.

A growing body of analysis has provided a firm basis to inform a financial stability view on climate (see de Bandt et al. 2023 for a review of recent evidence on climate risk for banks). A framework for macroprudential monitoring, curating this body of evidence, would consist of three building blocks: the evolution of climate shocks, the topology of exposures, and the potential for financial risk (see Figure 1).

Figure 1 Surveillance framework for climate-related financial stability risks

Tracking the scope for climate-related shocks constitutes the initial building block of a surveillance framework. Such shocks appear to be intensifying in noteworthy ways. On the one hand, a growing voracity of floods, water stress, wildfires, and droughts illustrate the acute physical aspects of chronic hazards such as rising sea levels. On the other hand, the transition risk from decarbonisation efforts is set to intensify, as nation states and firms seek to implement a growing set of net zero pledges. Growing scrutiny from forward-looking financial markets may suggest the scope for anticipation and some associated sudden repricing of purportedly distant climate shocks. This strengthening intensity of climate hazards, alongside looming energy transition needs, may imply the prospect of compound climate and financial shocks. At the same time, depleting carbon budgets are bringing global warming perilously close to ‘tipping points’ whereby non-linearities may kick in and create sharp adjustments in both expectations and asset prices.

CEPR

© CEPR - Centre for Economic Policy Research