Initial portfolio investment reverted quickly and intra-euro area cross-border portfolio investment exhibited low volatility. Only cross-border public flows have been limited. This suggests that the provision of unprecedented policy support has prevented private risk-sharing channels from collapsing, reducing the risk of a sudden stop in cross-border financial flows and a further exacerbation of the crisis.

The COVID-19 crisis represents a unique litmus test for the European Monetary Union’s (EMU) risk-sharing capacities in allowing us to assess whether the institutional progress made since the global crisis and the subsequent euro area sovereign debt crisis has borne any fruit.

Despite the progress in recent years, the European banking and capital markets unions are still incomplete. The decentralized nature of European fiscal policies has historically been an impediment to increasing and more resilient financial integration and stability in the EMU (Bénasse-Quéré et al. 2018, Constâncio 2018 and Berger et al. 2018). Enhancing the EMU’s private and public risk-sharing capacities has therefore been a central element of the policy debate on the euro-area reform (Pisani-Ferry and Zettelmeyer 2019).

The COVID-19 crisis has unique characteristics, and it is not over yet. While definitive answers can thus not yet be provided, we offer some preliminary – but important – policy insights on the evolution of risk-sharing among the EMU countries during the pandemic.

The case for intra-euro area risk sharing during the crisis

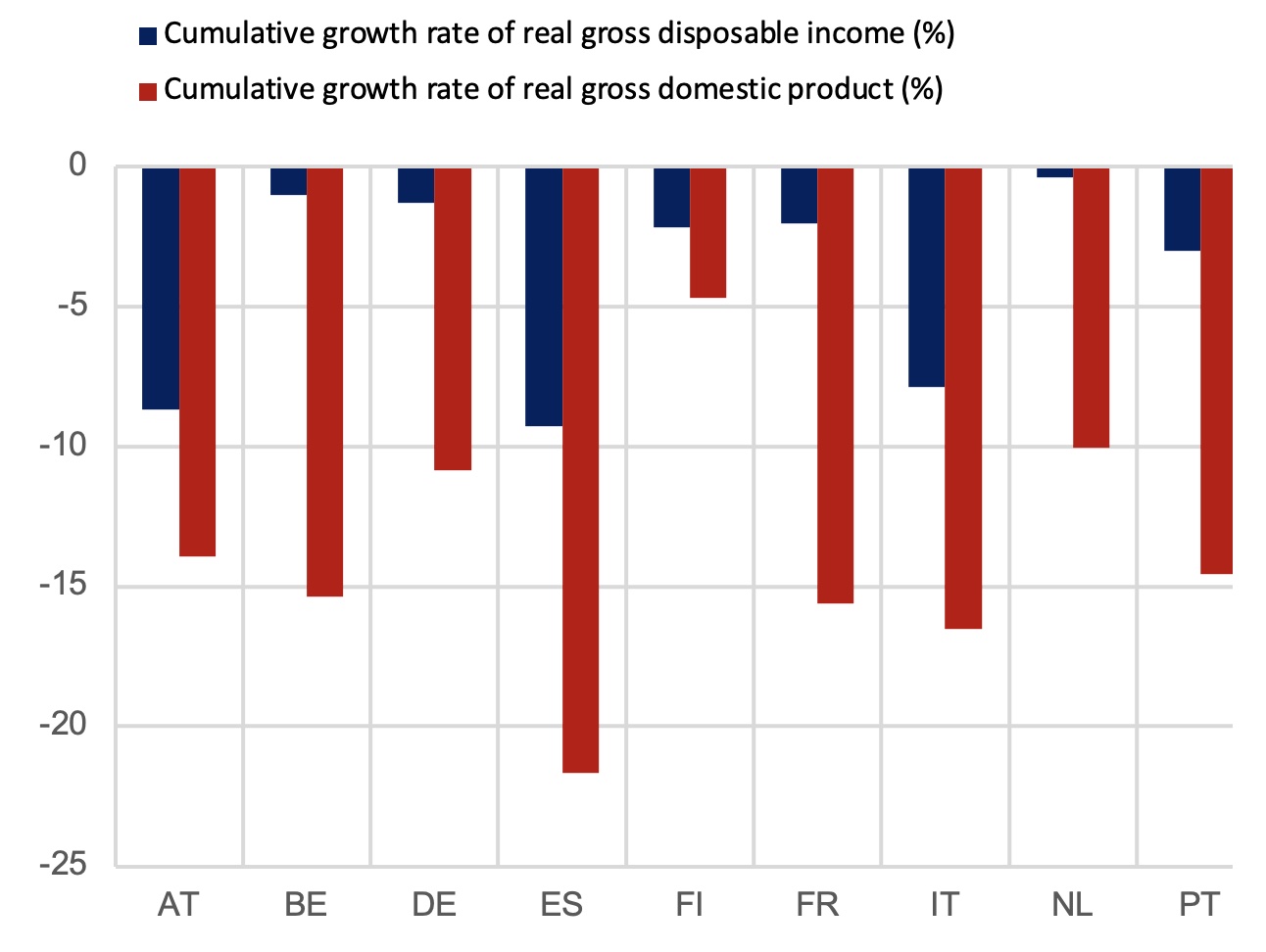

Given the common source of the COVID-19 crisis, one might prima facie expect only limited room for cross-country risk-sharing among euro area countries. Yet, despite its common cause, the economic fallout from the COVID-19 pandemic has been quite heterogeneous across euro area countries (see Figure 1), leaving room for cross-border risk-sharing.

Figure 1 Level and dispersion of growth rates of real GDP and real gross disposable income (quarterly data, top panel: Q4 2019 – Q2 2020, bottom panel: Q1 2019 – Q2 2020)

Source: Authors’ calculations using Eurostat data:

Notes:

The top panel shows the cumulative growth rates of the real GDP and

real gross disposable income for Austria, Belgium, Germany, Spain,

Finland, France, Italy, Netherlands, and Portugal from Q4 2019 to Q2

2020. For the other EMU countries gross disposable income data for

2020Q2 is not yet available. The bottom panel shows the dispersion,

measured as the standard deviation, of the quarterly real gross domestic

product growth rate and the quarterly real gross disposable income

growth rate across the same set of countries.

As shown by Dossche and Zlatanos (2020), the strict health measures taken in response to the spread of COVID-19 prevented households from consuming a large share of their normal consumption basket. Therefore, the procedure introduced by Asdrubali et al. (1996) and often used to analyse risk-sharing within the euro area cannot be applied in the current context. We thus focus on income risk-sharing (or income smoothing), as opposed to consumption risk-sharing. In other words, we look at the ability to separate a country’s change in gross national income from changes in its output.

How has income risk-sharing evolved during the COVID-19 crisis?

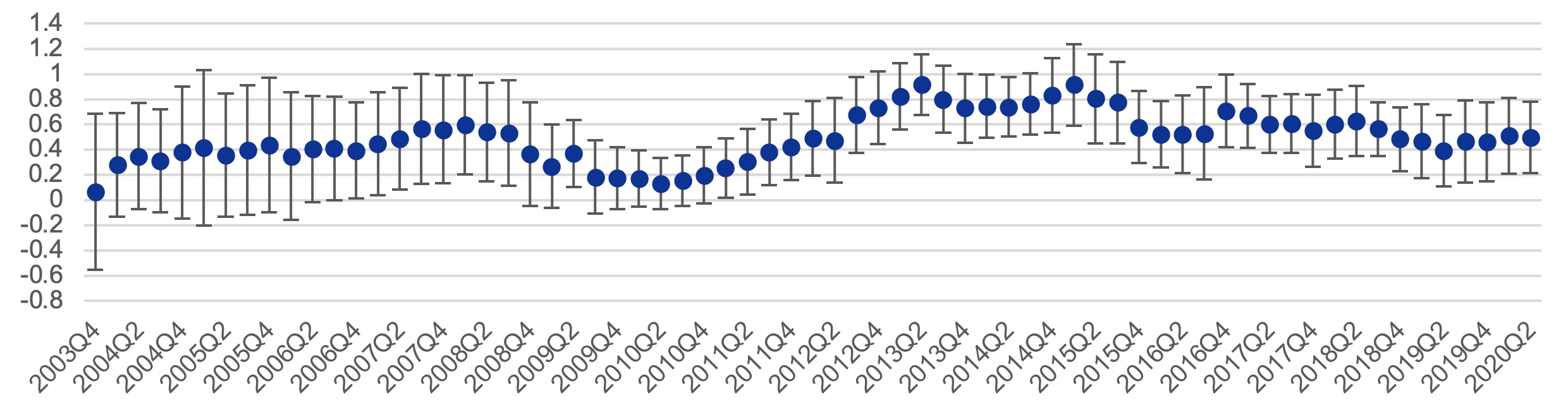

We first look at the contemporaneous co-movement between disposable income and output across euro area countries using a 12-quarter rolling-window panel and adapting the methodology usually employed for consumption risk sharing (ECB 2016). The results suggest that the amount of income risk-sharing has been relatively stable over recent years, albeit at low levels. Including the first six months of the current crisis in the two most recent estimation windows does not lead to a significant deterioration in the point estimate of income risk-sharing (Figure 2). This suggests that the overall income risk-sharing among euro area countries has been resilient so far throughout this crisis.

Figure 2 Comovement of disposable income and output in the euro area (percentage)

Source: Authors’ calculations using Eurostat data.

Notes:

The chart plots point estimates (dots) and confidence intervals

(whiskers) from a panel regression of changes in country per capita

gross disposable income on changes in country per capita GDP. Each dot

and whisker are estimated for data from the twelve quarters preceding

the time indicated on the horizontal axis (rolling window). Ireland is

excluded due to the major change in its GDP reporting in 2015. The

analysis is based on the following countries: Austria, Belgium, Germany,

Spain, Finland, France, Italy, Netherlands, and Portugal. For the other

EMU countries gross disposable income data for 2020Q2 is not yet

available.

Risk sharing channels during the crisis

In a second step, we examine the financial flows through which risk sharing should operate – i.e. cross-border private and public financial flows.

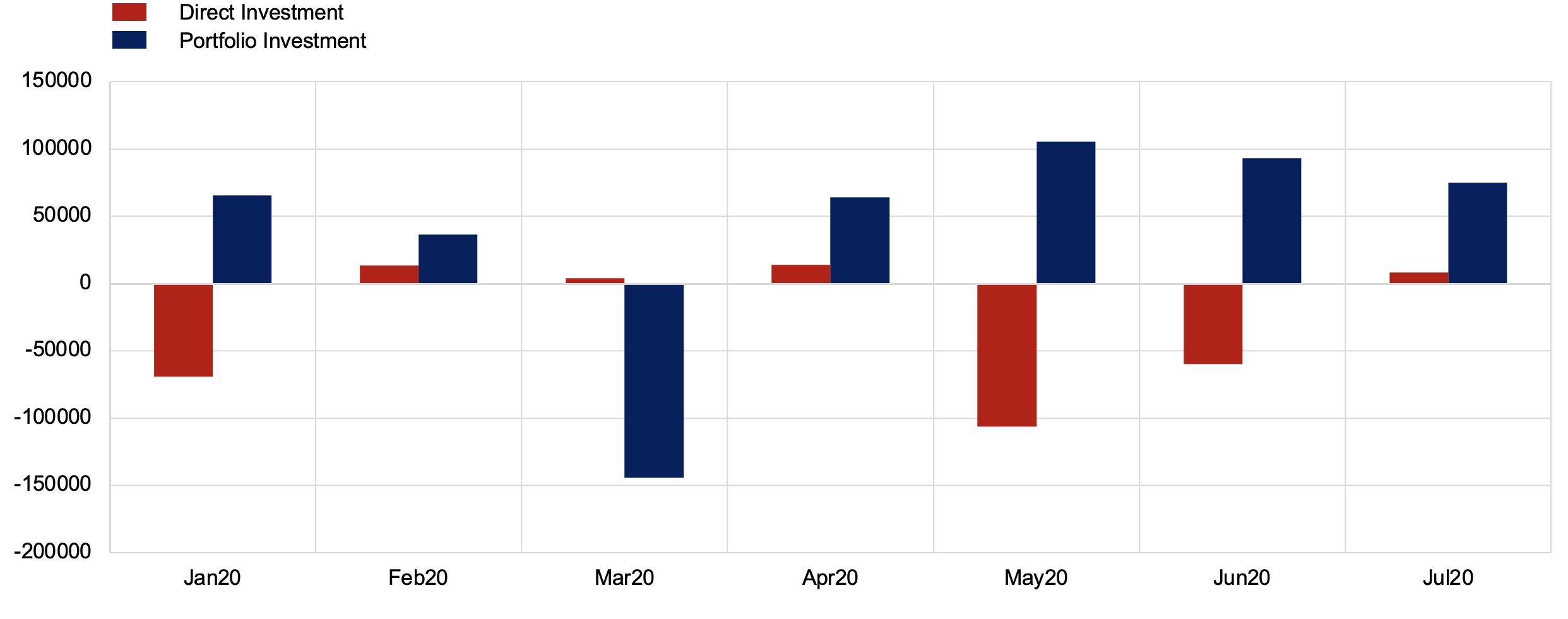

Figure 3 shows that intra-euro area cross-border private flows exhibited a high degree of resilience during the peak of the COVID-19 crisis. This is in sharp contrast with the experience during the previous crisis, when some euro area countries experienced a sudden stop in capital inflows (Gros and Alcidi 2013). While a strong outflow in intra-euro area portfolio investments was recorded in March 2020, this has been more than compensated by strong inflows in the following months (see Figure 3). Looking at intra-euro area direct investments, the flows appear less volatile, in line with the prediction of the literature (ECB 2016). The same pattern can be seen when looking at financial flows coming from outside the euro area (Lane 2020).

Figure 3 Intra-euro area cross border financial flows

Source: Authors’ calculations on ECB data.

Intra-euro area cross-border public flows were limited during the first peak of the crisis between March and June 2020. The depth of the COVID-19 shock triggered sizable fiscal responses at the national level, leading to a drastic deterioration of fiscal deficits. This is not new, and quite in line with the previous global crisis and euro area crises (Milano and Reichlin 2017).

Nevertheless, from the very onset of the COVID-19 crisis, there was a clear recognition that national measures should be supported by a common financing programme at the European level. This marked a key difference compared to the previous crises.

Already in April, the European Commission rapidly set up the Coronavirus Response Investment Initiative to provide €8 billion in immediate liquidity to the countries in greatest need. Not long after, the three EU safety nets, worth €540 billion, were established. Two of the three schemes – the Support to mitigate Unemployment Risks in an Emergency (SURE) and the European Stability Mechanism’s Pandemic Crisis Support credit line – provide loan-based support to governments. The third pillar – the pan-European guarantee fund of the European Investment Bank – provides support to companies. As this fund is expected to make losses over the course of its operations (at 20% in net terms; see Eurostat 2020), it is expected to produce direct cross-border transfers.

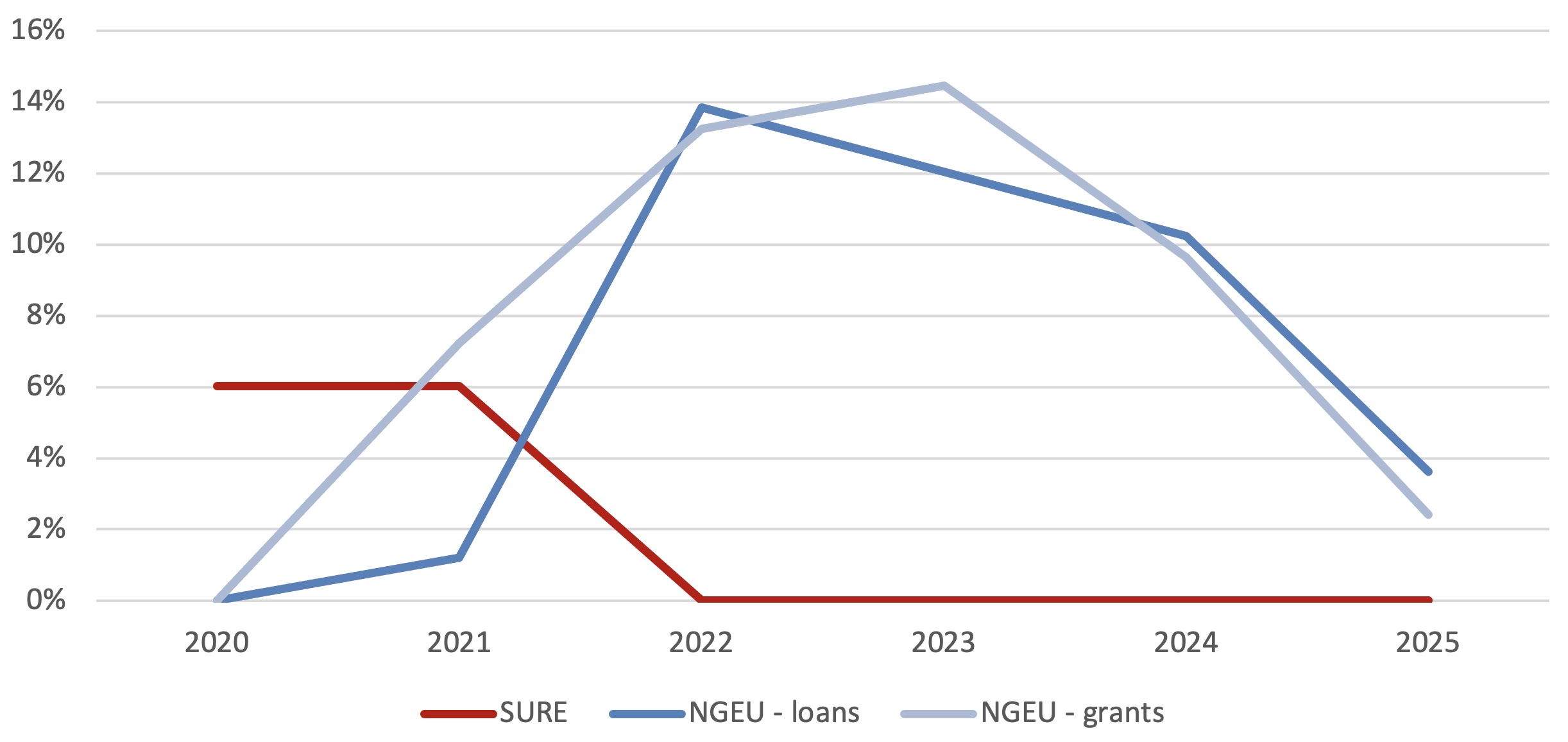

The most sizable programme of cross-border public support will be the Next Generation EU. The agreed distribution of funds will imply sizeable net financial support for those euro-area countries which face the biggest economic and fiscal challenges after the pandemic (ECB 2020a). The loan-based component will provide additional risk sharing via cross-border borrowing whereas the grant component will constitute of direct fiscal transfers. While the majority of the EU support will be provided only once the peak of the pandemic will be over, the fact that EU funding could act as a substitute for sovereign issuance in the future (especially for those countries facing the biggest economic and fiscal challenges) has played an important stabilising role and has been seen as a contributory factor to the decline in these countries’ sovereign yields.

Figure 4 Evolution of the EU-budget based support (% of total support)

Source: authors’ calculations on Commission RRF proposal and European Council conclusions.

Notes:

This estimate is based on several assumptions on how the expected

commitments in loans and grants translate into payments over the years.

It also assumes that 100% of the RRF loans will be used be used by

Member States.

Preliminary – yet important – policy considerations

As the COVID-19 crisis is not yet over, it is only possible to draw some preliminary policy considerations at this stage.

While some challenges for the resilience of the euro area financial integration emerged during the outbreak of the crisis (Borgioli et al. 2020), the unprecedented amount of fiscal and monetary policy measures provided timely support to the economies, stabilising financial markets and preventing private risk-sharing channels from collapsing. This, in turn, has reduced the risk of ‘sudden stops’ that would have further exacerbated the crisis. The mistakes that have characterised past episodes have been avoided thus far.

The key questions are now whether the unprecedented policy response to the ongoing crisis could provide the momentum for an ambitious overhaul of the EMU financial and fiscal architecture that would be conducive to more sustainable private and public risk sharing within the euro area.

Authors’ note: The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank.

References

Asdrubali, P, B Sorensen and O Yosha (1996), “Channels of interstate risk sharing: United States 1963‑1990”, Quarterly Journal of Economics 111(4): 1081‑1110.

Beck, R, L Dedola, A Giovannini and A Popov (2016), “Financial integration and risk sharing in a monetary union”, ECB Report Financial Integration in Europe, Special Feature A.

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel,N Véron, B Weder di Mauro, J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No 91.

Berger, H, G Dell'Ariccia and M Obstfeld (2018), “Revisiting the Economic Case for Fiscal Union in the Euro Area”, IMF Departmental Paper No 18/03, International Monetary Fund.

Borgioli, S, C-W Horn, U Kochanska, P Molitor, F P Mongelli, E Mulder, A Zito (2020), “European financial integration during the COVID-19 crisis: Insights from a new indicator”, VoxEU.org, 3 December.

Constâncio, V (2018), “Why EMU requires more financial integration”, Speech at joint conference of the European Commission and European Central Bank, Frankfurt am Main, 3 May.

Dossche, M and S Zlatanos (2020), “COVID-19 and the increase in household savings: precautionary or forced?“, ECB Economic Bulletin Issue 6.

ECB (2016), “ECB Financial Integration Report 2016”, April.

ECB (2020a), “Financial Integration and Structure in the Euro Area”, March.

Eurostat (2020), “Methodological note Guidance Note on the recording of the future EIB Pan-European Guarantee Fund”.

Giovannini, A, S Hauptmeier, N Leiner-Killinger and V Valenta (2020), “The fiscal implications of the EU’s recovery package“, ECB Economic Bulletin Issue 6.

Gros, D and A Alcidi (2013), “Country adjustment to a ‘sudden stop’: Does the euro make a difference?”, European Commission Economic Papers 492, April.

Haroutunian, S, S Hauptmeier and N Leiner-Killinger (2020), “The COVID-19 crisis and its implications for fiscal policies”, ECB Economic Bulletin Issue 4.

Lane, P (2020) “International flows and the pandemic: evidence from the euro area”, Bank of England / Banque de France / IMF / OECD workshop on ‘International capital flows and financial policies’, 21 October.

Milano, V and P Reichlin (2017), “Risk sharing across the US and Eurozone: The role of public institutions”, VoxEU.org, 23 January.

Pisani-Ferry, J and J Zettelmeyer (2019), Risk Sharing Plus Market Discipline: A New Paradigm for Euro Area Reform? A Debate, VoxEU eBook.