|

|

Once a year the ECB publishes a report presenting an overview of developments in the use of the euro by non-euro area residents. The international role of the euro is primarily supported by a deeper and more complete Economic and Monetary Union (EMU), including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU.

This 22nd annual review of the international role of the euro presents an overview of developments in the use of the euro by non-euro area residents. The report covers developments in 2022. This was a year that saw the onset of Russia’s war in Ukraine and a substantial increase in geopolitical risks with potential repercussions for the international monetary system. Rising inflationary pressures globally – in part coming from war-related energy and food price increases – and tighter monetary policies in major economies led to higher interest rates on the main international currencies.

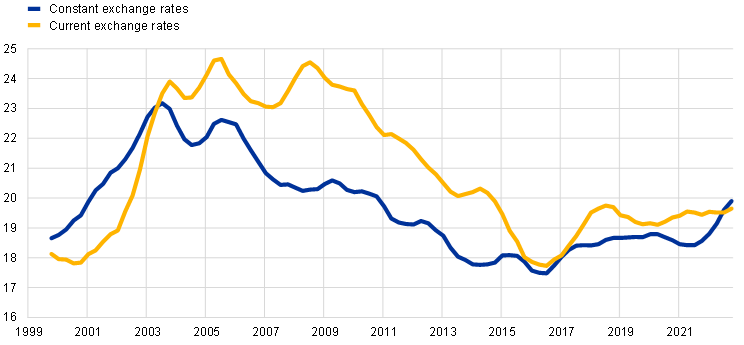

Against this challenging background, a composite index of the international role of the euro remained resilient over the review period (Chart 1). Adjusting for exchange rate valuation effects, the index increased by around 1.3 percentage points. At current exchange rates, it remained largely unchanged. The share of the euro across various indicators of international currency use averaged close to 20%. The euro remained the second most important currency in the international monetary system (Chart 2).

The international role of the euro was resilient in 2022

Composite index of the international role of the euro

(percentages; at current and constant Q4 2022 exchange rates; four-quarter moving averages)

Sources: Bank for International Settlements (BIS), International Monetary Fund (IMF), CLS Bank International, Ilzetzki, Reinhart and Rogoff (2019) and ECB calculations.

Notes: Arithmetic average of the shares of the euro at constant (current) exchange rates in stocks of international bonds, loans by banks outside the euro area to borrowers outside the euro area, deposits with banks outside the euro area from creditors outside the euro area, global foreign exchange settlements, global foreign exchange reserves and global exchange rate regimes. The estimates for the share of the euro in global exchange rate regimes are based on IMF data for the period post-2010; pre-2010 shares were estimated using data from Ilzetzki, E., Reinhart, C. and Rogoff, K. (2019), “Exchange Arrangements Entering the 21st Century: which anchor will hold?”, Quarterly Journal of Economics, Vol. 134, Issue 2, May, pp. 599-646. The latest observation is for the fourth quarter of 2022.

The euro remained the second most important currency in the international monetary system

Snapshot of the international monetary system

(percentages)

Sources: BIS, IMF, Society for Worldwide Interbank Financial Telecommunication (SWIFT) and ECB calculations.

Notes: The latest data for foreign exchange reserves, international debt and international loans are for the fourth quarter of 2022. SWIFT data are for December 2022. Foreign exchange turnover data are as at April 2022. *Since transactions in foreign exchange markets always involve two currencies, shares add up to 200%.

The share of the euro in global official holdings of foreign exchange reserves increased in 2022 by 0.5 percentage points to 20.5%, when measured at constant exchange rates (Table 1). The share of the US dollar declined by more than 2 percentage points, while the share of the renminbi was substantially unchanged. Box 1 examines whether the renminbi could play a stronger role as an international reserve currency despite China’s lack of full financial account openness. A strong dollar and large changes in the price of bonds issued by major economies encouraged official reserve managers to manage their portfolios actively in 2022. Net official purchases of assets denominated in currencies other than the US dollar increased, offsetting valuation effects arising from the dollar’s appreciation – which mechanically raised the share of the US dollar in official reserve portfolios at current exchange rates. Whether inflation developments influenced the decisions of official foreign exchange reserve investors is unclear, as shown by the poor correlation between changes in the share of major currencies in global foreign exchange reserves and inflation rates in the issuing economies. Box 3 discusses how these developments are not exceptional and reflect conventional reserve management strategies by central banks. Interest rates are another factor which can influence the management of reserve portfolios. While interest rates in the euro area returned to positive territory, they remained lower than in other major economies, which could have discouraged rebalancing to euro-denominated assets. Box 2 shows that interest rate differentials are important determinants in the active rebalancing of the government debt portfolios of a sample of US mutual fund managers, much as they influence investment decisions of official reserve managers.[1] Finally, heightened geopolitical risks might have played a role in the investment decisions of official reserve managers in some countries. Special Feature A shows that the accumulation of gold as an official reserve asset was especially strong in countries that are geopolitically close to China and Russia. This may be because such countries are looking to reduce their exposure to the risk of financial sanctions. Higher inflation globally might confound these developments, however, insofar as gold is traditionally seen as a hedge against inflationary risks.

Other indicators of the international role of the euro tracked in this report also point to a noteworthy resilience in the attractiveness of the euro (Table 1). The share of the euro in the outstanding stock of international debt securities increased by more than 1 percentage point to 22.0% in 2022 compared with the previous year, when measured at constant exchange rates. The shares of the euro in the outstanding stocks of international loans and international deposits rose by around 2.4 and 1.5 percentage points, respectively, in 2022. The share of the euro in foreign exchange settlements also increased by almost 3 percentage points to around 38%, when measured at constant exchange rates, over the review period. However, the latest BIS Triennial Survey points to a decline in the share of the euro in global foreign exchange turnover of around 1.8 percentage points since 2019, to 30.5%, owing to the relatively stronger growth of trading in other currencies, such as the US dollar and the renminbi. Box 4 shows that the City of London remained the main venue for foreign exchange trading in euro and that the United Kingdom’s importance for international financial activities in euro did not change materially after Brexit, albeit with a few exceptions. The international role of the euro in foreign currency bond issuance, including the issuance of international green bonds, was substantially stable. Finally, the share of the euro in the invoicing of extra-euro area imports and exports did not change significantly. The impact of Russia’s war in Ukraine on the international role of the euro was particularly visible in the form of a temporary surge in net shipments of euro cash outside the euro area, presumably for precautionary reasons (Box 5). This reversed in the second half of 2022 on the back of higher interest rates and opportunity costs of holding cash (Section 2.5)...

more at ECB