CEPR's Acharya/Cetorelli/Tuckman: Transformation of activities and risks between bank and non-bank financial intermediaries

01 May 2024

Non-bank financial intermediaries have surpassed banks as the largest global financial intermediaries, yet they remain lightly regulated...the intermediation activities and risks of non-bank financial intermediaries and banks have become intricately intertwined..

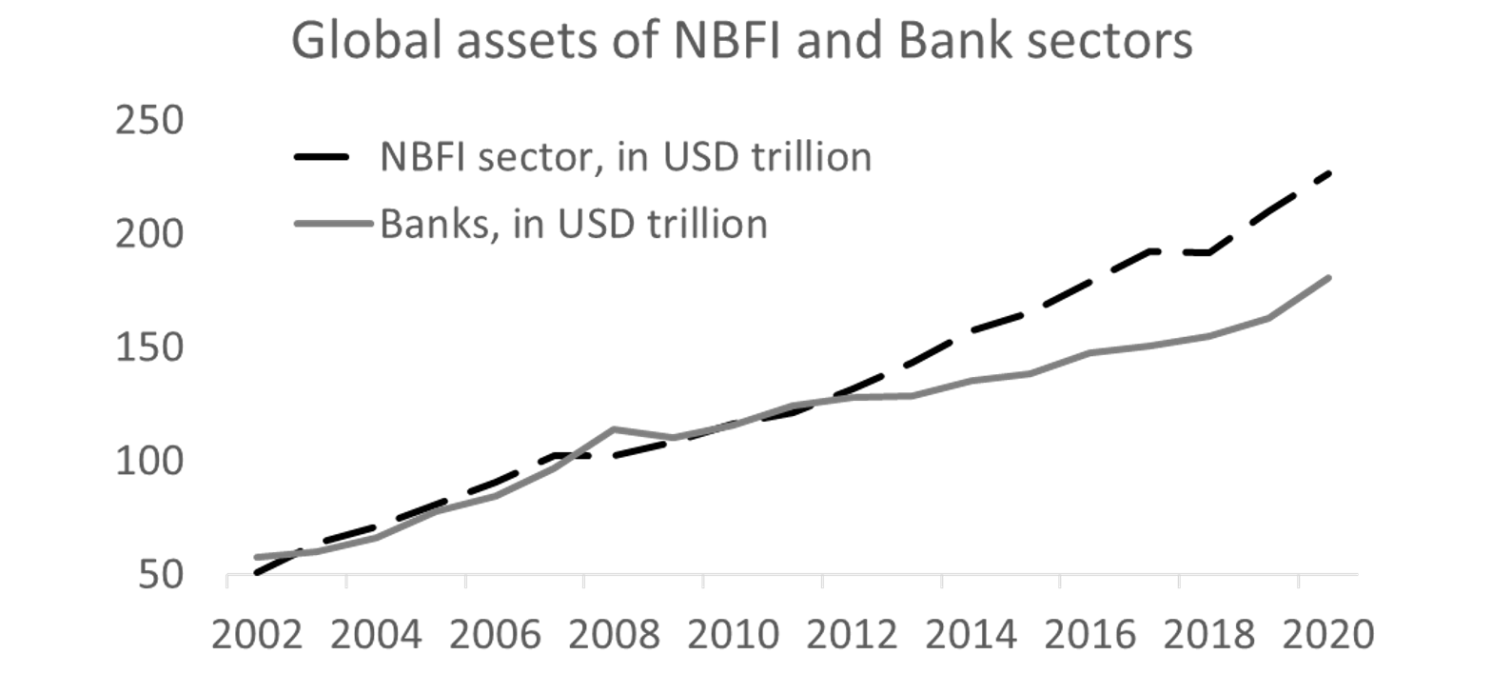

Non-bank financial intermediaries (NBFIs) have surpassed banks as the largest global financial intermediaries. And yet, most NBFIs continue to be lightly regulated relative to banks for safety and soundness, whether in terms of capital and liquidity requirements, supervisory oversight, or resolution planning. Figure 1 shows, using data from the Financial Stability Board (FSB), that the global financial assets of NBFIs have grown faster than those of banks since 2012, to about $239 trillion and $183 trillion in 2021, respectively. In percentage terms, the share of the NBFI sector has grown from about 44% in 2012 to about 49% as of 2021, while banks’ share has shrunk from about 45% to about 38% over the same period.

Notes: The NBFI sector includes all financial institutions that are not central banks, banks, or public financial institutions. Included are all 19 Euro area countries, Argentina, Australia, Brazil, Canada, Cayman Islands, Chile, China, Hong Kong, India, Indonesia, Japan, Korea, Mexico, Russia, Saudi Arabia, Singapore, South Africa, Switzerland, Türkiye, United Kingdom, and the United States. Source: Financial Stability Board [FSB] (2022).

more at CEPR

© CEPR - Centre for Economic Policy Research