|

|

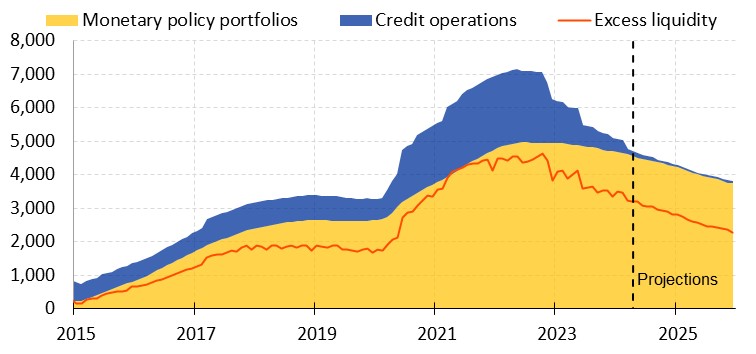

During and after the COVID-19 pandemic, the Eurosystem purchased large amounts of bonds and lent liquidity to banks at favourable interest rates. These measures ensured favourable financing conditions in support of the economic recovery and the achievement of the ECB’s price stability mandate when inflation was below-target. At the same time, the measures injected large amounts of liquidity into the banking sector much beyond banks’ required holdings of central bank liquidity. Therefore, excess liquidity[2] increased significantly, reaching a peak of EUR 4.7 tn in November 2022. Since then, the central bank balance sheet has been normalising and in turn excess liquidity has declined by 31% to EUR 3.2 tn until May 2024 (Chart 1).

Excess liquidity evolution and its drivers (EUR billions)

Source: ECB, ECB calculations.

Notes: The future paths of monetary policy portfolios and credit operations are based on the median expectations by analysts as reported in the latest SMA surveys. The projection of excess liquidity is based on these projections subtracting the projections of autonomous factors and minimum reserve requirements, based on ECB internal assumptions and models.

Excess liquidity is expected to remain ample for some time considering the gradual decline going forward (Chart 1). However, the experience of several crises, a changed regulatory environment and banks’ stricter risk management practises suggest that banks will want to hold on to more central bank liquidity as a buffer than before. Of course, the desired amount of extra reserves will differ across banks and will depend on their risk preferences or business model. Moreover, given that liquidity is unevenly distributed across banks, reflecting the diverse liquidity needs and business models across the euro area and banks, some may face liquidity shortages much earlier than others. That raises the question how banks are adjusting to an environment of lower aggregate liquidity and whether liquidity is flowing effectively from banks with still abundant liquidity to those with emerging liquidity needs. If such a redistribution was impaired and banks were at the same time reluctant to borrow from the ECB in its standard refinancing operations, this could give rise to liquidity shortages, volatility in money market rates and ultimately hamper the smooth transmission of monetary policy. Let’s take a look at two markets that are particularly important for the redistribution of liquidity among banks: the repo market and the covered bond market...

more at ECB