CEPR's Larch: High government debt in the EU or the end of ‘enjoy now, pay later’

24 September 2024

This column provides a brief history of government debt in the EU and draws attention to some important issues that are normally kept in the background.

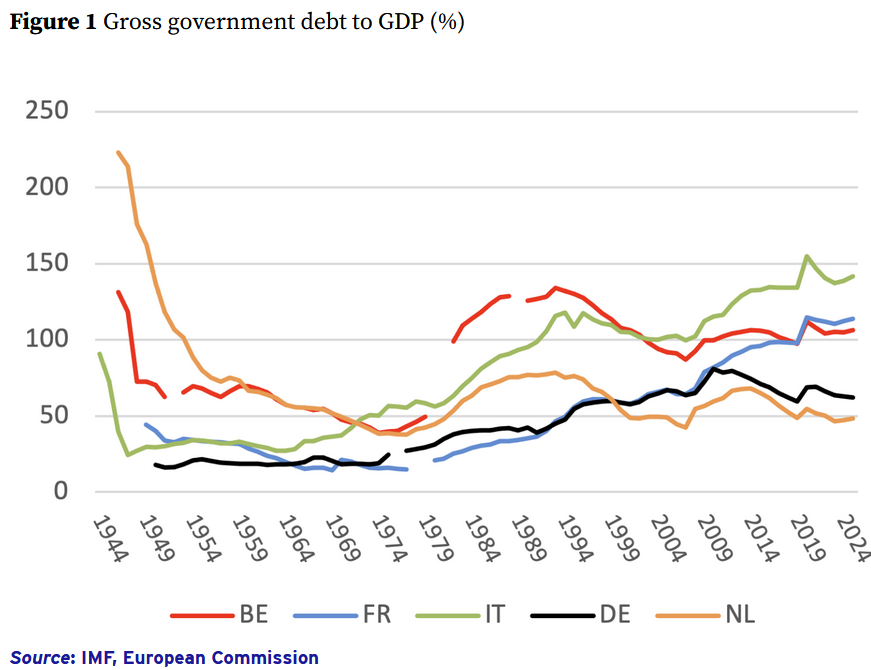

The post-WWII era marked a critical juncture for European nations as they embarked on rebuilding war-torn economies, not least through stronger economic and political integration. Amid this process, in several countries government debt went through a proper roller coaster development. During the early post-war years, most governments were primarily focused on reconstruction while at the same time managing a large amount of government debt accumulated during the war. High inflation and financial repression put debt on a downward trajectory (e.g. Reinhardt and Sbrancia 2011).

The 1950s and 1960s heralded an era of robust economic expansion, spurred by industrial recovery, the Marshall Plan, and burgeoning global trade. This period allowed many European governments to reduce their debt-to-GDP ratios, as economic growth outpaced the need for further borrowing. By the late 1960s, the countries which some ten years earlier had agreed to form the European Economic Community – the precursor to the EU – all recorded debt levels amounting to less than half of one year’s national economic output (see Figure 1).

This phase of economic recovery created a window of relative fiscal stability. Governments were able to fund infrastructure projects and emerging welfare programmes without significantly exacerbating public debt. However, the economic landscape changed in the 1970s, triggering a sustained rise in government debt that has continued, to varying degrees, across some parts of Europe until today....

more at CEPR

© CEPR - Centre for Economic Policy Research