|

|

|

Welcome to our Gold Friends weekly e-mail.

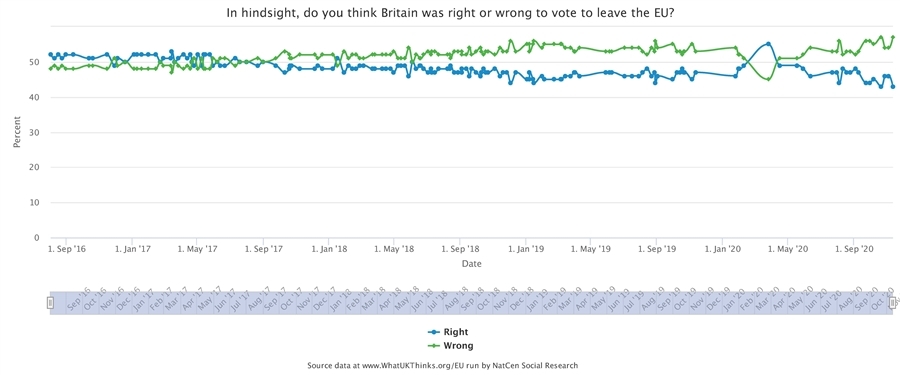

Highlights of the week: Commissioner McGuiness demanded change in the financial system - calling for markets to listen and support non-financial measures such as climate change. She is pushing at an increasingly open door! Non-financial factors are also at work in the approach to the EU budget and the Next generation financial package: Poland and Hungary have vetoed progress while they try to remove the “rule of law” conditions that reflect the founding ideals of the Union. But the week has not been short of financial news as the EBA gave its Advice on insolvency law, the SRB called for a common insurance scheme to aid the transfer of distressed assets and the SSM underlined the need for good governance – with `fit and proper’ executives. The final act of Brexit draws ever-closer – but the British public seems to be ever-more certain they made the wrong decision (see chart below). What will happen when the public experiences the reality of the imminent, hard Brexit? Graham Bishop

Articles from 13-19 November 2020

General Financial Policy

EURACTIV: McGuiness - Finance: becoming green while in the red : Money talks, but it also needs to listen: listen to the demand for change for a financial system that takes account of non-financial issues, from climate change to social inclusion, writes Commissioner Mairead McGuinness. View Article

Statement by EP Conference of Presidents on long-term EU budget and Rule of Law : The Conference of Presidents met today and reaffirmed the European Parliament’s position regarding the deal reached with the Council on the MFF, the related Inter-institutional Agreement (IIA), the related set of unilateral and joint declarations, and the regulation on Rule of Law conditionality. View Article

EURACTIV: Hungary and Poland veto stimulus against pandemic : Hungary and Poland blocked the approval of the EU’s seven-year budget and the recovery fund totalling €1.81 trillion, as both countries continued to oppose the rule of law mechanism attached to the EU funds. View Article

European Parliament: Recovery and Resilience Facility: MEPs ready to start negotiations : RRF to be forward-looking, greener and more democratic; Budget of EUR 672.5 billion; The core of the EU’s recovery and resilience package. MEPs gave the green light to the RRF, which is the EU’s most important tool to fight the economic and social consequences of the pandemic View Article

Bruegel: Next Generation EU payments across countries and years : How much cake does everyone actually get and at what speed? This blogpost estimates the yearly Next Generation EU (NGEU) payments to each EU country at current prices in euros and as a share of GNI. View Article

ECB: de Guindos - The euro area financial sector in the pandemic crisis : How the pandemic has amplified existing vulnerabilities in the financial system and the important role that financial regulation and prudential policy have played in response to the pandemic so far, and argue that further policy measures are needed. View Article

Commissioner Dombrovskis: European Semester Autumn Package : Our economic outlook remains very uncertain. It is now clear that Europe's economic recovery will take longer than we initially expected. View Article

Banking Union EBA publishes Report on benchmarking of national insolvency frameworks across the EU : The European Banking Authority (EBA) published today its Report on the benchmarking of national loan enforcement frameworks across EU Member States, in response to the EU Commission’s call for advice View Article

SSM Enria: The yin and yang of banking market integration – the case of cross-border banks : The Single Market for banking services was first introduced in the early 1990s with a view to spurring greater competition in a sector characterised by extreme market segmentation along product and regional lines. View Article

Speech by Sebastiano Laviola at the EUI FBF Bank Resolution Academy: Bank Resolution in times of uncertainty : While the banking sector was able to survive the immediate most severe hit of the crisis, there are no reasons for complacency....establish a harmonised administrative liquidation regime backed by a common insurance scheme to finance the transfer of assets and liabilities (transfer strategy tools).. View Article

JOINT PRESS RELEASE Pillar II project conclusion “The impact of banking regulation on employment : Since 2007, employment in the banking sector has experienced significative changes due to several factors including the 2008 financial crisis, the growth of digitalisation, market changes, and an increasingly complex EU regulatory framework. View Article

Capital Markets Union ESMA: new Union Strategic Supervisory Priorities: costs and performance; and data quality : The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, using its new convergence powers, has identified costs and performance for retail investment products and market data quality as the Union Strategic Supervisory Priorities for national competent authorities (NCAs). View Article

EFAMA: Initial reactions on the new Capital Markets Union action plan - Keynote Speech by Tanguy van de Werve : EFAMA is very supportive of the CMU initiative and has been since its launch in 2015.Decisive actions are clearly needed to make CMU a reality and it is very important that the entire financial services industry gives it its full support. View Article

BETTER FINANCE Position on the EC Proposal for an EU Recovery Prospectus : The BETTER FINANCE welcomes the proposal put forward by the European Commission to simplify Prospectus disclosure rules for equity issuers in order to stimulate equity financing by companies in need and restore sustainable debt-equity ratios. View Article

Insurance Europe: EU rules and trade policy must help, not hinder, European firms’ global competitiveness : Insurance Europe has published its response to a consultation conducted by the European Commission on its review of EU trade policy. View Article

CRE: S&P highlights top risks for global insurance industry : Most Covid-19-related losses such as business interruption and event cancellation will be picked up by reinsurers, according to S&P Global Ratings. View Article

CRE: UK regulator says insurers have ignored warning on reserves : The UK’s Prudential Regulation Authority (PRA) has told financial lines insurers to correct any weaknesses in reserving and warned it will “sharpen” its focus on firms with significant exposures to the risk. View Article

AFME and PwC identify trends and challenges for European ‘investment banks of the future’ : The COVID-19 pandemic has accelerated the journey of investment banks’ technology transformation, but both consistent regulation and further investment are needed to ensure banks in Europe can deploy competitive technology .... View Article

ISDA Statement on IBA and UK FCA Announcements on LIBOR Consultations : ISDA has published the following statement in response to today’s announcements by ICE Benchmark Administration (IBA), the administrator of LIBOR, and the UK Financial Conduct Authority (FCA). View Article

EIOPA calls for sound supervisory practices in registering or authorising IORPs to foster a level-playing field across the EU : Today, the European Insurance and Occupational Pensions Authority (EIOPA) published a supervisory statement on the sound supervisory practices for registering or authorising Institutions for Occupational Retirement Provision (IORPs), including the assessment of suitability for cross-border activities. View Article

Environmental, Social, Governance (ESG) SSM: Good governance in times of crisis : The coronavirus (COVID-19) pandemic represents the biggest test for banks since the 2008 financial crisis. Against this backdrop, it is crucial that banks make the right decisions so that they are able to weather the pandemic shock which is pushing the global economy into recession. View Article

SSM: Bolstering fit and proper supervision : Robust governance is one of the cornerstones of the sound and prudent management of supervised credit institutions. This is why banks’ management bodies need to include members that are suitable to fulfil their executive and non-executive responsibilities throughout their entire term. View ArticleEFRAG’s consultation on the ad personam mandate on non-financial reporting standard setting : European Commission Executive Vice-President Valdis Dombrovskis has invited Jean-Paul Gauzès, on an ad personam basis, to provide recommendations about the possible changes to the governance and financing of EFRAG, in case the latter were entrusted with the responsibility for the development of possible EU non-financial reporting standards. View Article

SSM: Ramping up climate-related and environmental risk supervision : ECB Banking Supervision is committed to making banks manage their climate-related and environmental risks more effectively and disclose these risks more transparently. While government action since the 2015 Paris Agreement and other sustainability initiatives are driving the shift to a greener economy, significant challenges remain. View Article

CDSB and SSE announce intention to collaborate on capacity building initiatives : The joint capacity building activities for stock exchanges and regulators will help strengthen the support activities for climate-related disclosures and green finance. View Article

IA publishes industry stance on tackling climate change : The IA’s Climate Change Position Paper, published in full today, represents the stance of the UK’s £8.5 trillion investment management industry and reflects the importance with which the industry views climate change. View Article

EFRAG: PROGRESS REPORT PUBLISHED FOR PROJECT ON PREPARATORY WORK FOR THE ELABORATION OF POSSIBLE EU NON-FINANCIAL REPORTING STANDARDS : The Commission issued a request for technical advice mandating EFRAG for preparatory work for the elaboration of possible EU non-financial reporting standards in a revised NFRD, the ultimate objective being to allow for the swift development, adoption and implementation of European standards,. View Article

Fin Tech Regulation José Manuel Campa's introductory remarks at the 2020 EBA Policy Research Workshop "New technologies in the banking sector – impacts, risks a : This year the Workshop focusses on the application of new technologies in the banking sector and the impacts, opportunities and risks. This is timely. View Article

WSBI-ESBG: Systemic cyber risk :The potential for serious negative consequences for the real economy?: Interview with Wiebe Ruttenberg, Chair of the Eurosystem Task Force on Cyber Resilience Strategy for Financial Market Infrastructures and Senior Adviser, DG Market Infrastructure & Payments at the European Central Bank. View Article

SUERF: Retail CBDC Remuneration: The Sign Matters : More and more central banks are planning or considering the possibility of issuing a “general purpose” also said “retail” central bank digital currency (CBDC), that would be accessible to the public and the financial institutions and have published reports on the subject View Article

SUERF: Cyber risk in the financial sector : Cyber attacks on financial institutions and financial market infrastructures have become more frequent and sophisticated, prompting ever-larger investments and efforts. View Article

Economic Policies Impacting EU Finance European Parliament: MEPs quiz experts on better designing taxation to help the economic recovery : MEPs discussed with experts ways in which taxation systems should be reformed to ensure big multinationals, traders and the wealthiest persons contribute more to the economic recovery. View Article

Brexit

CER: Perfect sovereignty under Brexit will come at an economic cost : Sam Lowe says it makes no sense to argue on the one hand that there is a big economic dividend to be had from freedom to negotiate FTAs with other countries, but on the other that there is no economic penalty in not having such an FTA with the UK’s biggest trading partner, the EU. View Article

LSE blog: Does Joe Biden’s election victory change the dynamic of Brexit? : John Ryan claims that the ‘Global Britain’ vision is about to collide with Brexit realities. View Article

Federal Trust: Ireland: A shared island – Brexit and a Celtic future ? : An atmosphere of crisis in Ireland north and south is dominating discussions of the future among seasoned observers and commentators there. It is occasioned by the impending decision on Brexit due to be made shortly ahead of the end of the transition period on 31 December. View Article

SSM: Brexit: banks should prepare for year-end and beyond : The end of the Brexit transition period is approaching fast, with negotiations on the future relationship between the United Kingdom and the European Union still ongoing. With the additional uncertainty generated by the COVID-19 crisis, this raises the stakes for banks and other market participants. View Article

FT: City regulator warns on three Brexit ‘cliff-edge’ risks : UK-EU trade deal may not offset disruption to financial services on January 1, says FCA director View Article

Joint statement on the implementation of prudential reforms in the Financial Services Bill : Joint statement from HM Treasury, the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) on the implementation of prudential reforms contained in the Financial Services Bill. View Article

FCA: Towards end of the transition period: getting ready for a new environment : ..continue to prepare ahead of the UK’s exit from the transition period, and not be complacent;.. ensure that our regulatory approach to financial services remains effective and appropriate now that we have left the EU; View Article

IPE: Top governance group warns against ‘race to the bottom’ : A leading international corporate governance group has warned UK Chancellor of the Exchequer against adopting a dual class share regime and lowering free-float standards as part of his plan for regulation to make the UK more attractive to business. View Article

Follow us on

|

© Copyright 2020 Graham Bishop |

Highlights of the week: Commissioner McGuiness demanded change in the financial system - calling for markets to listen and support non-financial measures such as climate change. She is pushing at an increasingly open door! Non-financial factors are also at work in the approach to the EU budget and the Next generation financial package: Poland and Hungary have vetoed progress while they try to remove the “rule of law” conditions that reflect the founding ideals of the Union. But the week has not been short of financial news as the EBA gave its Advice on insolvency law, the SRB called for a common insurance scheme to aid the transfer of distressed assets and the SSM underlined the need for good governance – with `fit and proper’ executives.

The final act of Brexit draws ever-closer – but the British public seems to be ever-more certain they made the wrong decision. What will happen when the public experiences the reality of the imminent, hard Brexit?