|

|

While deteriorations in sovereign debt market liquidity are evident, these appear to be driven by a ‘dash for collateral’ in euro-denominated safe assets. This suggests some differences from the US experience, as well as variations across European countries.

The spread of Covid-19 has caused tremendous stress to public health around the globe. As the scale of the pandemic became increasingly clear to investors in March 2020, financial markets were strongly affected – both in terms of valuations and their functioning. Economists use the concept of market liquidity to capture the ease of trading in financial markets. In this column, we study how market liquidity in European sovereign bonds evolved at the start of the pandemic, and explore the main possible drivers of this evolution: ‘dash for cash’ or ‘dash for collateral’.

We first focus on German Bunds, which serve as a benchmark safe asset for the euro area and beyond. The liquidity of risk-free assets such as Bunds is a key measure of market stress. In the US, widespread selling pressure – a ‘dash for cash’ – led to a dramatic deterioration of liquidity conditions in the Treasury market by early- to mid-March (Duffie 2020, Muzinich 2020). To answer the question of whether this deterioration was mirrored in European sovereign bond markets, we use data from the inter-dealer platform, MTS.

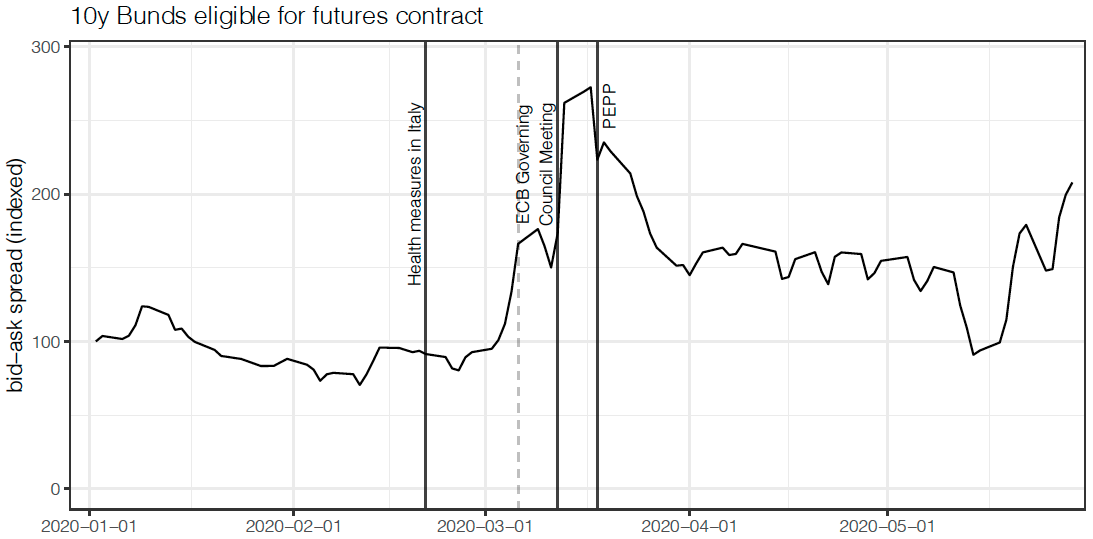

Figure 1 Average bid-ask spread of German sovereign bonds eligible for the current 10 years futures contract

Note: 3-day rolling average indexed to 100 for 2 Jan 2020.

Source: MTS, own calculations.

A standard measure of liquidity is the bid-ask spread. This measures the transaction cost dealers charge each other for trading Bunds. Figure 1 shows the evolution of the average bid-ask spread quoted for German reference bonds from January to May 2020.1 The solid vertical lines in Figure 1 indicate (1) the enforcement of health measures in Italy on 21 February 2020, (2) the meeting of the ECB governing council on 12 March 2020, and (3) the announcement of the Pandemic Emergency Purchase Program (PEPP) on 18 March 2020. This programme was introduced to “counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the outbreak and escalating diffusion of the coronavirus, COVID-19” (ECB 2020). The figure shows that the bid-ask spread began to rise at the beginning of March. Shortly after the ECB Governing Council meeting, it reached more than double its pre-pandemic level. Around the announcement of the PEPP, the bid-ask spread started to fall again but remained at approximately 150% of its pre-pandemic levels thereafter. The increase in transaction cost is not limited to the inter-dealer segment. As we show in a related research paper (de Roure et al. 2020), transaction costs in the inter-dealer (D2D) and the dealer-to-customer (D2C) segments of the Bund market are closely related. Indeed, a similar picture of increased transaction costs emerges from D2C trades reported on Bloomberg (Nguyen 2021).

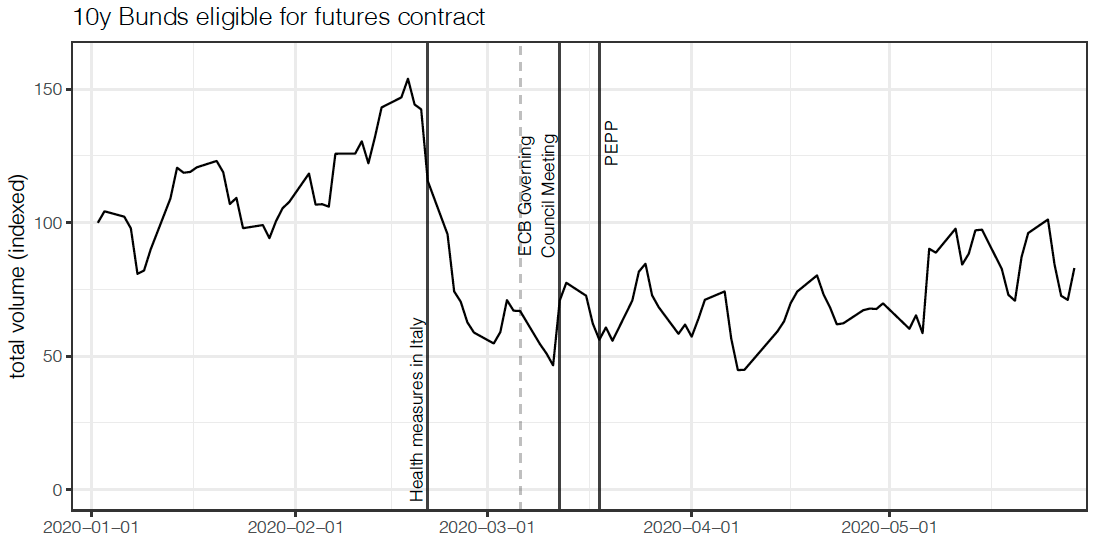

Figure 2 Average volume available for trading in the MTS order book across all levels, for German sovereign bonds eligible for the current 10 years futures contract

Note: 3-day rolling average indexed to 100 for 2 Jan 2020.

Source: MTS, own calculations.

more at Vox