|

|

Rapidly growing public debt

Fiscal policy responses to the global financial crisis (GFC) of 2007-2009, the European financial crisis of 2010-2015 and the COVID-19 crisis of 2020-2021 led to the rapid increase of public debt-to-GDP ratios in most advanced economies. In most countries, the gap between both crises (the second half of the 2010s) was not used to repair fiscal balances and create sufficient room for a fiscal response to a new downturn.

Table 1 shows that by 2019 only Germany, Iceland, Ireland, Malta and the Netherlands managed to radically improve their gross debt-to-GDP ratios (compared to the peaks during the global and European financial crises), some of them (Germany and Malta) below their pre-financial crisis levels. Czechia, Denmark and Portugal recorded a less impressive but still meaningful improvement. Beyond Europe, the same happened in Israel. Norway, Sweden, Switzerland, and Taiwan avoided increases in public debt aftermath of the financial crisis. The euro area and the European Union decreased their relative indebtedness only marginally.

The outbreak of the COVID-19 pandemic was marked by rapid deterioration of the debt-to-GDP ratios in almost all advanced economies except Norway, Sweden, Switzerland and Taiwan. The IMF World Economic Outlook forecast for 2021 (the last column of Table 1) does not promise much improvement despite the ongoing rapid recovery. On the contrary, several countries may record a further increase in their indebtedness.

In 2020, general government gross debt exceeded 100% of GDP in 12 advanced economies, including all G7 economies except Germany and will remain above this threshold in 2021. These are record-high figures for peacetime and are a cause for concern for public debt sustainability in advanced economies and the stability of the global economic and financial system.

Public debt sustainability

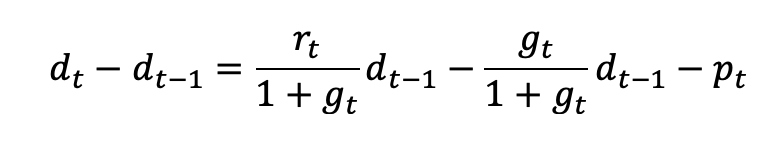

The public debt dynamic is described by the following equation:

(Eq.1)

(Eq.1)

where dt = general government gross debt-to-GDP ratio at the end of period t

dt-1 = general government...morte at Bruegel