Public debts soared in the wake of the global financial crisis and the COVID-19 pandemic, with gross debt levels rising by about 15% of world GDP on both occasions. At some point, governments will have to pivot toward debt consolidation. They will attempt to reduce debt-to-GDP ratios in order to prevent debt service costs from crowding out other public programmes and debt overhangs from becoming a burden on private investment. They will take steps to enhance and restore their capacity to borrow in order to meet the next emergency.

In the past, some governments have relied on inflation to reduce and even liquidate heavy debts, Weimar Germany being a textbook example (Feldman 1997). Similarly, there is discussion currently of whether inflation will be part of the response to current debt problems (e.g. Goodhart and Pradhan 2020), though few would credit the likelihood of a Weimar-like scenario in the advanced countries.

What we do

In a recent paper (Eichengreen and Esteves 2022), we analyse the role of inflation in debt consolidations over the last 220 years. We build a database of historical debt consolidation episodes covering a maximum of 183 countries and apply an accounting framework to distinguish the role of inflation.

This is, to our knowledge, the first attempt to assemble a worldwide historical database of debt consolidations spanning such a long period, although it is preceded by important country studies (e.g. Hernandez de Cos et al. 2016 for Spain, Wickens 2022 for the UK), on which we build. It is similarly the first attempt to apply a framework explicitly distinguishing the role of inflation to a large debt-consolidation dataset.

We define debt consolidation in a number of different ways. At one extreme, we include episodes of any duration (one year or longer) over which the debt/GDP ratio fell by at least 10 percentage points. At the other, we include episodes lasting at least 10 years and involving a decline in debt/GDP of at least 15 percentage points. We allow for interruptions – periods when the ratio rose – so long as these were no more than two years in length. We identify as many as 283 debt consolidation episodes over two-plus centuries.

Consolidation episodes

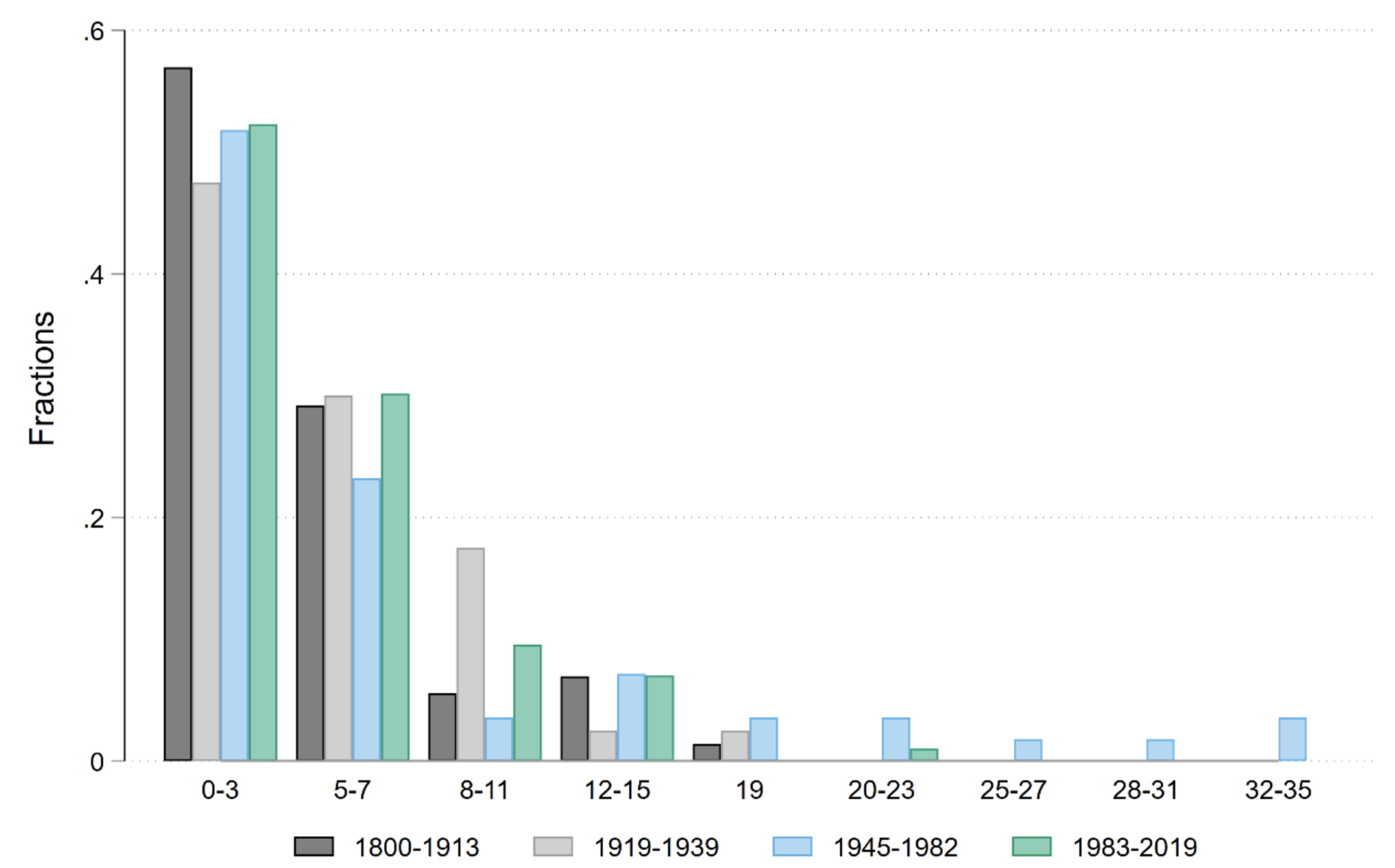

Figure 1 shows a histogram of consolidation durations (in years). It spans the long 19th century (through 1913), the interwar period, the years from WWII to the Latin American debt crisis, and the subsequent period. In all four eras, the histogram is skewed to the right, with most episodes lasting fewer than 15 years, apart from some exceptionally long consolidations in the third period (1945–82).

Figure 1 Histogram of consolidation durations (in years)