The

United Kingdom (UK) will officially leave the European Union (EU) on

1 January 2021. Many detailed aspects of Brexit remain unclear. However,

from that date, the UK becomes as far as the EU is concerned a ‘third country’.

Businesses will become importers and exporters between the EU and the

UK and they need to take urgent action to minimise the disruption to

their business.

Accountants are instrumental in helping their clients make the

necessary plans, so it is important that accountancy bodies make their

members aware of the fundamental changes in the manner in which trade

will take place, to better advise their clients.

This Q&A provides practical information on the main changes known so far. It is not a comprehensive document.

EU-UK trade will change significantly from 1 January 2021, and then

again for e-commerce from 1 July 2021. Businesses should take the

following main actions:

- speak to their logistics providers / customs agents

- speak with their suppliers and customers about the changes

- get familiar with customs requirements and classify their goods

- apply for a GB / EU EORI Numbers and VAT registrations where applicable

- consider the implications of the E-Commerce changes

- remember EU VAT refunds – 31 March 2021

Accountants with clients who engage in trade between the EU and the

UK, and vice versa, should further research the technicalities and are

strongly advised to contact their relevant clients as soon as possible

to discuss their specific circumstances. Unrepresented businesses are

strongly advised to take specialist advice to ensure the continuity of

their business.

We have also highlighted some of the changes that could occur as a

result of Brexit in respect of other taxes. The impacts of these often

depend on the provisions of double tax treaties between the UK and

individual EU Member States and specialist advice should be sought. Brexit & direct taxes is available on this page.

Question 1: There’s still the possibility of a trade deal

between the UK and the EU being agreed and adopted before 1 January

2021. Surely, I should wait until the trade deal is announced before my

business takes any steps?

Answer: Absolutely not! Even a

comprehensive trade deal will only cover such aspects as the removal or

reduction of tariffs (‘customs duties’), the absence of quotas on UK

origin goods and customs and other regulatory procedures on movements of

goods. In respect of cross-border (“EU-UK”) supplies of services, a

trade deal will be far more restricted and may only cover, for example,

mutual recognition of qualifications and regulatory standards.

In respect of accounting for VAT, and the requirements for customs

clearance of goods, it is certain that there will be significant changes

– the details of most of which are already known.

Businesses must urgently review their processes to be sure that they

are ready for the changes that take effect on 1 January 2021.

Question 2: Does it make any difference if I am a UK business selling into the EU or an EU business selling into the UK?

Answer: Not really. The changes are broadly

equivalent on both the EU and UK sides. The main difference is that

there is more certainty in respect of the procedures (and custom tariff

rates) in the EU because these are already established. However, there

is significant variation in procedures and rates of VAT across the 27

Member States, so UK exporters importing into the EU will, depending on

their terms of trade, need to acquaint themselves with the local rules

of each Member State into which they make supplies.

Also, there is currently a critical distinction in respect of

supplies of goods made between Northern Ireland and the EU (and vice

versa) and the rest of the UK (for the purpose of this document,

subsequently referred to as ‘Great Britain’ – GB). We will look at this

issue in more detail below.

Supplies of Goods – VAT

Question 3: I sell goods between the EU and GB. What will be the changes for me from the 1 January?

Answer: Such supplies will cease to be intra-EU

supplies. Consequently, they will be treated as exports from the country

of dispatch and imports in the country of arrival. This has important

implications for VAT, customs and excise duties. It also impacts on

other regulatory requirements that will have to be met for goods, such

as those subject to health checks (for food, medicines, live animals,

etc), chemicals, medicines, weapons, and dual-purpose goods.

The goods leaving the country will be treated as exports. This means

that they are exempt\zero rated from VAT – so no output VAT will be

charged on the supply of goods. You must, however, be able to provide

proof that the goods have left the EU, or GB for exports to the EU.

Different rules apply to Northern Ireland – EU supplies of goods and to Northern Ireland – GB supply of goods (See below).

The goods entering GB for supplies to the EU and for supplies from

the EU to the UK will be treated as an import. VAT will have to be

charged at the local rate of VAT of the country of import for that type

of good. A searchable ‘Taxes in Europe’ database has been developed for EU Member States, which shows Member States’ VAT rates for specified goods.

Question 4: Who accounts for and pays the VAT?

Answer: That depends on the terms of business, who is identified as the importer and who receives the goods.

General guidance is available here (in respect of where to tax) and here (in respect of who is liable to pay the tax).

If your organisation imports for your its own use – in manufacturing

or for resale for example – then you will be liable to register for VAT

in the country of import and account for the import VAT under the local

VAT reporting requirements.

If you make distance sale of goods, the situation is more complex.

If you make B2B supplies, then your customer would normally be

expected to account for the VAT on import, which would be charged by

customs at the point of import.

If you make B2C supplies of goods, you have the choice as to whether

your business terms provide that you will deal with the customs duty

and import VAT yourself (‘Delivered Duty Paid – DDP’) and thereby price

the goods to include these costs. With DDP, you would be required to

register and pay the VAT in the country of the customer- and\or use an

agent.

Alternatively, you could opt for ‘Delivered at Place’ (DAP) – where

only the net price and delivery costs would be shown, and the customer

would be liable to pay the VAT and customs duty. This would typically be

collected by the courier or national postal service and goods would be

withheld until payment is received. It is possible that in some Member

States the national postal service will pay the import VAT and reinvoice

the supplier.

The rules are complicated and specialist advice should be sought.

Question 5: You mentioned distance sales. I thought I only had to register in other countries if I made a lot of sales there?

Answer: The national exemption thresholds for distance sales of goods

only cover sales between two Member States to non-VAT identified

customers in the second EU Member State. Therefore, from 1 January this

simplification regime will not apply for EU-GB sales and GB-EU sales.

You must then choose whether to use the DAP or the DDP terms

described in Question 4. If they chose DAP then the VAT would normally

be paid at the point of import by the customs declarant (e.g. the

courier, postal operator or by a customs agent) and then recovered from

the customer before the goods are handed over.

If the DDP method is chosen, an EU supplier must register with HM

Revenue and Customs and declare and pay VAT for distance supplies made

to the UK. Simplification procedures will be available for small value

consignments (see Question 6 below).

GB suppliers making distance sale of goods under DDP into the EU will

normally be required to register for VAT in each Member State into

which they make supplies of goods originating outside the EU. Currently,

there is no exemption threshold for non-EU established businesses and

EU Member State local registration and reporting requirements differ

greatly. For example, many EU Member States require that 3rd

country suppliers (i.e. non-EU registered businesses) formally appoint a

tax representative that will have joint and severable liability for any

unpaid VAT. One example of this is France, as shown in this article.

Question 6: But I only sell small items through a sales platform. Surely, I don’t have to worry about this?

Answer: Unfortunately, you do. There are big changes

in both the UK and the EU in 2021 in respect of distance selling to

consumers of low value items. The changes are similar but the timing is

not – the changes will apply in the UK from 1 January 2021 and from 1

July 2021 in the EU.

EU to UK distance selling

From 1 January 2021 the UK’s low value consignments exemption for

goods not exceeding £15 in value will be withdrawn. This will make all

imports subject to import VAT (and potentially customs duties). At the

same time, a small consignment import simplification process will be put

into place and online marketplaces (OMPs) must start accounting for VAT

on behalf of suppliers that use their platforms.

A simplification will be available

from 1 January 2021 for low value consignments where the total value of

the goods (not the individual value of each item) does not exceed £135,

excluding shipping costs and duty. EU suppliers must register with HM

Revenue and Customs and charge VAT at UK rates at the point of sale and

then account for the VAT using normal VAT return procedures. The goods

will then not be delayed by the requirement for VAT to be charged by

customs at the point of entry.

If such goods are sold via an OMP, it is the OMP that would account for VAT at the point of sale.

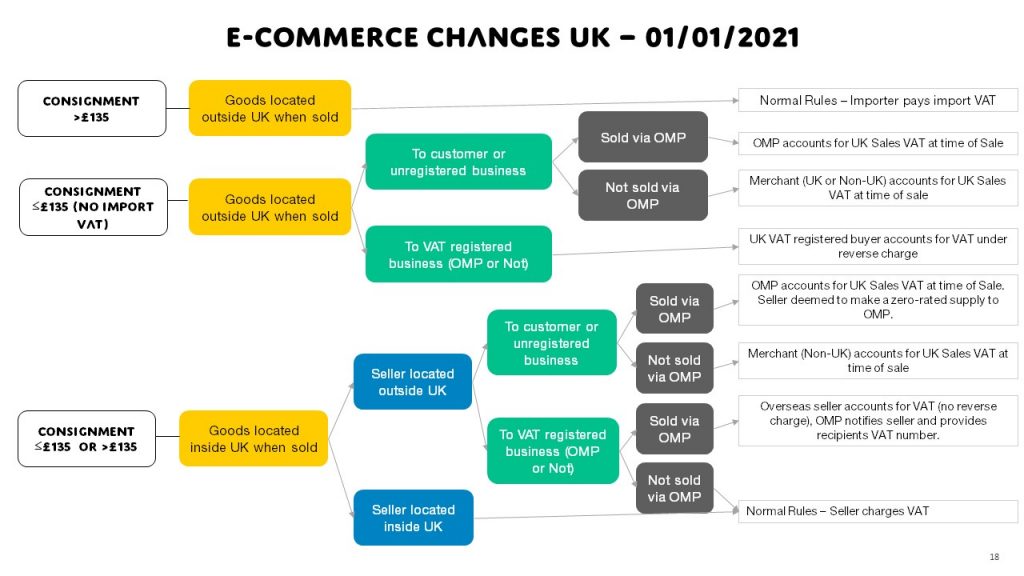

The options for e-commerce sellers

from GB to the EU, and how the changing roles that the OMPs will play in

this, are shown in the graphic below:

Source: ICAEW

This is a complex area and specialist advice should be sought as soon as possible.

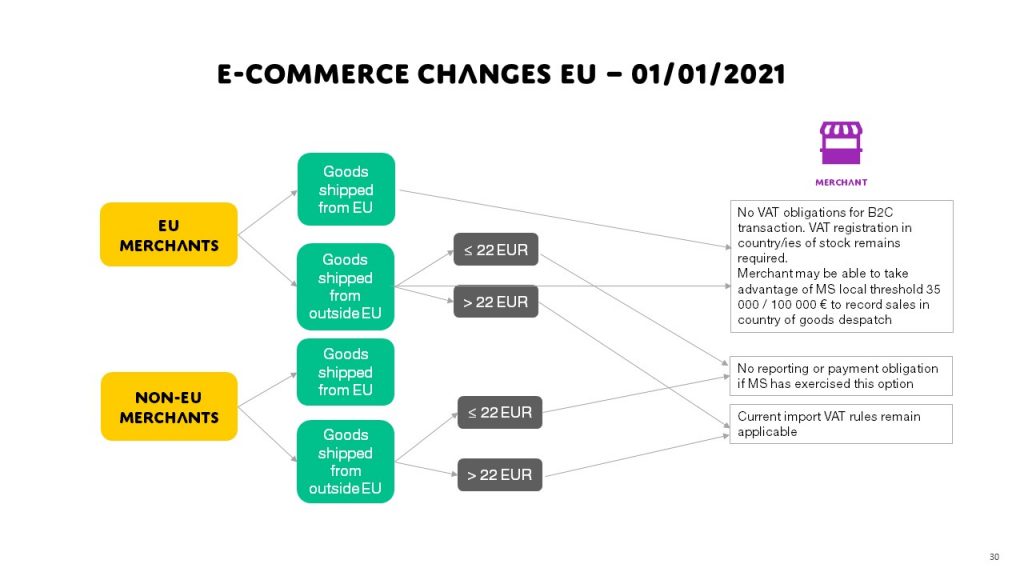

GB to EU distance selling

Very similar measures will be introduced in the EU but have been postponed until 1 July to allow for delays caused by the Coronavirus crisis.

This means that where Member States have adopted

this option, the EU’s €22 exemption will be maintained until 1 July 2021

(note that not all Member States have adopted the maximum threshold,

which is, for example €1 in France €17.05 in Cyprus, DK80 in Denmark and

€nil in Sweden).

However, all other distance sales of goods from GB

into the EU will be subject to import VAT from 1 January in the Member

State where the good are imported into. Consequently, GB suppliers will

have to register and account for VAT in each Member State where they

make distance supplies. The different ways

with which e-commerce imports into EU Member States are accounted for,

for VAT purposes, between 1 January and 30 June 2021 are shown below.

Source; ICAEW

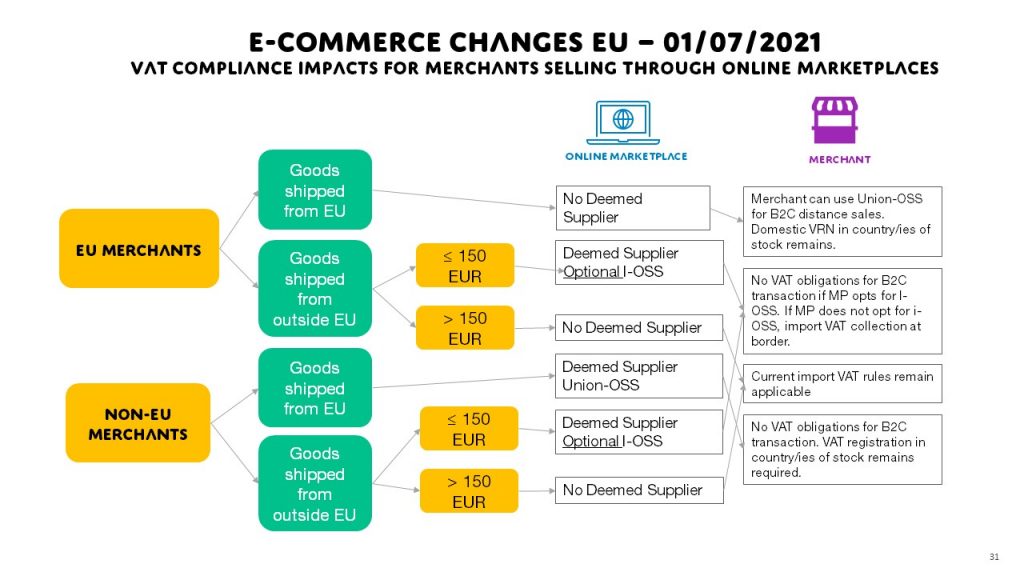

From 1 July 2021 the simplified procedures for low value consignments come into effect in the EU

for consignments with a total value of up no more than €150. These

mirror the simplifications that the UK will introduce from 1 January

2021, with the important addition of the ability in the EU to use the

import One Stop Shop (IOSS).

From this date GB businesses can choose a single

EU Member State of Identification and then use the IOSS to make a single

return of all small value consignment distance supplies of to each

Member State.

Additionally, the EU’s rules on the distance sales

facilitated through an online platform will come into effect on 1 July.

However, in the intervening period, you may not be able to rely on your

digitalised sales platforms to deal with the necessary formalities.

Indeed, Amazon have already confirmed that they will not allow

cross-channel sales from Fulfilment By Amazon (FBA). Cross-channel

traders will be required to transfer goods to a fulfilment centre in the

UK or EU as relevant – which after 1 January will have VAT and customs

duty consequences for the supplier. The

options for e-commerce sellers from GB to the EU, and how the changing

roles that the OMPs will play in this, are shown in the graphic below:

Source: ICAEW

Again, this is a very complex subject and expert advice should be sought to deal with your individual circumstances.

Question 7: You can’t always assume that customers will

receive their goods by the expected date. What happens if goods are in

transit on 1 January 2020?

Answer: Any EU-UK supplies made on or before 31

December will be treated as intra-EU supplies until 31 March 2021.

Consequently, they will follow the current intra-EU supplies VAT and

duty treatment. However, it is possible that some goods may be stopped

at Customs until the supplier is able to demonstrate that the despatch

of the goods took place before 1 January 2021.

Question 8: I’m lucky. I only sell digital services and we

already have the Mini-One-Stop Shop (MOSS). Surely, nothing changes for

me?

Answer: Yes, it does. If you are a UK established

supplier of digital services selling to non-VAT registered customers in

the EU you will still be able to use the Mini-One-Stop Shop to make your

return filing.

However, from 1 January 2021 the £8 818 (€10 000) threshold will

disappear for supplies of digital services between the UK and EU non-VAT

registered customers. UK suppliers must register in a single EU Member

State and use the Mini One-Stop Shop (or else register in every EU

Member State where the clients are established) for digital services to

declare all of the EU sales, and the VAT thereon.

For EU businesses selling digital services into both UK and the EU,

you will be able to use the MOSS for EU supplies but for UK supplies you

must register in the UK and declare your sales to HMRC – you can no

longer use the MOSS for these supplies from 1 January 2021.

Question 9: I have a complex supply chain that involves

movements of goods between the UK and EU. Is there anything else I

should be concerned about?

Answer: Almost certainly, but the impact will depend on your business model and the nature and scale of your cross-border supplies.

In the short-term at least, EU and UK VAT legislation will remain

reasonably aligned (although Member State options already mean that

there are considerable differences between Member States local VAT

rules) but may well diverge in the future (e.g. in respect of financial services).

However, even before the rules diverge further there will be practical

issues to deal with – especially in respect of access to EU systems and

to simplifications directly related to intra-EU supplies of goods. As an

indication, we can consider the Quick Fixes that came into effect from

the 1 January 2020.

Non-established suppliers will be able to use the call-off stock simplification after Brexit, as can be seen from this Explanatory Note

from the European Commission, section 2.5.25. However, in respect of

chain transactions, section 3.6.2, this simplification will only apply

to intra-EU movements of goods so movements of goods from 3rd countries

must make use of other simplifications, if available (or else be VAT

registered in an EU Member State).

Question 10: If

I incur input VAT in respect of EU-GB supplies but am not required, and

have not chosen to, register in the country where the VAT was incurred,

will I still be able to recover it after 31 December.

Answer: Yes. However, for supplies made after 31 December the claim for refund

must be made directly to the authorities of the country concerned,

providing that there is a reciprocity agreement. Such claims cannot then

be made through the electronic refund claim system.

The one exception to this rule being

in respect of goods or services supplied up to 31 December 2020. In such

cases the electronic system can be used by all UK and EU businesses

until 31 March 2021 to recover the VAT incurred in 2020.

Supplies of Goods – Customs Duties/Tariffs

Question 11: I have not had to worry about import duty for EU-GB transactions before. What is going to be the impact on me?

Answer: This is one area where it is difficult to be

definitive as a trade deal between the EU and the UK could impact on

the tariffs imposed on both sides of the customs border and also on the

imposition of any quotas. First, you should concentrate on dealing with

what is known and also ensure that you are up to date with the progress

of a comprehensive UK-EU trade deal.

Urgent Action

Irrespective of whether a trade deal is reached between the EU and

the UK, cross-channel suppliers must take some urgent administrative

steps:

- Suppliers must be sure that they have an Economic Operator

Registration Identification (EORI) number otherwise they will not be

able to clear goods at customs. In certain circumstances, they may need both a UK and an EU EORI number.

- They should acquaint themselves with the relevant exit and entrance

customs documentation for supplies made after 31 December – otherwise it

will not be possible to export the goods or, goods may become stuck in

customs at the point of import. Some points of departure will require

pre-lodgement of customs declarations before movement of goods takes

place, so certification may have to be lodged in advance of the 31

December deadline.

- Suppliers need to choose the right standardised commodity

identification (customs) code for all of their products. Getting this

wrong could result in the wrong tariff being applied or the goods being

blocked by customs.

- Suppliers should also review their commercial terms (e.g. Incoterms)

to determine whether they or their customers will be responsible for

paying the customs duties.

Import tariffs – subject to amendment in the event of a comprehensive trade deal

In respect of tariffs, in the event of no-deal the European

Commission has confirmed that there will be no legal alternative other

than for Member States to impose the Common Customs Tariffs on goods

transported from Great Britain, on the WTO most-favoured-nation basis.

The UK will apply its own import tariffs from 1 January 2021, which are not the same as EU tariffs. The UK tariffs can be found here.

The UK Global Import Tariff essentially reduces the overall duty

payable on imports compared to the current EU Tariff Free Lines (i.e. UK

47%, EU 27%; Average Duty rate UK 5.7%, EU 7.2%).

From 1 January 2021, importers of non-controlled goods into the UK

will be subject to basic customs requirements and can delay their supplementary customs declarations

until July 2021. For importers using this delayed filing, the payment

of duties and VAT can be delayed to the time when the supplementary

declaration is submitted. Full customs procedures will be required from 1

January 2021 in respect of controlled goods – e.g. alcohol and tobacco

products.

From 1 January 2021, goods brought into the EU from the UK will be

subject to full customs procedures. This means customs formalities will

have to be observed at importation of the first EU country at which the

goods arrive and that duty suspension will no longer automatically be

available – leading to tariffs and VAT being due on importation. Some

individual Member States may offer the option of customs duty deferment.

From 1 January 2021 UK economic operators can no longer use the EU’s

Excise Movement and Control System (EMCS) for imports of controlled

goods into the EU from Great Britain.

Northern Ireland

Question 12: I move goods between the EU and Northern Ireland and, sometimes, on to Great Britain. What will change for me?

Answer: As it currently stands

under the Withdrawal Agreement, Northern Ireland remains part of the EU

Single Market until at least 31 December 2024, with the possibility for

the Northern Ireland Assembly to extend this period.

Consequently, supplies of goods (not services)

between Northern Ireland and the EU Member States from the 1 January

2021 will continue as intra-EU supplies, with economic operators having

to use the EMCS and SEED systems for all movements, and the EU online

refund mechanism still being available. Equally, current reporting

requirements such as Intrastat and EU Sales Lists (ESL) will continue.

Movements of goods from Northern Ireland to Great Britain and vice

versa will be treated as exports and imports respectively. Consequently,

the impacts will be the same as those discussed previously for

movements of goods directly between Great Britain and the EU Member

States.

However, the UK’s Internal Market Bill has introduced uncertainty

into the arrangements agreed in the Withdrawal Agreement. The Bill has

not yet passed the legislative process in the UK, so the situation

remains unclear. The latest HM Government advice for moving goods under

the Northern Ireland protocol can be found here.

It is important that you

constantly review the situation, which could change significantly

depending on whether a trade deal between the UK and EU is agreed

between now and the end of the year.

Supply of services

Question 13: I supply services between the UK and the EU. If there is no trade deal, how will this impact me?

Answer: Free trade agreements concentrate on supplies of goods, rather than services (albeit there is the WTO General Agreement on Trade in Services (GATS)).

Consequently, there will be significant changes in how supplies of

services cross-channel are accounted for, for VAT purposes whether there

is a deal or not a deal.

However, one important aspect a trade deal may cover is mutual

recognition of qualifications. Without this, it may not be legal for a

service provider in a regulated profession (i.e. medical, legal,

accountancy, architectural) to provide cross-channel services – and this

can depend on the national rules of the specific country where the

services are to be conducted. Without a trade deal it is possible that

visas may be required for cross-channel business trips.

The degree to which you may be affected can be gauged by using the European Commission’s regulated professions database.

Without a comprehensive trade deal, it is also possible that certain

regulated industries, such as financial services, may not be able to

provide services from UK to the EU, and vice versa.

Question 14: OK. I am not practicing in a regulated profession. How will the rules change for me after 1 January?

Answer: The current EU VAT legislation is

already quite complex in respect of the determination of place of

supply of services, which can depend on factors, such as the nature of

the service, whether the recipient of the service is a taxable person,

where the service is performed etc.

Where the current rules indicate that the service is ‘supplied’ in

another country, the supply will be subject to VAT in that country.

Consequently, if, for example, the place of supply is deemed to be in a

Member State for services provided by a taxable person based in the UK,

it would be an outside the scope of VAT supply in the UK (zero-rating) and taxable in the Member State where the place of supply of the service is located.

The reverse would apply for an EU taxable person making supplies of services where the place of supply was the UK.

B2B supplies of services are situated where the

customer is established. As a rule, the customer will be liable for the

payment due of VAT in the country where they are established. There are,

however, exceptions to this rule.

B2C supplies of services are generally situated

where the supplier is established so consequently a VAT liability will

be incurred in the country where the supplier is established.

However, the place of supply rules for services are complex and expert advice should be taken.

As with the supply of goods, there will be many specific

circumstances where the end of the transitional period could result in

uncertainties and issues for specific business models.

For example, Art 59a of the VAT Directive permits Member States to

override the normal place of supply rules if the effective use and

enjoyment of these services takes place outside the EU despite being

performed in their Member State, and vice versa. This is a measure to

prevent double taxation, or non-taxation, and is often used by Member

States to tax services that would otherwise be out of scope of VAT. If

EU Member States were to apply this to certain supplies made by

suppliers established in the UK, or vice versa, there could be issues in

respect of recovering VAT already paid – thereby leading to double

taxation and the question of how this double taxation could be

recovered.

Next steps

Question 15: What should I do next?

Answer: If you make EU-UK supplies or have a supply

chain that relies on EU-UK deliveries, you should immediately assess the

risks to your business and make the necessary registrations. A useful

checklist can be found here.

There will be a last-minute rush to effect VAT and customs

registrations and obtain tax advice. Many businesses have been waiting

on more clarity as to the scope and extent of any trade deal between the

EU and the UK. If you leave it too late you may find that you are

unable to obtain the necessary authorisations and registrations before 1

January 2021.

Specialised businesses (for example, those requiring licenses or

those with complex supply chains) should take expert advice as soon as

possible.

Getting this wrong, or doing nothing, could be very costly.

In the longer term, it will be necessary to monitor the legislative

developments in both the EU and the UK to identify new divergencies

between the two VAT systems and the practical issues that these may

cause.

By virtue of the UK’s Taxation (Cross-border Trade) Act 2018, the

UK’s VAT rules will effectively remain on 1 January 2021 largely aligned

with those of the European Union, to avoid any cliff edge effect on

that date. At the same time, this Act adapts UK law to remove, for

example, in relation to Great Britain, the concepts of intra-EU

acquisitions of goods as they become imports from 1 January 2021.

Over time though, we could see divergence in areas such as the VAT treatment of financial services (the UK government recently announced

that UK financial services businesses will be able to recover input VAT

in respect of supplies made to the EU), VAT groups, and partial

exemption, for example.

Currently there is no clear indication of what such changes will be, or when they will occur.