Following the Brexit referendum five years ago, firms in the UK and also those in the EU and other countries operated in an environment with increased uncertainty over future trade policies. This column presents evidence of the detrimental effects of this uncertainty on trade in the UK before any changes to trade policy had taken place.

Studying the

period after the Conservative Party won the general election in May 2015

until just after the Brexit referendum in June 2016, it finds that an

increasing probability of Brexit significantly reduced UK export values

and product entry, while increasing product exit.

Five years after the

Brexit referendum, research has evaluated its impact so far on UK

trade. The findings show that the ongoing Brexit uncertainty has already

reduced UK trade in goods and services before any actual policy changes

took place. This disintegration is present in UK trade, with countries

potentially affected by trade policy changes including the EU and other

UK preferential trade partners. Firms in these countries faced increased

trade policy uncertainty, leading to depressed export investments.

We discuss the

importance of policy stability and commitments, and their effects on

business decisions and investment generally (Bloom et al. 2018, 2019).

We focus on recent evidence drawn for the impact of Brexit uncertainty

on UK trade in goods and services and conclude with some policy remarks.

The role of trade policy uncertainty

Exporting generally

involves sunk investments, such as compliance with border and national

regulations, learning about demand, and setting up distribution

networks. Examples of these and other export costs have multiplied in

the media post-Brexit.1 Firms make these investments today if

the expected profit is higher now than in the future. But increases in

uncertainty raise the risk of current export investments, increasing the

option value of waiting and thus lowering current firm exports.

Trade agreements aim

to reduce trade policy uncertainty and evidence shows that in doing so

they promote integration. One example is Portugal’s accession to the EU

in 1986. Even prior to 1986 Portuguese exporters mostly faced zero

tariffs in the EU. However, this market access was uncertain since

tariffs or other barriers could be raised at any time. Handley and Limão

(2015) find that this uncertainty was eliminated post-accession,

leading to an increase in the number of Portuguese exporters and trade

even if tariffs remained constant.2 Brexit is analogous to a

reversal of this process: the UK-EU market access is becoming more

uncertain and is therefore a source of trade disintegration.

The impact of Brexit uncertainty on EU-UK trade in goods

In May 2015, the

Conservative Party won the general election after promising a referendum

on the EU membership of the UK. The Conservative government introduced

the referendum bill days after the election. For more than a year after

that, both UK and EU firms operated knowing that there was a real,

politically enabled probability of the UK leaving the EU. In June 2016,

the ‘Leave’ campaign won.

Crowley et al.

(2019) find that Brexit uncertainty reduced UK firm export participation

by comparing pre- and post-referendum firm export entry and exit. In

Graziano et al. (forthcoming), we focus on the effect of Brexit

uncertainty between the conservative election and the referendum. We

explore variation in the probability of Brexit – measured via prediction

market contracts (or polls) – and find that the higher the predicted

probability of Brexit, the lower trade. This effect is expected to be

more pronounced for riskier industries, i.e. those facing potentially

higher protection in case of a hard Brexit, as measured by the

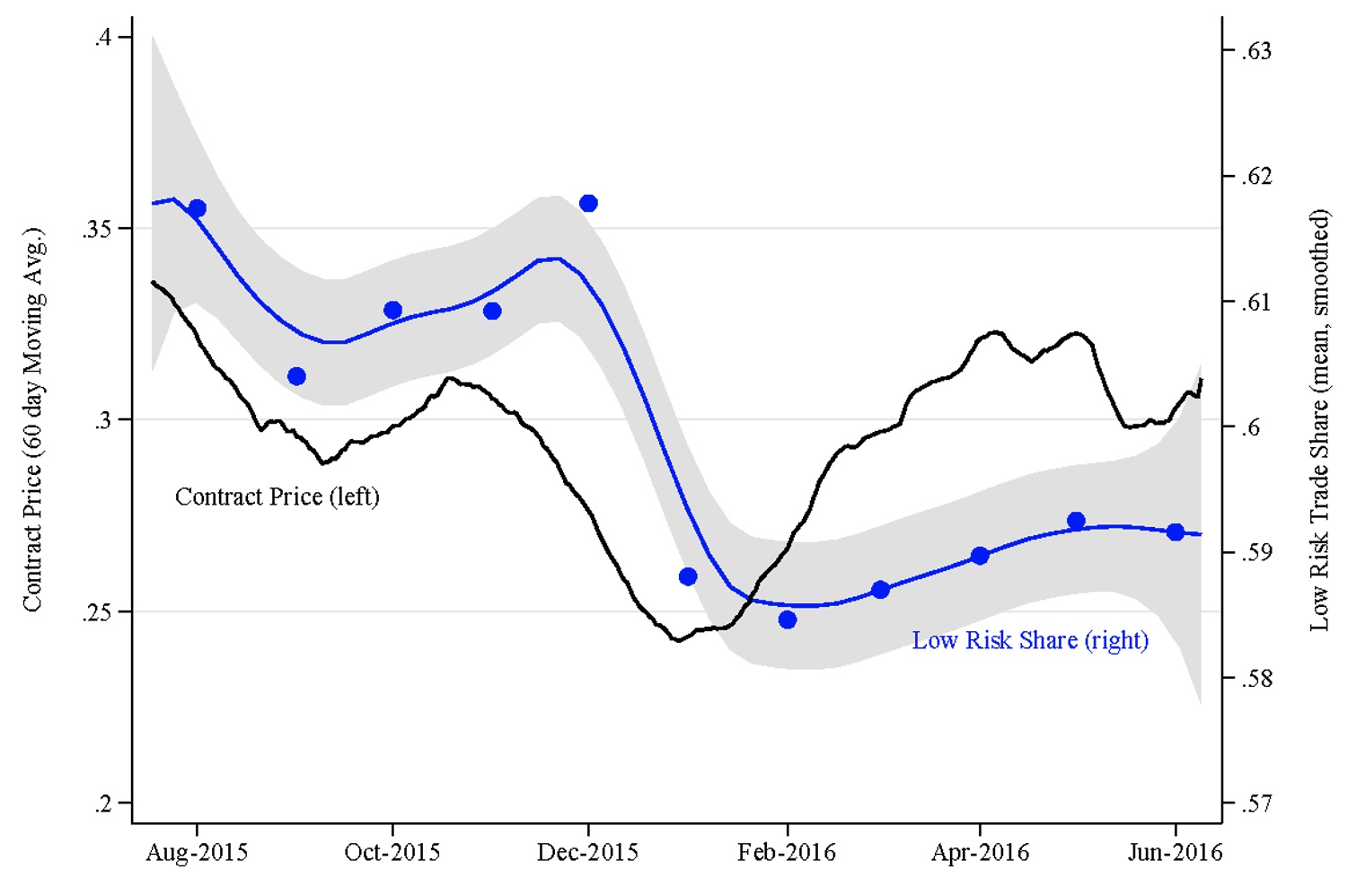

most-favoured nation tariffs. Hence, increases in the Brexit probability

should be positively associated with the trade share of lower risk industries, as we observe in Figure 1.

Figure 1 Brexit 60-day moving average contract price and low MFN risk trade shares

Source: Graziano et al. (forthcoming)

We estimate a

structural equation relating monthly bilateral industry exports and

trade policy uncertainty, after controlling for other trade

determinants. The uncertainty measure reflects industry-specific tail

risk as well as the Brexit probability, and has a significant negative

effect on exports. Consistent with the theory, the trade policy

uncertainty (TPU) effect reduced product entry and increased exit, and

is only present in industries with significant export sunk costs.

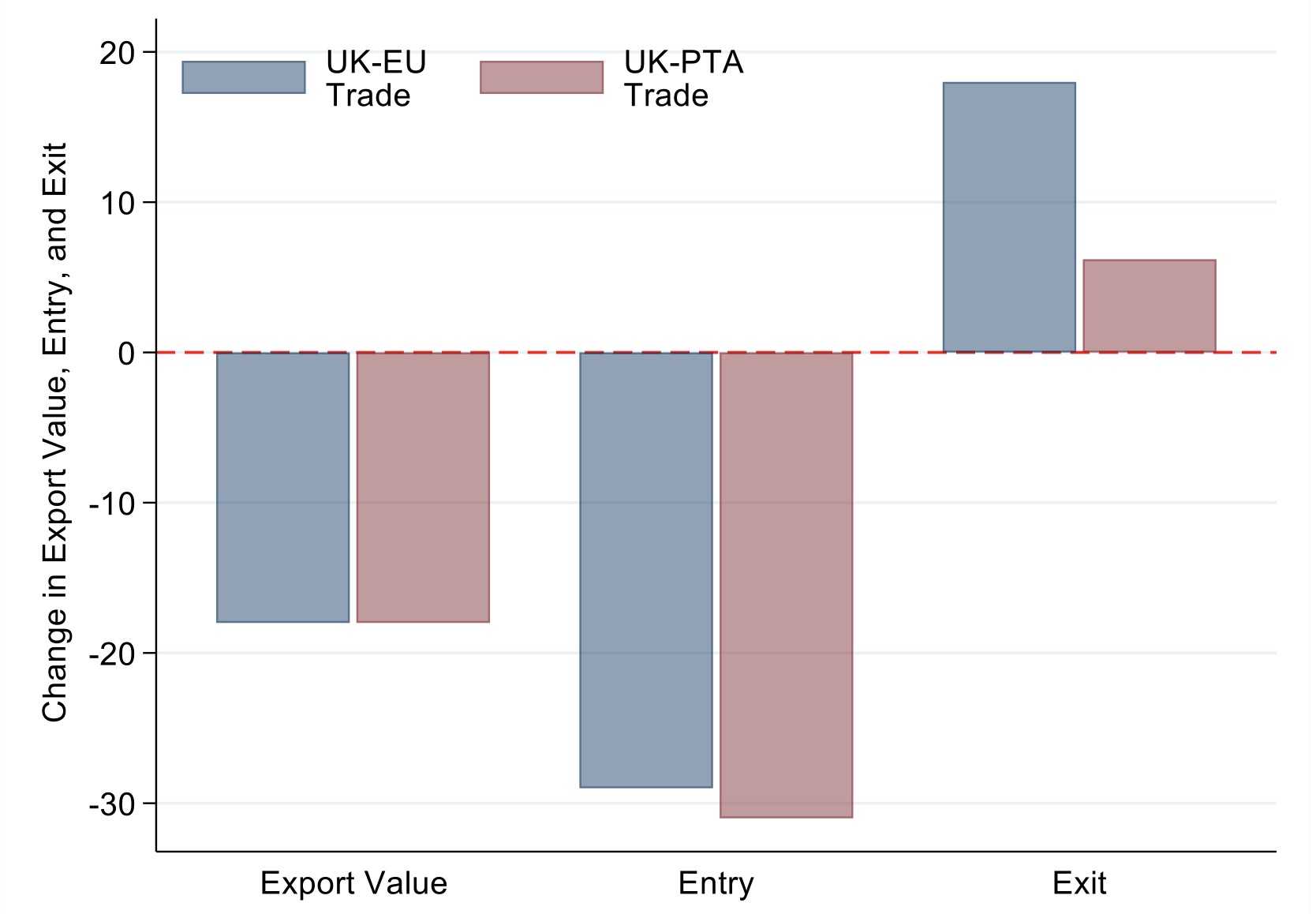

To quantify the

average impact of the referendum on UK-EU trade, we apply the estimated

uncertainty elasticity to the implied change in the probability of

Brexit once the Leave option won the referendum. These impacts are

calculated at the average tariff risk. The implied increase in TPU due

to the referendum changed UK-EU trade as depicted in Figure 2 (-18 log

points for export values, -29% for entry, and 18% for exit).

Figure 2 Brexit referendum uncertainty impact at average MFN risk

Source: Graziano et al (2020). Export value changes in log points; entry and exit represent percent changes.

Brexit externalities beyond the EU

Brexit uncertainty

spilled over to trade between the UK and preferential partners beyond

the EU – such as South Korea, Turkey and Israel – suggesting that firms

in these countries also faced tariff risk. This implies that a

referendum that was mainly about defining UK-EU integration caused

externalities for third countries since they had preferential trade

arrangements (PTAs) with the EU. We apply the framework described above

for UK-EU trade to these other countries and find very similar effects

as shown in Figure 2....

Full paper Vox

© VoxEU.org

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article