Current-account gap set to reach widest since World War II, Shortfall could test foreign investor appetite for U.K. assets

A hole in Britain’s finances is starting to worry economists and

stoke concerns about the pound. This time, the vast budget deficit

created by the pandemic is not the issue.

The focus is gradually shifting to the

current-account shortfall, the difference between money coming into the

U.K. and money going out. The gap is forecast

to reach its widest since World War II this year as Britain grapples

with post-Brexit ties with the European Union and an imports-fueled

rebound from the pandemic.

That will test the willingness of foreign

investors to keep on funding the spending habits of the nation by buying

British assets. Data on Wednesday will likely show that the U.K. had

one of its biggest trade deficits on record in the first full quarter

since completing the withdrawal deal with the EU.

“A big jump in the trade deficit can put into

question whether it can be sustained by capital flows,” said Sonali

Punhani, European Economist at Credit Suisse. “This can increase the

premium investors demand to invest in U.K. assets.”

The deficit is adding to the longer-term risks gathering over

the pound, which also include the prospect of another Scottish

independence referendum.

While the currency has rallied this year amid a brightening economic

outlook, strategists say further significant gains are unlikely.

The

current-account gap, which also includes flows of investment income,

may almost double to 6.4% of economic output this year, according to the

U.K.’s fiscal watchdog. The forecast reflects an export performance

hobbled by Brexit and strong demand for foreign-made goods as the

economy rebounds at pace from the pandemic.

What Bloomberg Economics Says...

“It’s

well known that the U.K. is a serial borrower from the rest of the

world. One of the potential consequences of recovering earlier and more

quickly than the rest of the world is the U.K.’s current account deficit

widens even further as export growth lags imports. That’s likely to

catch the eye of investors if the U.K.’s recovery proceeds as expected.”

-- Dan Hanson, senior U.K. economist.

The

Bank of England, which upgraded the U.K.’s economic outlook

significantly last week, predicts an 8.5% surge in imports and almost no

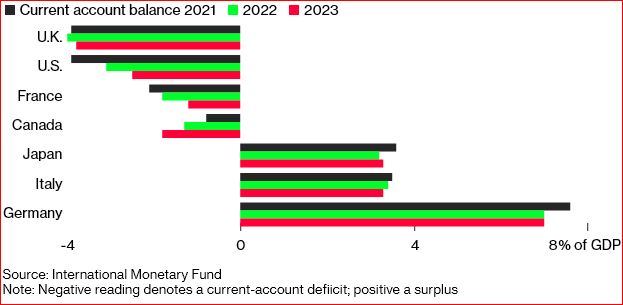

growth in exports. The International Monetary Fund says Britain will

have the biggest shortfall among major industrial nations.

Trade Imbalance

Britain is facing the largest current-account deficit in the Group of Seven

In recent years, Britain has had no problems funding

the gap. Foreigners attracted by a robust legal and financial systems

and the prospect of decent investment returns have proved eager buyers of British firms and high-end London properties. They also bought U.K. equities and debt.

While they may continue to regard the U.K. as a good bet --

the economy is forecast to outgrow its major peers this year -- Brexit

has raised some awkward questions.

The U.K. is no longer part of

the EU single market, access to which was a key reason for many firms

choosing to invest in Britain.

The government also appears to have

jettisoned the idea of trying to lure investors by turning Britain into

a “Singapore of Europe” with low taxes and light-touch regulation. In

his March budget, Chancellor Rishi Sunak raised taxes to levels not seen

in half a century, with businesses bearing the brunt, in an effort to

rein in the biggest budget deficit in peacetime.

In a recent

research report, RBC Capital Markets said Britain can no longer count on

being a “natural haven” for foreign direct investment, with neither the

pound nor U.K. equities currently trading at cheap levels....

more at Bloomberg

© Bloomberg

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article