Dutch professor estimates cost of fragmentation of clearing; Permission for cross-border clearing expires in June next year

One of the biggest Brexit battlegrounds between the European Union

and the U.K. now has a price tag: at least $2.4 million a day.

That’s

how much any move by the European Union to cut off access to London’s

dominant clearinghouses for derivatives could cost traders in euro

interest rate swaps, net of buying, according to an estimate from Albert

Menkveld, professor of finance at Vrije Universiteit Amsterdam, who has

sat on advisory panels to European regulatory authorities.

Fragmenting cross-Channel clearing would

result in additional costs because global dealers would need more

collateral for their positions in multiple clearinghouses in the U.K.

and in the EU, Menkveld said. They wouldn’t be able to offset, or net,

the positions as easily and that would require dealers to raise extra

funds.

Those additional costs would likely be passed

on to pensions, money managers and other users of derivatives in the

local jurisdiction, Menkveld said, who compares the burden on financial

markets to traffic jams caused by passport controls.

“This is the price we all paid for control by national authorities,” Menkveld wrote in a blog post.

“As a European citizen I can now zip onto the Autobahn at 100-plus

kilometers per hour, but my pension fund might soon pay for crossing the

border with the U.K. to diversify risk.”

His tally is one of the first to show the

immediate fallout if authorities stop the seamless, cross-Channel

settlement of trillions in euro interest rate swap contracts, which

currently takes place largely in London. The actual cost could be far

greater if it weakens London’s attractiveness as a global financial

center. The business is widely viewed as a core pillar of London’s

standing and the EU’s desire to pull more of that business away has

prompted sabre-rattling from politicians, financiers and even the governor of the Bank of England.

The

U.K. and major lobby groups for the biggest banks and money managers in

the world are calling for the EU to maintain easy access to London

clearinghouses, including the London Stock Exchange Group Plc’s

LCH unit which is the world’s biggest for euro interest rate swaps. The

European Commission in Brussels wants the bloc’s traders to move more

of their euro-denominated business inside the EU and not rely so heavily

on London. A ruling last year extended access to London through June

2022.

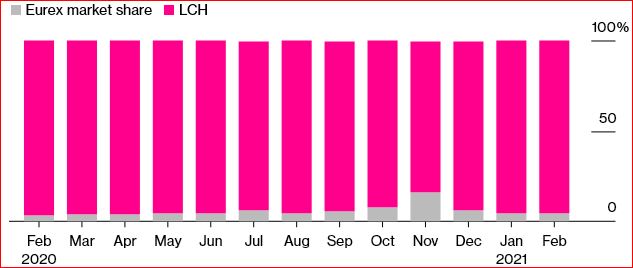

Clearing Prize

London's LCH clearinghouse dominates euro interest rate swap market

Source: Clarus Financial Technology

Clearinghouses serve as a key hub in

the global financial system, settling hundreds of trillions of dollars

in deals between banks, hedge funds, pensions and a wide range of

corporations. The firms collect collateral, or margin, from buyers and

sellers to reduce the risk that the default of one side spreads panic to

the other and, in turn, across the broader system.

If the temporary decision isn’t renewed, Bank

of England Governor Andrew Bailey has said a quarter of

euro-derivatives clearing business would need to shift to the EU. The

rest would likely stay in London because it is currently the most

efficient place for it, he said....

more at Bloomberg

© Bloomberg

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article