In the year following the end of the transition period, overall UK trade volumes fell, although with some surprising compositional effects.

Our March 2022 EFO was published just over a

year since the end of the transition period. In this box, we presented

the latest evidence for the impact of Brexit on UK trade and considered

the UK's recent trade performance relative to other advanced economies.

This box is based on CPB, OECD and ONS data from February and March 2022 .

It

is more than five years since the Brexit referendum, two years since

the UK left the EU, and just over a year since the transition period

ended. Since then, the implementation of the Trade and Cooperation

Agreement (TCA) has proceeded at different speeds on either side of the

Channel. EU countries applied full customs requirements and checks on UK

exports at the start of 2021, while the UK delayed the introduction of

full customs requirements on EU imports until January 2022 and full

health, safety and security checks to the second half of 2022.a

In

the year following the end of the transition period, overall UK trade

volumes fell, although with some surprising compositional effects:

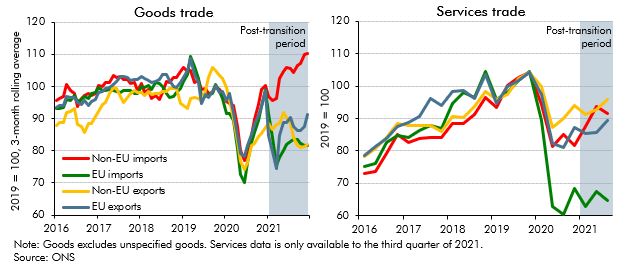

- Goods.

Despite tighter restrictions on the EU side of the border, UK goods

imports from the EU have fallen by more than UK goods exports to the EU

(Chart H, left panel). In the fourth quarter of 2021, goods imports from

the EU were down 18 per cent on 2019 levels, double the 9 per cent fall

in goods exports to the EU. The weakness of EU imports is more striking

compared to the 10 per cent rise in goods imports from non-EU

countries, suggesting some substitution between them. However, there is

little sign to date of UK goods exports to non-EU countries making up

for lower exports to the EU, with the former down 18 per cent on 2019

levels.b

- Services. UK services trade

with the EU has fallen by more relative to 2019 levels than non-EU

trade (Chart H, right panel). However, much of this decline is likely to

reflect the impact of the pandemic, particularly in sectors such as

travel and transport that accounted for a greater proportion of

pre-pandemic EU services trade than non-EU. UK service exports to the EU

and rest of the world have recovered to around 5 and 10 per cent below

2019 levels while imports of services from the EU are still down by over

30 per cent.

Chart H: EU and non-EU goods and services trade

The

seemingly paradoxical weakness in UK imports from the EU relative to

exports to the EU since the end of the transition period is likely the

result of a combination of factors. This could partly relate to rising

prices of energy imports, which are largely sourced from outside the EU.

Some of the apparent substitution between EU and non-EU imports might

also reflect changes in reporting trade flows or goods that always

originated outside the EU no longer passing through the EU on their way

to the UK. Brexit-related effects are likely to include the fact that

the UK is a relatively small market for individual EU exporters, so it

may not be worth the cost of additional paperwork to continue to export

to the UK. One survey shortly after the end of the transition period

found that 17 per cent of German companies had stopped exporting to the

UK, at least temporarily.c Global supply bottlenecks are

likely to have contributed to the weakness in some EU imports, with

machinery and transport equipment accounting for around half of the

import shortfall at the end of 2021 compared to 2019 levels. Stockpiling

likely also boosted EU imports in 2019 before the UK’s departure from

the EU, though imports from the EU are still much lower than even

pre-referendum levels.

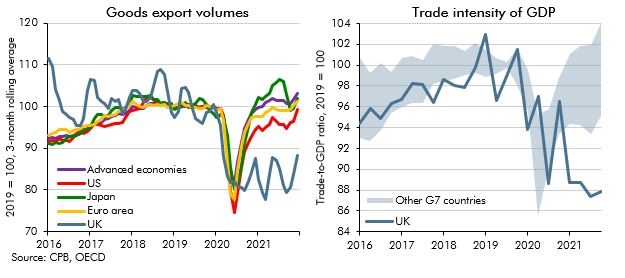

Comparing our recent overall trade

performance with other advanced economies suggests that the UK saw a

similar collapse in exports as other countries at the start of the

pandemic but has since missed out on much of the recovery in global

trade.d UK and aggregate advanced economy goods export

volumes fell by around 20 per cent during the initial wave of the

pandemic in 2020. But by the fourth quarter of 2021 total advanced

economy trade volumes had rebounded to 3 per cent above their

pre-pandemic levels while UK exports remain around 12 per cent below

(Chart I, left panel). The UK therefore appears to have become a less

trade intensive economy, with trade as a share of GDP falling 12 per

cent since 2019, two and a half times more than in any other G7 country

(Chart I, right panel).

Chart I: UK and advanced economy trade

While

additional trade with other counties could offset some of the decline

in trade with the EU, none of the agreements concluded to date are of a

sufficient scale to have a material impact on our forecast. The

Government’s own estimate of the economic impact of the free-trade

agreement with Australia, the first to be concluded with a country that

does not have a similar arrangement with the EU,e is that it

would raise total UK exports by 0.4 per cent, imports by 0.4 per cent

and the level of GDP by only 0.1 per cent over 15 years.f

In

summary, there is little in the data since the TCA was implemented to

suggest the assumption of a 15 per cent reduction in trade intensity as a

result of Brexit is no longer a central estimate. But these effects are

likely to take several years to be fully realised, so with only just

over a year having passed since the end of the transition period, and

given the difficulty abstracting from the impact of the pandemic, we

will continue to keep this assumption under review.

OBR

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article