Most international trade is denominated in dominant currencies (Gopinath and Itskhoki 2021) such as the US dollar. What explains the adoption of dominant currency pricing and what are its macroeconomic implications? In a recent paper (Garofalo et al. 2024), we explore a rare instance of transition in aggregate export invoicing patterns. In the aftermath of the depreciation that followed the Brexit referendum in 2016, UK exporters progressively shifted to invoicing most of their exports in dollars, rather than in pounds. This was driven by firms more exposed to currency mismatches – for example, exporting in pounds but importing in dollars before the depreciation. As a result of this aggregate transition to dollar pricing, a dollar appreciation now depresses demand for UK exports by twice as much than before 2016.

A dominant currency pricing transition

Recent studies on international invoicing find currency choice of exporters to be a remarkably persistent phenomenon at the aggregate level, for example in the cross-country data set on invoicing currencies compiled by Boz et al. (2022). The stable and outsized role of the dollar in global trade invoicing has given rise to a dominant currency paradigm (Gopinath et al. 2020) underpinned by network effects and strategic complementarities.

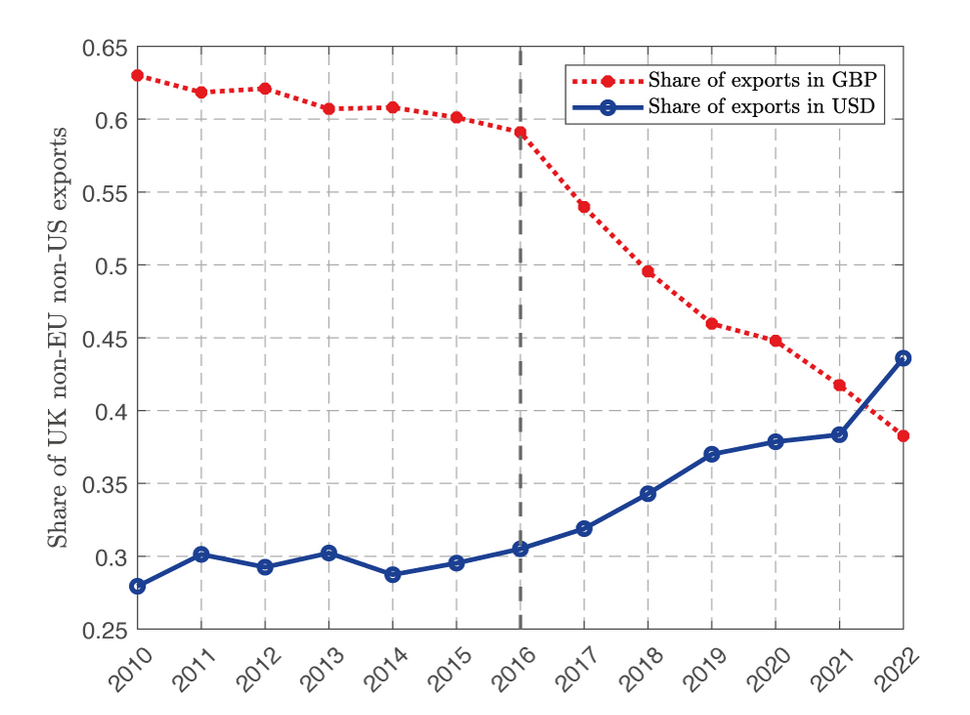

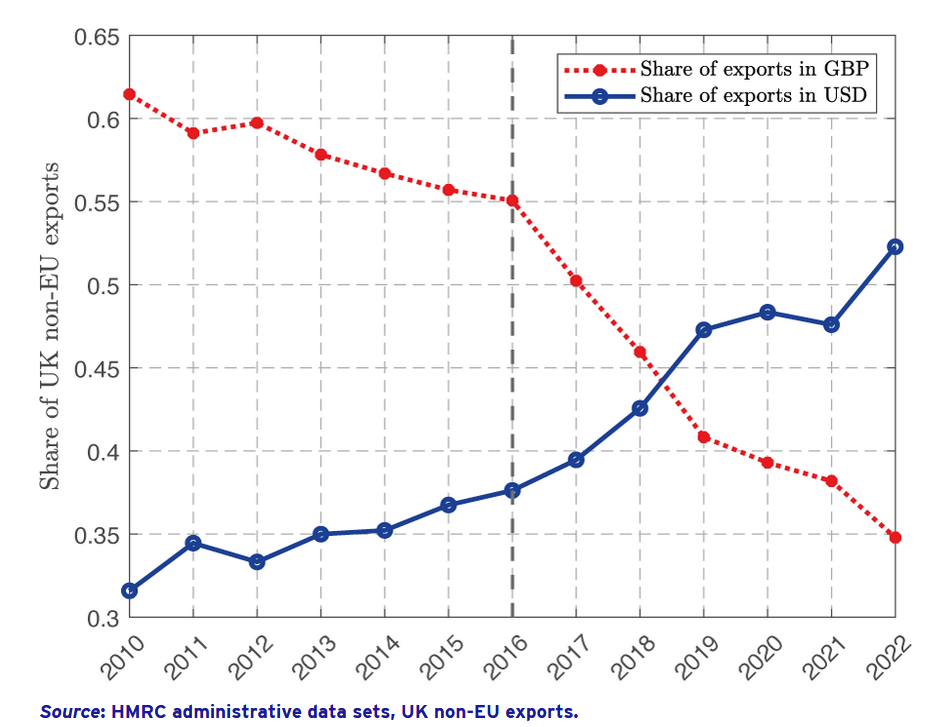

In stark contrast with the cross-country evidence is the story told by UK transaction-level data on exports and imports of goods recorded by His Majesty’s Revenues and Customs (HMRC). Until 2016, the majority of UK non-EU exports were invoiced in the ‘producer’ currency, the British pound. However, in the aftermath of the June 2016 Brexit referendum and the subsequent depreciation of the pound, the share of non-EU UK exports invoiced in pounds started to sharply decrease. It went from about 55% in 2015 to 35% in 2022. At the same time US dollar invoicing has surged from around one third to nearly 55% (Figure 1). Thus, the majority of extra-EU UK exports is now invoiced in the dominant currency of the international pricing system, the US dollar – a dominant currency pricing transition.

Figure 1 Invoicing shares of UK non-EU exports including (top) and excluding (bottom) the US

Most international trade is denominated in dominant currencies (Gopinath and Itskhoki 2021) such as the US dollar. What explains the adoption of dominant currency pricing and what are its macroeconomic implications? In a recent paper (Garofalo et al. 2024), we explore a rare instance of transition in aggregate export invoicing patterns. In the aftermath of the depreciation that followed the Brexit referendum in 2016, UK exporters progressively shifted to invoicing most of their exports in dollars, rather than in pounds. This was driven by firms more exposed to currency mismatches – for example, exporting in pounds but importing in dollars before the depreciation. As a result of this aggregate transition to dollar pricing, a dollar appreciation now depresses demand for UK exports by twice as much than before 2016.

A dominant currency pricing transition

Recent studies on international invoicing find currency choice of exporters to be a remarkably persistent phenomenon at the aggregate level, for example in the cross-country data set on invoicing currencies compiled by Boz et al. (2022). The stable and outsized role of the dollar in global trade invoicing has given rise to a dominant currency paradigm (Gopinath et al. 2020) underpinned by network effects and strategic complementarities.

In stark contrast with the cross-country evidence is the story told by UK transaction-level data on exports and imports of goods recorded by His Majesty’s Revenues and Customs (HMRC). Until 2016, the majority of UK non-EU exports were invoiced in the ‘producer’ currency, the British pound. However, in the aftermath of the June 2016 Brexit referendum and the subsequent depreciation of the pound, the share of non-EU UK exports invoiced in pounds started to sharply decrease. It went from about 55% in 2015 to 35% in 2022. At the same time US dollar invoicing has surged from around one third to nearly 55% (Figure 1). Thus, the majority of extra-EU UK exports is now invoiced in the dominant currency of the international pricing system, the US dollar – a dominant currency pricing transition....

more at CEPR