Banks that participated in the 2016 EU-wide stress test subsequently

reduced their credit risk relative to banks that were not part of this

exercise. Relying on new metrics for supervisory scrutiny, it also shows

that the disciplining effect is stronger for banks subject to more

intrusive supervisory scrutiny during the stress test.

Since the financial crisis, stress tests have become an

important supervisory and financial stability tool (Constâncio 2017).

Against this background, an important question is whether stress tests

contribute to financial stability by promoting risk reduction in the

banking sector, as recent evidence suggests (Cortes et al. 2017, Acharya

et al. 2018, Steri and Pierret 2018). Stress tests offer deep insights

into banks’ vulnerabilities to supervisors and the public through an

intense supervisory process. Recent evidence suggests that supervisory

scrutiny decreases banks’ risk-taking activities (Rezende and Wu 2014,

Hirtle et al. 2018, Bonfim et al. 2018, Kandrac and Schlusche 2019). In

the same vein, in a recent study, we show that higher supervisory

scrutiny led to a disciplining effect for banks in the part of the

European Banking Authority (EBA) EU-wide stress test conducted by the

ECB in 2016.

How supervisory scrutiny is exerted in stress tests

In Europe, stress tests involve interactions between banks and

supervisors on banks' risk management practices as well as confidential

communications about best stress-testing practices and techniques. We

use data on these confidential interactions to approximate how much

scrutiny was exerted on Single Supervisory Mechanism (SSM) banks under

the direct supervision of the ECB during the 2016 EU-wide stress test.

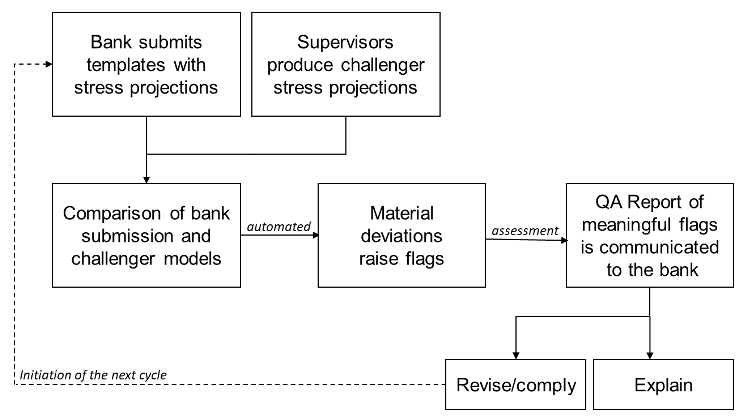

These interactions arise as part of the constrained bottom-up approach

pursued in the EBA-coordinated exercises (see Figure 1). In this

context, banks use their own internal models to generate projections

(e.g. for credit losses). Meanwhile, banks' projections are challenged

by the competent supervisory authorities typically by applying top-down

models and other challenger tools. In the presence of material

deviations between these two sets of projections, ‘flags’ are triggered

and are later discussed between supervisors and banks. Banks need to

either comply with or explain the issues raised in the interactions with

the ECB. We construct the scrutiny measure by counting the flags

related to credit risk projections. Intuitively, banks that received

more flags had to work harder on their resubmissions and had lengthier

and probably more intense interactions with supervisors while banks that

received no flags in principle had no further interactions with

supervisors.

Figure 1 Simplified illustration of one quality assurance cycle under the constrained bottom-up approach

Source: Own illustration based on Mirza and Zochowski (2017).

Scrutiny measures the intensity of stress tests

We apply a differences-in-differences approach where we use the

stress test as a treatment and the involved scrutiny as a measure of the

intensity of the treatment. In a first step, we compare the credit risk

of banks that were part of the stress test and banks that were not part

of the stress test four quarters before and four quarters after the

2016 stress test. In a second step, we compare credit risk of banks that

were subject to a more intense supervisory scrutiny and banks that

received less or none.1 The 2016 EU-wide stress test was

executed on significant institutions (SIs). Less significant

institutions (LSIs) were not tested and we therefore use them as the

control group.2

The effect of supervisory scrutiny on credit risk

We focus our analysis on credit risk, which accounts for a large part

of the stress testing projections and on average for 86% of risk

exposure amounts in bank balance sheets. To measure credit risk at the

bank level, we use the risk-weight density (RWD), i.e. the aggregate

risk weight assigned to total credit risk exposures according to

regulatory standards.

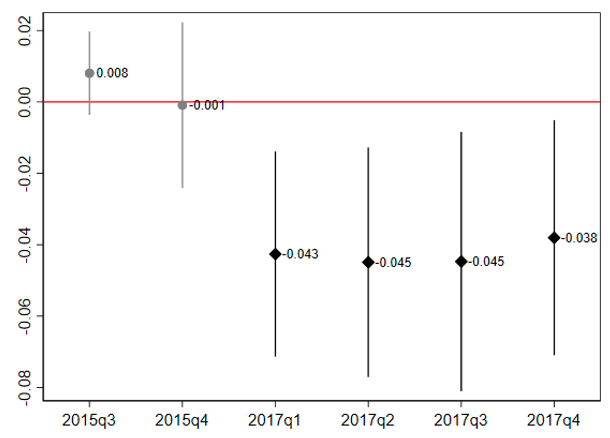

Figure 2 Estimate and 90% confidence interval of the

differential effect on RWD between tested and non-tested banks before

and after the reported quarter.

We find no significant difference in RWD between the treatment and

the control group before the stress test (2015q1 and 2015q4; see Figure

2) but significant negative differences for the period after the test

(2017q1 to 2017q4). The reduction in RWD of tested banks after the

stress test was on average 4.2 percentage points lower than the

reduction of not-tested banks. This effect is economically material as

it amounts to a change of about 20% of the standard deviation of RWD.3 These results confirm the findings based on US data that ‘treating’ banks with stress tests can affect their risk.

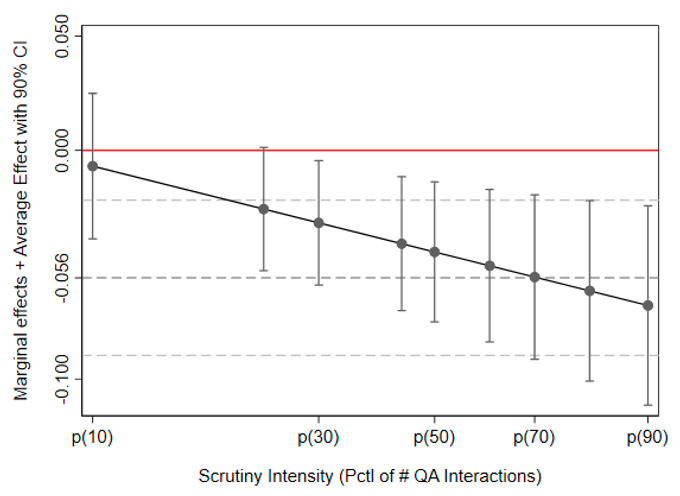

Figure 3 Marginal effect and average effect

estimates with 90% confidence intervals of the differential effect of

scrutiny intensity on RWD

Second, we show that the more interactions banks had with

supervisors, the higher their reduction in RWD after the stress test

exercise (see Figure 3). We find that those banks that received more

scrutiny (the half with scrutiny intensity above the median) exhibit a

5.6 percentage point greater decrease in credit risk than the half that

received less scrutiny.4 All in all, these findings provide

novel evidence that the tighter and more intrusive supervisory scrutiny

associated to the EU-wide stress-test has the potential to enhance

banks' risk management practices and to induce lower bank risk.

Policy implications

We contribute to the emerging evidence on the effectiveness of

supervisory scrutiny. Our results suggest that stress tests conducted

applying a robust quality assurance of banks' projections and models

have disciplining effects on stress-tested banks’ risk. However, it has

to be noted that one of the stress tests' primary objectives is to

correctly assess banks' risk profiles. Our findings do not provide

information on how well this objective is met. The possible strategic

underreporting of banks' vulnerabilities under a bottom-up approach

could undermine the reliability of the stress test outcomes from this

perspective (Niepmann and Stebunovs 2018). Pursuing a more unbiased

top-down approach while retaining supervisory interactions with banks

during and after the stress test might be more suitable to achieve this

goal. We, therefore, with our analysis, only deliver one insight among

many that could serve the policy discussion on the future stress test

design in Europe.

References

Acharya, V, A Berger and R Raluca (2018), “Lending Implications of U.S. Bank Stress Tests: Costs or Benefits?”, Journal of Financial Intermediation 34: 58—90.

Bonfim, D, G Cerqueiro, H Degryse and S Ongena (2020), “On-site inspecting zombie lending”, CEPR Discussion Paper No. 14754.

Constâncio, V (2017), “Macroprudential stress tests: A new analytical tool”, VoxEU.org, 22 February.

Cortés, K, Y Demyanyk, L Li, E Loutskina and P E Strahan (2020), “Stress tests and small business lending”, Journal of Financial Economics 136(1): 260—279.

ECB (2019), “What makes a bank significant?”, European Central Bank Banking Supervision.

Hirtle, B, A Kovner and M Plosser (2020), “The Impact of Supervision on Bank Performance”, The Journal of Finance 75(5): 2765—2808.

Ivanov, I and J Wang (2019), “The impact of bank supervision on corporate credit”, Working Paper.

Kandrac, J and B Schlusche (2017), “The effect of bank supervision on

risk taking: Evidence from a natural experiment”, Finance and Economics

Discussion Series No. 79, Board of Governors of the Federal Reserve

System.

Kok, C, C Müller, S Ongena and C Pancaro (2021), “The Disciplining Effect of Supervisory Scrutiny in the EU‑wide Stress Test”, CEPR Discussion Paper No. 16157.

Mirza, H and D Zochowski (2017), “Stress Test Quality Assurance from a Top-Down Perspective”, Macroprudential Bulletin 3.

Niepmann, F and V Stebunovs (2018), “How EU banks modelled their stress away in the 2016 EBA stress tests”, VoxEU.org, 30 July.

Pierret, D and R Steri (2019), “Stressed Banks”, Swiss Finance Institute Research Paper No. 58.

Rezende, M and J Wu (2014), “The effects of supervision on bank

performance: Evidence from discontinuous examination frequencies”,

Midwest Finance Association 2013 Annual Meeting Paper.

Endnotes

1 We also compare banks that received more treatment to banks that

received less treatment excluding banks that received no treatment at

all, i.e. the effect of supervisory scrutiny within the tested banks.

2 Significant institutions are those SSM banks that fulfil certain

criteria (ECB 2019). LSIs are SSM banks that do not fulfil any of the

criteria. LSIs are directly supervised by the national competent

authorities under the oversight of the ECB which ensures the consistency

of the regulatory framework and supervisory practices applied to these

banks. To account for the differences between SIs and LSIs, we include

robustness checks where we use matching and sample exclusions to

estimate the effect in a sample with minimized differences.

3 The mean of RWD of tested banks before the stress test is 43.7

percentage points with a standard deviation of 22.5 percentage points.

4 An increase in supervisory scrutiny intensity by 10% decreases RWD on average by around 0.27 percentage points.