The City of London deployed the latest statistics to show its contribution to global finance while a former French ambassador to the UK did not spare the UK’s blushes when she pointed out that “Britain faces a tough challenge to retain global influence after its departure from the EU under a prime minister who has a well-known reputation for “lying”.

(This e-mail provides the headers of a selection of the articles published this week. If you would like to upgrade to our Gold service and access all articles - with live links to the underlying news - please click on the button)

General Financial Policy

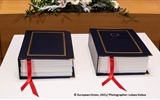

Conference on the Future of Europe: Engaging with citizens to build a more resilient Europe : This paves the way to launching a series of debates and discussions that will enable people from every corner of Europe to share their ideas to help shape Europe’s future.

EPC: The Conference on the Future of Europe: Comparing the Joint Declaration to institutions’ expectations : The Conference on the Future of Europe is finally ready to start. After an eight-month-long negotiation, the European Commission, the European Parliament and the Council agreed on a Joint Declaration, determining the Conference’s mandate, set-up, agenda and principles.

Banking Union

ECON Brief: Non-performing Loans - New risks and policies? - What factors drive the performance of national asset management companies? : This paper develops, on the basis of a cost-benefit analysis, on the conditions that must be met for an Asset Management Company (AMC), established under the centralised approach in EU Member States, to efficiently facilitate the management and recovery of non-performing loans (NPLs).

SRB launches consultation on 2021 Single Resolution Fund contributions : Institutions have the opportunity to review the SRB’s preliminary Master Decision for the 2021 ex-ante contributions before its adoption, and are invited to comment on any aspects they consider pertinent to the calculation exercise.

EBA assesses consumer trends for 2020/2021 : The Report identifies topical issues including irresponsible lending, creditworthiness assessments, and digitalisation, which the EBA has very recently addressed, as well as others, such as selling practices and access to bank account, which it has recently started to work on.

Vox EU: Bank performance in the time of COVID-19: Evidence from the US : Across the globe, economies have been hit hard and fast by COVID-19. This column explores the effect of the pandemic on US banks’ health and their ability to support the economy with lending, using a novel measure to gauge banks’ exposure to COVID-19 and lockdown measures.

Capital Markets Union

ISDA Statement on UK FCA LIBOR Announcement : “Today’s announcement constitutes an index cessation event under the IBOR Fallbacks Supplement and the ISDA 2020 IBOR Fallbacks Protocol for all 35 LIBOR settings. .."

EFAMA responds to IOSCO Consultation on Market Data in Secondary Equity Market : EFAMA supports the initiatives launched by IOSCO and other regulators (e.g. ESMA, FCA, SEC) to analyse and address the significant issues concerning market data in the secondary equity market.

Accountancy Europe: EC’s Consultation on a European Single Access Point (ESAP) for financial and non-financial information publicly disclose:We have submitted our response to the European Commission’s Consultation on a European Single Access Point (ESAP) for financial and non-financial information publicly disclosed by companies

ALFI responds to European Commission targeted consultation on the establishment of an ESAP : A European Single Access Point or ESAP was outlined a priority under the Capital Markets Union Action Plan. This could significantly facilitate access to financial and non-financial data (including but not limited to sustainability related data) by investors in general and asset managers.

Insurance Europe: EIOPA should prioritise prevention, risk reduction and resilience building over pricing when considering insurance and cli : Insurance Europe has today published its response to a discussion paper by the European Insurance and Occupational Pensions Authority (EIOPA) on non-life underwriting and pricing in light of climate change.

Environmental, Social, Governance (ESG)

IPE: Gamechanger’ potential in proposed EU ESG reporting standards – EFAMA : The European Fund and Asset Management Association (Efama) has said the accelerated development of mandatory European sustainability reporting standards (ESS) could “become a game-changer unleashing the impact of sustainable finance”.

Vox EU: The ECB’s green agenda : Debates have emerged recently on central banks’ role in mitigating climate change... The February 2021 CfM-CEPR survey asked members of its European panel of experts about measures the ECB could take to address the environmental impact of its bond-purchasing policies.

SUERF: Greening the UK financial system – a fit for purpose approach : The transition to a low-carbon economy consistent with the 2015 Paris Agreement represents the greatest challenge of our time...re-aligning our financial sector. The deregulated and market-oriented approach to greening finance taken by the current UK government will not go far enough.

CDSB/WBA: CDSB and WBA issue recommendations to bring policy coherence to the EU sustainable finance agenda : CDSB and the World Benchmarking Alliance (WBA) issued recommendations based on discussion in a multi-stakeholder roundtable hosted by the two organisations to strengthen policy coherence between the different legislations and requirements of the EU sustainable finance agenda.

CDSB’s reactions on the EFRAG report on EU sustainability reporting standard-setting : The EU Commission-appointed EFRAG Project Task Force published its final report on the creation of European non-financial reporting standards. CDSB welcomes recommendations on international co-construction and digitisation, but cautions around areas of duplication that can be avoided.

CDSB welcomes IFRS statement on sustainability standards : A welcome pace as IFRS Trustees take further steps towards a global approach to sustainability standards.

CRE: D&O exposure under further threat as MEPs vote on corporate accountability Directive : Members of the European Parliament (MEPs) will today vote on whether to request the European Commission (EC) adopts a new Directive on corporate accountability and governance that would oblige EU companies to address infringements of human rights and environmental damage within their supply chains.

Economic Policies Impacting EU Finance

EURACTIV: ‘OpenLux’ showed need for tougher enforcement of EU tax rules, says Gentiloni : The OpenLux investigation last month by journalists, including from Le Monde, Le Soir, Miami Herald and Sueddeutsche Zeitung, said Luxembourg’s investment fund industry is a $5.4 trillion “black box” that helps people launder money and avoid tax.

Tax Justice Network: Corporate Tax Haven Index - 2021 Results : The Corporate Tax Haven Index is a ranking of jurisdictions most complicit in helping multinational corporations underpay corporate income tax. Tax haven ranking shows countries setting global tax rules do most to help firms bend them.

Brexit

City of London Corporation: Providing financial services to the world : Exports from UK financial services and insurance firms amounted to £79bn in 2019 and generated £59bn of trade surplus, according to data published in the ONS Pink Book.

FT: Amsterdam: Europe’s surprise early winner as Brexit shakes up the City : The Dutch city has taken some business from London, but Frankfurt and Paris are better placed to take long-term advantage

CEPS: On the fringes: EU-UK financial services under the TCA : The outcome of the Trade and Cooperation Agreement (TCA) for trade in financial services between the EU and UK deal was even more paltry than expected. The TCA does not even institute a dedicated financial services committee, but rather a general one for services.

EURACTIV: UK faces difficult post-Brexit era under ‘lying’ PM, says French ex-ambassador : Britain faces a tough challenge to retain global influence after its departure from the EU under a prime minister who has a well-known reputation for “lying”, France’s former ambassador to the UK told Agence France-Presse (AFP) in an interview.