Cross-border payments are inefficient, and technology could play a role in making them better. One means could be through interoperating central bank digital currencies (CBDCs), forming multi-CBDC (mCBDC) arrangements.

This paper explores dimensions of payment system

interoperability, how they could feature in mCBDC arrangements and where

potential benefits lie. These benefits are especially relevant for

emerging market economies poorly served by the existing correspondent

banking arrangements. Yet competing priorities and history show that

these benefits will be difficult to achieve unless central banks

incorporate cross-border considerations in their CBDC development from

the start and coordinate internationally to avoid the mistakes of the

past.

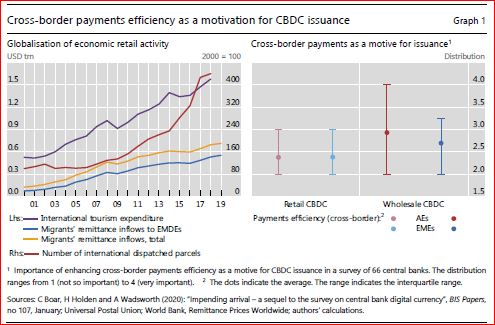

Cross-border payments are ever more vital for economies, especially transactions

underpinning tourism, e-commerce and remittances, which have grown substantially

over the last decade (Coeuré (2019) and Graph 1, left-hand panel). Yet such payments

are often slow, opaque and expensive.2 Improvement is a priority for globally

coordinated policy efforts, and a multi-year G20 “roadmap” is coordinating efforts

(G20 FMCBG (2020) and CPMI (2020)).

As well as driving improvements to current systems, central banks are exploring

the opportunities central bank digital currencies (CBDCs) might bring to cross-border

payments (Carstens (2020 (a, b), 2021), Group of central banks (2020) and Graph 1,

right-hand panel). CBDCs are a widely researched new form of digital central bank

money, which are just starting to be issued and piloted in some jurisdictions.3

Improving cross-border payments efficiency is an important motivation for research

(right-hand panel).

Full paper

BIS

© BIS - Bank for International Settlements

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article