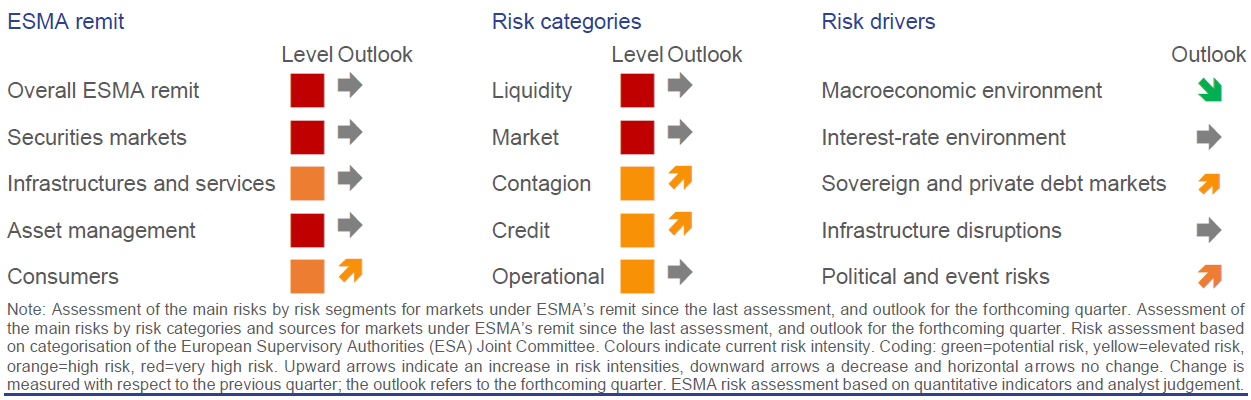

The past few months have seen the macroeconomic outlook brightening, and there is realistic scope for a reduction in risk levels if improvements in financial markets prove resilient in the medium-term.

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, today publishes the second Risk Dashboard for 2021,

covering the third quarter of the year. ESMA maintains risk

levels unchanged, at a high level, as the market environment remains

defined by very high uncertainty, continued elevated asset valuations

with risk of price corrections and abrupt shifts in risk premia.

Market reactions to the issues related to Evergrande

have shown the continued importance of event risks, the reactivity of

markets to such events, and the continued potential impact on investors

and financial stability going forward.

The past few months have seen the macroeconomic outlook brightening,

and there is realistic scope for a reduction in risk levels if

improvements in financial markets prove resilient in the medium-term.

This critically depends on the ability of markets to withstand the

potential future phasing out of the pandemic-linked public and monetary

support without material disruptions.

The most important risk drivers for the quarter are the economic

outlook, inflation uncertainty, indebtedness in sovereign and private

debt markets and political and event risks. Looking ahead, the scars of

the pandemic, its resurgence in Q4, and uncertainty around inflation and

the continuation of fiscal and monetary policy support may exacerbate

long-term vulnerabilities both for the financial and non-financial

sectors.

ESMA

© ESMA

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article